Reinsurance News

Risk Modelling

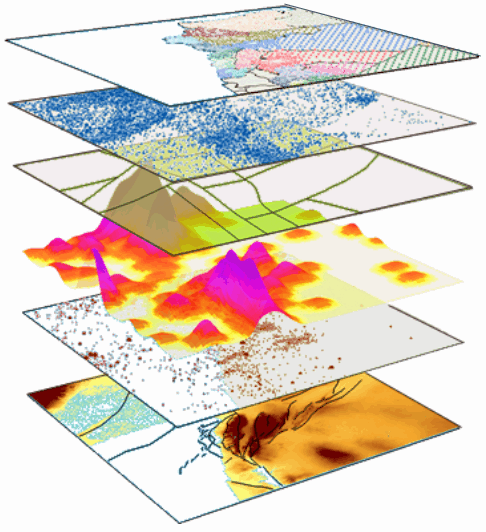

Boat Oasis adds Australian modeller COMBUS to global CAT risk platform

27th July 2017

Boat Oasis has expanded its shared services platform with its first catastrophe simulation models for Australia with the addition of the COMBUS model that assesses risk for Australian Bushfire, Severe Convective Storm, Low Pressure System, Tropical Cyclone and Earthquake. "By integrating with Boat Oasis, COMBUS becomes more easily accessible to re/insurance firms ... Read the full article

AIR Worldwide announces release of severe thunderstorm model for Australia

26th July 2017

Catastrophe risk modeller AIR Worldwide has released the industry's first Australia severe thunderstorm model, offering re/insurers a comprehensive view of risk by incorporating the three sub perils of hail, tornado, and straight-line wind. The new model simulates daily severe thunderstorms activity based on historical occurrence rates and local and seasonal weather ... Read the full article

RMS highlights potential of catastrophe re/insurance schemes in low income countries

17th July 2017

Catastrophe risk modeller RMS has conducted analysis on the potential impact of insurance schemes in low and low-middle income countries against natural catastrophe events, revealing that such structures could increase the volume of average annual asset recoveries to $3.1 billion. A new report from RMS commissioned by the UK Department for International Development ... Read the full article

RMS releases new typhoon and earthquake models for Asia-Pacific

12th July 2017

Global risk modeller RMS has released new risk models for the Asia-Pacific region, including what is says are the most sophisticated typhoon models on the market for South Korea and Taiwan, and earthquake models for Singapore, Malaysia, Thailand and Vietnam. The new earthquake models come as a RiskLink® version 17 update, expanding RMS' ... Read the full article

RMS launches RiskAssessor™ 2.0, a custom vulnerability solution for hurricane risk

30th June 2017

Global catastrophe risk modeller, RMS, has released RMS RiskAssessor™ 2.0, enabling insurers and reinsurers to obtain a more distinct and expansive view of hurricane risk. RMS describes the engineering-based technology as "the first auditable custom vulnerability modeling solution," which, enables the re/insurance industry to produce a more "distinct" and "expansive" view of hurricane ... Read the full article

Cape Analytics expands property data services across Southeastern coastal states

27th June 2017

Artificial intelligence and machine learning company Cape Analytics has expanded its services with the addition of bespoke geospatial property data analytics to support insurance carriers across the Southeastern seaboard states. The firm now offers advanced property data analytics services to an additional eight coastal states; Texas, Louisiana, Florida, Mississippi, Alabama, Georgia, South ... Read the full article

AIR Worldwide releases new Canada crop hail risk model

26th June 2017

AIR Worldwide has released a new Crop Hail Model for Canada, the first probabilistic model for the industry, offering a complete overview of risk crop hail portfolios and the ability to assess different impact of hail on various crop types as well as larger losses than have previously hit the crop ... Read the full article

CATRisk launches Lloyd’s sponsored Middle East earthquake risk model

20th June 2017

CATRisk Solutions has released a new Lloyd's sponsored earthquake risk model, which offers bespoke solutions for risk assessment in the Middle Eastern region - where according to the model, nearly one fifth of the population live in areas at risk of earthquakes. The new risk tool, which has been released on the Oasis ... Read the full article

AIR Worldwide releases updated U.S. earthquake model

19th June 2017

Catastrophe risk modeling firm AIR Worldwide today announced the release of an updated U.S. earthquake model that includes additional subperils of tsunami and landslide and an enhanced seismicity module to capture impact of human activity on earthquake frequency. AIR said the new model has updated its existing sub-perils; fire following, liquefaction, ... Read the full article

RMS releases version 17.0 of its North American Earthquake Models

9th June 2017

Global catastrophe risk modelling firm RMS has released its updated version 17.0 RMS North America Earthquake Models, which provides a more accurate and comprehensive view of earthquake risks across the U.S., Canada, and Mexico. RMS describes the release as a "major step forward in managing earthquake risk," claiming that its new ... Read the full article

Florida Commission approves RMS North Atlantic Hurricane Models

26th May 2017

Risk modeller RMS's version 17.0 North Atlantic Hurricane Models were certified by the Florida Commission on Hurricane Loss Projection Methodology (FCHLPM) on May 12, 2017, for use in residential rate filings with the Florida Office of Insurance Regulation. The new hurricane risk model incorporates the latest research, science and data on landfall ... Read the full article

RMS stress tests would see leading banks’ corporate borrowers downgraded when exposed to drought risk

5th April 2017

Risk modeler RMS found the clients of leading banks across the globe would see credit rating downgrades when tested against exposure to normal drought scenarios with a sophisticated drought stress testing tool RMS recently made in collaboration with financial institutions. RMS worked with leading banks from the U.S., China, Mexico, Brazil and other ... Read the full article

Colin Kerley joins RMS as new senior vice president from AXIS

3rd April 2017

Leading risk modeling and analytics firm, RMS, has announced Colin Kerley as new senior vice president of the firm’s platform solutions. In his new role Kerley will oversee RMS market and product development teams to improve business and strategic imperatives, reporting to Michael Steel, head of RMS global solutions practice. Steel commented on Kerley's ... Read the full article

RMS releases new India and China agriculture risk models

13th March 2017

Catastrophe risk modeller, RMS, has launched new agricultural risk models for India and China and plans to expand coverage further into Asia-Pacific and the Americas as part of a strategic focus to help clients close the coverage gap. RMS also announced plans to reveal a series of risk models and updates ... Read the full article

JBA opens U.S. office with new models for flood risk

14th February 2017

Natural hazard modelling services provider, JBA Risk Management, has opened its first U.S. office in response to demand for what it's called a gap in the insurance and reinsurance sectors' knowledge of sophisticated U.S. flood risk assessment. Despite floods consistently falling amongst the highest ranking causes of insured losses globally, and being the most prevalent ... Read the full article