Reinsurance News

Benign April helps offset heavy YTD cat losses: Jefferies

17th May 2021

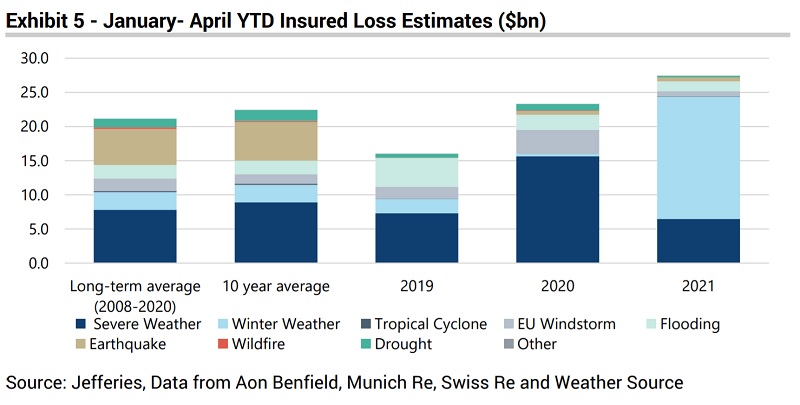

Analysts at Jefferies have characterised April as a largely "benign" month in terms of global insured catastrophe losses, which should help to ease the pressure on what has been a remarkably active year for catastrophes to date, with claims running at about 30% above the long-term average over the first ... Read the full article

Berkshire (BHSI) names Nikki Nagra as Head of Casualty Claims, UK

17th May 2021

Berkshire Hathaway Specialty Insurance (BHSI), the insurance arm of Warren Buffett's global insurance and reinsurance company, has announced the appointment of Nikki Nagra as Head of Casualty Claims in the UK. Nagra comes to BHSI with more than two decades of claims management experience, and has spent the previous 16 years ... Read the full article

Aon to sell retirement & investment business in Germany as part of EC remedy package

17th May 2021

Aon has agreed to sell its pensions consulting, pension insurance broking, pensions administration and investment consulting business in Germany to Lane Clark & Peacock LLP (LCP), as the global re/insurance broker moves closer to completing its proposed combination with rival Willis Towers Watson (WTW). This latest divestment comes as the brokerage seeks ... Read the full article

Lockton hires two MDs for Pacific region

17th May 2021

Lockton Insurance Brokers has appointed Harpreet Ubhi and Reid Eanes as Managing Directors to lead the Lockton Financial Services Practice (LFS). Ubhi and Eanes collectively bring over 30 years of industry experience, specialising in directors & officers liability, employment practices liability, corporate governance risk management, private equity and corporate acquisitions across ... Read the full article

Oxbridge Re posts improved Q1 net income

17th May 2021

Cayman Islands based Oxbridge Re generated a first quarter net income of $28,000, up from the $364,000 loss announced in the prior year quarter. The company attributes this improvement to a positive change in the fair value of equity securities compared to the depressed financial markets a year ago. However, the combined ... Read the full article

SRG hires Eastham as Managing Partner and Head of M&A team

17th May 2021

Insurance brokerage Specialist Risk Group (SRG) has appointed Nikki Eastham as Managing Partner and Head of its M&A team. Eastham joins after a 12-year career at PWC, where she was most recently a Director of the M&A team. She has a range of experience within strategic advisory, deal origination, target engagement, diligence, ... Read the full article

Guy Carpenter names Tres as lead of Strategic Risk & Capital Life Solutions, EMEA

17th May 2021

Guy Carpenter, the reinsurance arm of global brokerage Marsh McLennan, has hired Luca Tres as Head of Strategic Risk and Capital Life Solutions, EMEA, effective June 1st, 2021. In his new role, Tres takes on responsibility for driving continued growth in both the development and delivery of non-traditional life solutions to ... Read the full article

Peak Re appoints Sascha Bruns as Head of Global Retro

17th May 2021

Hong Kong domiciled reinsurer, Peak Reinsurance Company Limited, has announced the addition of Sascha Bruns, previously of Hannover Re, as Director, Global Head of Retrocession, effective September 1st, 2021. In his new role, Bruns will lead the design and implementation of the company's retro strategy for its global Property & Casualty ... Read the full article

Pipeline attack a “timely reminder” of cyber cost: Bloomberg Intelligence

17th May 2021

Bloomberg Intelligence has said that the recent attack on Colonial Pipeline serves as a “timely reminder” of the vulnerability of energy infrastructure and the need for cyber insurance. BI cited a recent report by the Center for Strategic and International Studies in partnership with McAfee which estimates the annual monetary cost ... Read the full article

Oneglobal appoints Nicolau Daudt as CEO of Latin America

17th May 2021

Oneglobal Broking, the commercial re/insurance brokerage owned by investor JC Flowers, has announced the appointment of Nicolau Daudt as CEO for Latin America. In this role, Daudt will help to build out Oneglobal’s re/insurance capability in key Latin American markets, taking on responsibility for all countries outside of Brazil. Most recently, he ... Read the full article

Aston Lark adds Bethan Jones to newly-created Integration Director role

17th May 2021

Chartered insurance broker Aston Lark has promoted Bethan Jones to the newly created role of Integration Director, with responsibility for ensuring the successful integration of all acquired companies. Jones joined Aston Lark in 2017 before being appointed to its board in 2019. She provides leadership across the firm’s Project Office and Applications ... Read the full article

ArgoGlobal partners with green finance MGA Tierra Underwriting

17th May 2021

Lloyd's of London insurer and Argo Group subsidiary ArgoGlobal has partnered with Tierra Underwriting Limited (Tierra) to provide insurance in support of green project finance transactions. ArgoGlobal will provide $25 million in underwriting capacity to support the MGA, which Tierra will use to support transactions that have carbon abatement at their ... Read the full article

Ethos raises $200mn in Series D funding

17th May 2021

Insurtech company Ethos has raised $200 million in a Series D investment round, boosting its valuation to $2 billion. Since its initial launch, revenue and users have each grown by more than 500% year-over-year, and the company expects to issue $20 billion of life insurance coverage in 2021. The latest funding round ... Read the full article

UK rules out any kind of event cancellation scheme before June 21

14th May 2021

UK culture secretary Oliver Dowden has ruled out the possibility of a government-backed event cancellation insurance scheme before June 21, at which point lockdown restrictions are expected to lift entirely. According to reports from The Independent, Dowden was speaking at a DCMSC committee meeting when Conservative MP Heather Wheeler asked for ... Read the full article

Spinnaker hires Torben Ostergaard as CEO

14th May 2021

Spinnaker Insurance Company, a fronting carrier wholly owned by insurtech group Hippo Enterprises, has appointed Torben Ostergaard as its new president and chief executive officer. Ostergaard joins Spinnaker after more than a decade in c-suite roles at insurance and financial services firm USAA. He succeeds Dave Ingrey, who will transition to chief ... Read the full article