Reinsurance News

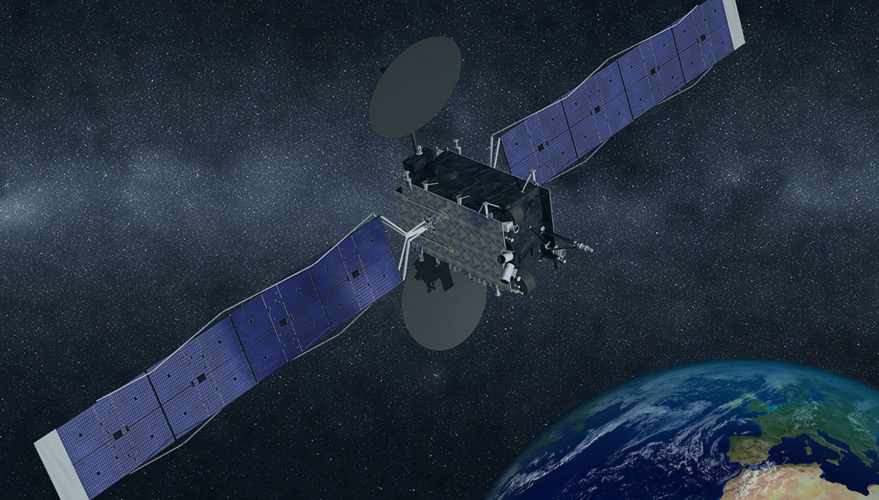

Eutelsat 100% covered if satellite facing solar array incident is lost

24th October 2019

Satellite operator Eutelsat is facing an incident and potential malfunction related to a solar array on a recently launched satellite, for which it has told us it is fully covered by insurance, with no retention, should a loss occur. The EUTELSAT 5 West B geostationary satellite was only launched on October ... Read the full article

Aviva completes £1.7bn buy-in deal with staff pension scheme

24th October 2019

Aviva Life & Pensions UK has announced the completion of a £1.7 billion buy-in with the Aviva Staff Pension Scheme, securing the defined benefit pension liabilities of around 5,800 members. The deal, which affects 4,300 deferred and 1,500 current pension members, follows a £5 billion longevity swap in 2014 The swap passed ... Read the full article

Ransomware cyber attacks on the rise, warns Chubb

24th October 2019

On the back of a significant increase from 2017 to 2018, the volume of ransomware cyber attacks in the first-half of 2019 has already outpaced the total number of claims witnessed in the whole of 2018, according to global insurer and reinsurer Chubb. The significant increase witnessed in the first-half of ... Read the full article

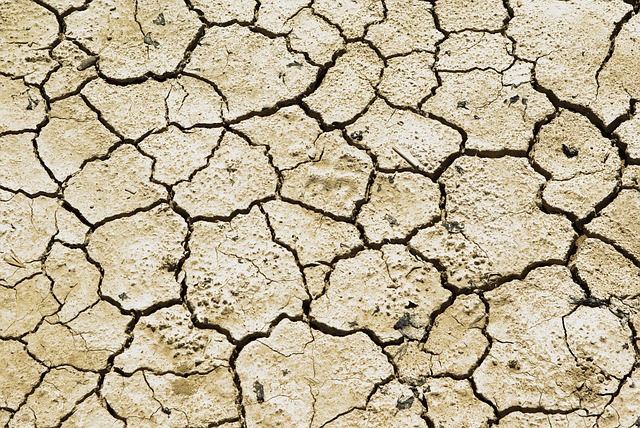

ARC and UNCCD to collaborate on drought, extreme weather resilience

24th October 2019

The Africa Risk Capacity (ARC), the parametric development insurance provider, is once again collaborating with the United Nations (UN) to develop financial tools to help Africa become more resilient to drought and other extreme weather events. This year alone, more than 45 million people across Africa are food insecure as a ... Read the full article

IUA launches London Market construction committee

24th October 2019

The International Underwriting Association has established a new London market committee for underwriters providing professional indemnity cover to the construction industry. The IUA says a particular focus for the international group will be issues around the use of cladding and fire protection following the Grenfell fire, which claimed 72 lives in ... Read the full article

The Hanover appoints Lowsley Exec VP, chief human resources officer

24th October 2019

Massachusetts-based property and casualty insurer The Hanover Insurance Group has appointed Denise Lowsley executive vice president and chief human resources officer. Working closely with executive leadership, Lowsley will help implement the firm’s ‘human capital strategy’. She brings over 20 years’ experience in the property and casualty space and joins from The Navigators ... Read the full article

Swiss Re’s iptiQ is fuelled by the protection gap, says CEO Walker

24th October 2019

iptiQ Americas, a wholly owned subsidiary of reinsurance giant Swiss Re, is focused on helping to close the huge and growing life and health protection gap, explained the Chief Executive Officer (CEO) of the firm, Philip Walker. Speaking with Willis Re as part of the reinsurance broker's latest quarterly InsurTech ... Read the full article

Willis Tower Watson accounting platform hits $20bn premium, powered by Ebix

24th October 2019

Willis Accounting, the carrier interface from Willis Towers Watson, has now seen over $20 billion of premium submitted in its four years since inception. The service is powered by the electronic platform EbixExchange from Ebix Europe, an international supplier of On-Demand software and E-commerce services to the re/insurance, financial, healthcare, and ... Read the full article

SCOR beats target, as P&C expansion continues but reserve release helps

24th October 2019

SCOR, the French headquartered global reinsurance firm, reported its third-quarter results this morning, revealing that its targets continue to be exceeded in terms of returns, while growth in property & casualty lines continues apace. However, the reinsurer's P&C business almost fell to a technical underwriting loss in Q3 due to higher ... Read the full article

Growth & efficiency underpin Swiss Re’s strategy, says Fernando Villar

23rd October 2019

Swiss Re’s success in the EMEA region is underpinned by the development of innovative solutions to promote growth, unlock new efficiencies, and optimise profitability, according to Fernando Villar, COO and Head of P&C Client Solutions EMEA at Swiss Re. Villar spoke to Reinsurance News about the reinsurer's strategy in an interview ... Read the full article

Risk Strategies names Bob Dubraski as Chief Growth Officer

23rd October 2019

Risk Strategies, a privately held US insurance broker and risk management firm, has announced the appointment of Bob Dubraski as Chief Growth Officer. The appointment represents an expansion of Dubraski’s current role as National Health Care Practice Leader, and will see him work with all of Risk Strategies’ business units to ... Read the full article

Aon calls for further changes to reinsurance under IFRS 17

23rd October 2019

The Reinsurance Solutions business of Aon, the global re/insurance brokerage, has called for further changes to the way reinsurance will be reported under International Financial Reporting Standard (IFRS) 17. The recommendations came in response to a consultation draft for amendments to IFRS 17, published in June 2019 by the International Accounting ... Read the full article

Norsk Hydro claims first $3.6mn from its cyber insurance

23rd October 2019

Aluminium manufacturing giant Norsk Hydro has announced that it has claimed approximately USD 3.6 million (NOK 33 million) from its insurers in the third-quarter of 2019 following the cyber-attack on its operations in March. After detecting unusual activity on its servers that disabled part of its smelting operations on March 19th, ... Read the full article

CDPQ, OTPP invests $500m in Anurag Chandra’s new insurance platform

23rd October 2019

Former Chief Executive of Prosperity Life, Anurag Chandra, has secured $500 million in funding from Caisse de dépôt et placement du Québec (CDPQ) and the Ontario Teachers’ Pension Plan (OTPP) to launch Constellation Insurance Holdings, a platform set to focus on P&C and life insurer acquisitions and demutualizations. Chandra, who will ... Read the full article

Insurtech investments already ahead of 2018 at $4.36bn: Willis Towers Watson

23rd October 2019

New funding commitments to the insurtech sector totalled $4.36 billion during the first three quarters of 2019, according to Willis Towers Watson. This figure is already 5% up on the total amount of investments in insurtech during the previous year. The broker recorded 239 total transactions across the year so far, 83 ... Read the full article