Reinsurance News

Insurance and reinsurance pricing news

News on pricing in global insurance and reinsurance markets, with a particular focus on renewal rates on line in reinsurance and commercial insurance pricing trends.

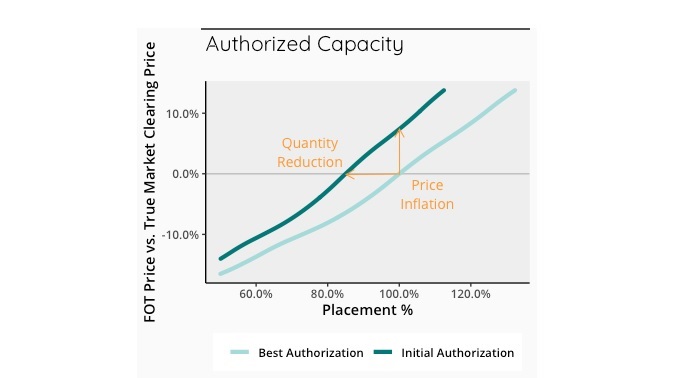

Tremor finds price inflation inefficiencies in traditional market placements

17th December 2019

Tremor, the programmatic insurance and reinsurance risk transfer marketplace, has compiled new data that reveals the extent of price inflation inefficiencies in traditional market placements. On average, the company believes that reinsurers must be inflating prices by at least 5-10% for program placements, with inflation found to be present and substantial ... Read the full article

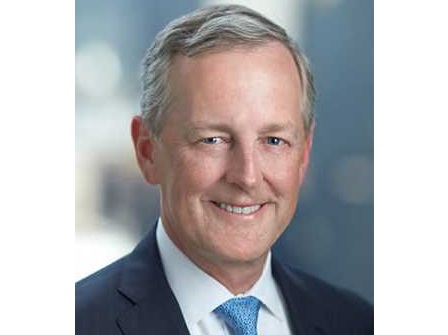

Another big loss is needed to fundamentally shift rates: Occam CEO Gibbins

17th December 2019

A fundamental shift in the re/insurance pricing environment will ultimately require another significant market loss event, according to Lance Gibbins, Chief Executive Officer (CEO) of specialty Lloyd’s of London managing general agent (MGA) Occam Underwriting. Speaking in a recent interview with Reinsurance News, Gibbins acknowledged that carriers are now responding to ... Read the full article

“Unexciting” rate movements forecast for 1/1 renewals: analysts

9th December 2019

Analysts at JMP Securities are forecasting “unexciting” rate increases at the January re/insurance renewals, with more notable improvements likely to be seen later in the year during the April and June/July renewals. While the property and casualty (P&C) market does appear to be improving in all areas, it is doing so ... Read the full article

Pricing power to challenge reinsurers in 2020, says Deutsche Bank

4th December 2019

While pricing has picked up over the past couple of years, Deutsche Bank analysts argue that the level of increases post-major events is not as large as it might have been several years ago and remains a challenge for reinsurers going into 2020. While an oversupply of capacity and the resulting ... Read the full article

A changing environment shouldn’t change your strategy: PartnerRe’s Colello

29th November 2019

Reinsurers should not be looking to alter their strategy in response to changing market conditions, but should instead be focusing on consistency and execution, according to Jon Colello, CEO for P&C Americas and President of PartnerRe. Speaking in an interview with Reinsurance News, Colello acknowledged that both insurers and reinsurers were ... Read the full article

Property market still hardening, set to persist through 2020: WTW

18th November 2019

Pricing conditions in the property re/insurance market have continued to harden over and above baseline predictions, with rate increases set to persist through 2020, according to broker Willis Towers Watson (WTW). The current “micro-hard market” has produced pricing increases of between 50% and 100%, according to WTW’s numbers, with some challenged ... Read the full article

P&C pricing momentum unlikely to result in hard market, says Fitch

14th November 2019

While favourable pricing trends in the US property and casualty (P&C) market have been gaining some momentum this year, analysts at Fitch Ratings do not believe these increases are likely to cause a return to hard market conditions. Competitive forces and less favourable claims trends in some key segments make it ... Read the full article

Fundamentals must change before price adequacy can return: PwC’s Wightman

12th November 2019

The re/insurance industry has broadly enjoyed a hardening rate environment in 2019, but a return to price adequacy will require some fundamental changes in terms of the way companies model and respond to catastrophe losses. This is according to Arthur Wightman, PwC Bermuda Territory and Insurance Leader, who spoke to Reinsurance ... Read the full article

More rate improvements ahead after market pain in 2019: AXIS CEO Benchimol

1st November 2019

AXIS Capital is anticipating ongoing insurance and reinsurance pricing increases into the 2019 renewals and beyond, according to its Chief Executive Officer (CEO), Albert Benchimol. Speaking during the firm’s third quarter earnings call, Benchimol explained that rates remain inadequate in many lines, and should be spurred on by the further “pain” ... Read the full article

Reinsurers optimistic about market outlook, says Appleby’s Brad Adderley

25th October 2019

Optimism is high in the reinsurance industry this year, according to Brad Adderley, partner at offshore law firm Appleby, and there appears to be some confidence that the market’s outlook will improve further. Speaking in an interview with Reinsurance News at Reinsurance Rendezvous event in Monte Carlo this year, Adderley explained ... Read the full article

P&C market favourable for smaller, niche players: JP Morgan

25th October 2019

Smaller, niche carriers are particularly well positioned to take advantage of favourable conditions in the property and casualty (P&C) re/insurance market, according to analysts at JP Morgan. In a new report, the firm said it expects smaller players to accelerate their market share gains as larger market leaders retrench in an ... Read the full article

Typhoons to boost Japanese reinsurance rates, but not market-wide: Barclays

17th October 2019

The substantial industry losses stemming from Japanese typhoons in 2019 will provide a boost to affected regional lines, but are unlikely to trigger a sharp recovery in wider property and casualty (P&C) reinsurance prices, according to analysts at Barclays. With insured losses from Typhoons Faxai and Hagibis now pegged at between ... Read the full article

TRIPRA expiration could cause “domino effect” of price rises: Marsh CEO

17th October 2019

John Doyle, President and CEO at Marsh, has warned that a failure to renew the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) could cause a “domino effect” of price increases across multiple re/insurance lines. Doyle recently testified before the United States House Committee on Financial Services to advocate for a timely ... Read the full article

Rate divergence continues for upstream & downstream energy: Marsh JLT Specialty

17th October 2019

A new report from Marsh JLT Specialty has highlighted the ongoing divergence in rates between upstream and downstream energy markets, as the upstream market continues to struggle to achieve meaningful increases. In contrast, downstream energy rates are gaining more traction, driven by withdrawals and cutbacks in capacity. Other specialty lines – including ... Read the full article

Casualty markets undergoing abrupt shift to profitability: Lockton

14th October 2019

Pricing adequacy has continued to increase across the US casualty re/insurance market, with some lines undergoing an abrupt shift to a renewed focus on profitability, according to global re/insurance brokerage Lockton. The umbrella and excess casualty markets in particular have seen a positive turn, Lockton said, with carriers now demanding higher ... Read the full article