Reinsurance News

Great American Insurance announces President of new Accident & Health Division

5th September 2019

Great American Insurance Group has announced the launch of its new Accident & Health Division, which builds upon its existing range of Accident & Health insurance solutions. The new division will have a focus on customised coverages for organisations and educational institutions, and will be based in Charlottesville, Virginia. In light of ... Read the full article

Lockton Re adds Simon Mills & Fraser Howard to London office

5th September 2019

Lockton Re, the reinsurance division of broker Lockton, has hired Simon Mills and Fraser Howard, previously of JLT, as part of its global healthcare reinsurance expansion. The pair will be based in London, and will be seeking to support collaboration across the reinsurance broker's international network to further develop a seamless ... Read the full article

Lack of reliable loss estimates has impaired ILW market in Japan, says PCS

5th September 2019

A lack of access to reliable and independent sources of industry loss estimates has impaired the market for industry loss warranties (ILW) in Japan, according to a new report from PCS, a Verisk business. The report looked at the impact of potential underreporting by informal loss reporting data sources, as well ... Read the full article

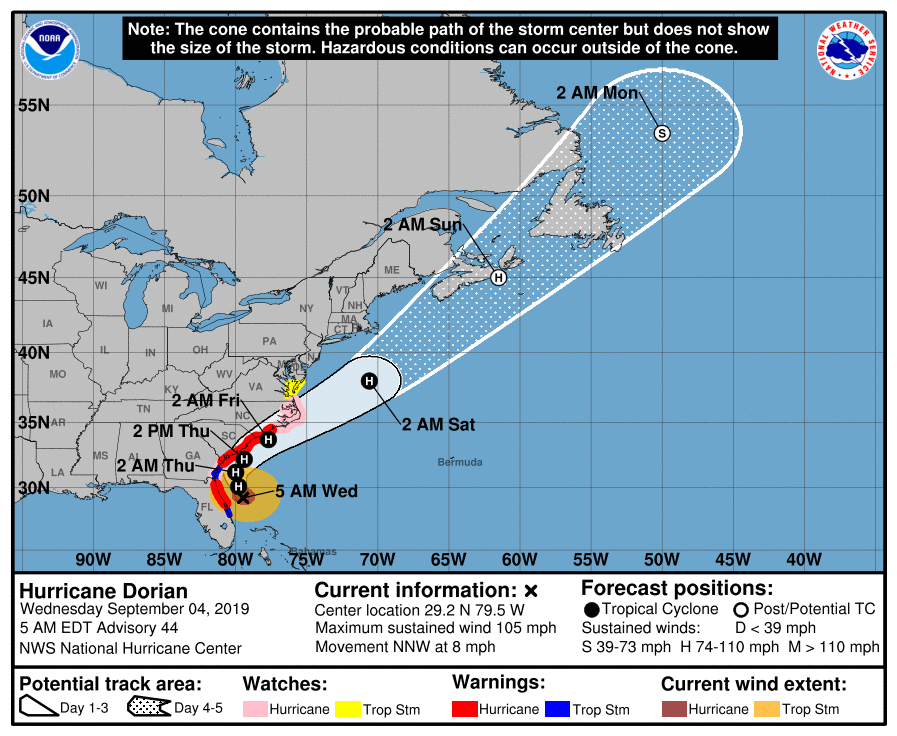

Dorian wind & storm surge threat to US coast remains significant

4th September 2019

After moving clear of the Bahamas, Hurricane Dorian continues its slow track north along the Florida coast as a Category 2 (96-110mph) storm with maximum sustained winds of 105 mph (91 knots), higher gusts and central pressure of 964 mb. Hurricane Dorian remains a dangerous Category 2 storm, and is forecast ... Read the full article

Austin Su named US Underwriting Lead of AXA XL’s Structured Risk Solutions

4th September 2019

AXA's property and casualty (P&C) and specialty division, AXA XL, has named Austin Su as US Underwriting Lead of its Structured Risk Solutions (SRS) business. Based in New York, Su joins SRS' expanding global Alternative Risk Transfer business and will have a focus on the development of structured re/insurance solutions for ... Read the full article

Tremor reaches $1bn of reinsurance quotes, adds new investors

4th September 2019

Tremor Technologies, the programmatic risk transfer platform, has passed $1 billion of total reinsurance quotes and lines bound of nearly $500 million, and has announced $10 million in financing from new investors. The company has now completed six reinsurance placements, with quotes from more than 70 reinsurers, ILS funds, and Lloyd’s ... Read the full article

HDI Global Specialty adds two to UK executive team

4th September 2019

HDI Global Specialty SE, the specialty lines insurer launched collaboratively by Hannover Re and HDI Global, has expanded its UK executive team with the appointments of Clare Constable as Director of Claims and Will Morris as Director of Underwriting for Delegated Authority. Constable has over 20 years’ experience in the re/insurance ... Read the full article

Few to lead TigerRisk’s UK, EMEA and Asia expansion

4th September 2019

James Few has left re/insurer MS Amlin to join reinsurance broker TigerRisk Partners LLC as Chief Executive Officer (CEO) of its London office, reporting to President and Chief Operating Officer (COO), Rob Bredahl. The global brokerage states that Few, a global strategist and product innovator, will lead expansion in the UK, ... Read the full article

JLT Re’s David Flandro joins Hyperion X as Managing Director, Analytics

4th September 2019

Hyperion Insurance Group's data and technology division, Hyperion X, has announced the appointment of David Flandro as Managing Director, Analytics. He joins the firm from global reinsurance broker JLT Re, where he served as Global Head of Analytics and a member of the company's Executive Committee. In his new role, Flandro will ... Read the full article

PCS expands catastrophe loss index service to Mexico

4th September 2019

Property Claim Services (PCS), a division of Verisk that collects and aggregates the insurance industry loss data widely used by reinsurers, has announced the launch of its catastrophe loss index for Mexico. PCS Mexico will provide full coverage for natural and man-made events across Mexico with total re/insurance industry loss estimates ... Read the full article

Ryan Specialty renames MGU to RSG Transactional Risks Europe

4th September 2019

London-based MGU Hunter George & Partners, which joined Ryan Specialty Group (RSG) in 2016, is changing its name to RSG Transactional Risks Europe. Hunter George & Partners is the transactional risk managing general underwriter of Ryan Specialty Group Europe, and under its new name will offer numerous products, including Warranty & ... Read the full article

U.S. Risk acquires Floridian wholesale brokerage Regency

4th September 2019

U.S. Risk, a Property & Casualty wholesaler and Managing General Agent, has announced the acquisition of Regency Insurance Brokerage Services, a Florida-based wholesale brokerage and Managing General Agent. Though terms of the sale have not been disclosed, it has been confirmed that the Regency team will join U.S. Risk Brokers, the ... Read the full article

Just Group signs longevity reinsurance deal with RGA

4th September 2019

Life insurer Just Group has signed a deal with The Reinsurance Group of America that will reduce its exposure to longevity risk, and the associated capital requirements, for Defined Benefit De-risking Solutions business. Effective July 1, the agreement will see Just Group increase the proportion reinsured to 100% for all in-force ... Read the full article

Aon adds Purves as a partner in risk settlement team

4th September 2019

Global re/insurance brokerage Aon has announced the appointment of Stephen Purves as a partner in its Risk Settlement team. Purves most recently served at Aviva as Head of core business and was responsible for four deal teams and led on several significant transactions in the bulk annuity market. He joins Aon with ... Read the full article

Former TMR CEO Ruoff to join ILS specialist Schroder Secquaero

4th September 2019

Insurance-linked securities (ILS) fund manager Schroder Secquaero, has announced that Stephan Ruoff, former CEO at Tokio Millennium Re (TMR), is set to join the company as Deputy Head in November. Ruoff served as Group CEO of TMR from April 2015 to March 2019, having joined the company as CEO for Continental ... Read the full article