Reinsurance News

Risk Modelling

CoreLogic’s US quake model to be made available via Nasdaq’s ModEx

12th June 2019

Nasdaq has announced that CoreLogic is the latest catastrophe risk modeller to make its models available via ModEx, the catastrophic modelling ecosystem Nasdaq acquired in January as part of the Cinnober Technology AB deal. CoreLogic offers more than 180 catastrophe risk models across more than 100 regions, and its U.S. earthquake ... Read the full article

RMS launches new risk modelling & data platform, as it sunsets RMS(one)

14th May 2019

Catastrophe risk modelling and analytics firm RMS has announced the launch of a new strategic risk modelling and data platform for the re/insurance industry, called Risk Intelligence. At the same time, RMS said that it is sunsetting the RMS(one) platform, which faced numerous delays in implementation following its 2014 launch and ... Read the full article

Flood Re & Lighthill Risk Network partner with re/insurers on flood modelling report

14th May 2019

Flood Re, the UK’s government-backed reinsurance scheme, has partnered with researchers at Lighthill Risk Network, as well as a number of re/insurers and brokers, to produce a collaborative report on ways to improve flood risk understanding and management. The research project compiles input from Swiss Re, SCOR, Allianz, Aspen, Lloyds TSB, ... Read the full article

CoreLogic offers new property exposure solution for tornadoes

3rd May 2019

Global catastrophe risk modeller CoreLogic has announced the launch of Tornado Path Maps, a new solution that promises to deliver precise damage exposure data from a tornadic event in minutes. CoreLogic claims that the solution will allow insurers to anticipate claims volume and adjuster deployment for streamlined claims processing, offering quicker ... Read the full article

Risk Frontiers offers Australian hail model on ModEx platform

28th March 2019

Risk management and catastrophe modelling firm Risk Frontiers has announced that its Australian hail model is now available on ModEx, the independent multi-vendor modelling platform for the re/insurance industry. HailAUS 7.0 is a fully stochastic loss model for hail and covers all of Australia, calculating losses for residential, commercial and industrial ... Read the full article

Machine learning tech can enhance wildfire modelling, says Swiss Re

6th March 2019

There is significant potential for machine learning technologies to enhance the re/insurance industry’s approach to modelling wildfire risk, which has failed to adequately predict the growing frequency of large losses in recent years, according to Swiss Re. The reinsurer stressed the possible advantages in utilising real-time data to complement probabilistic wildfire ... Read the full article

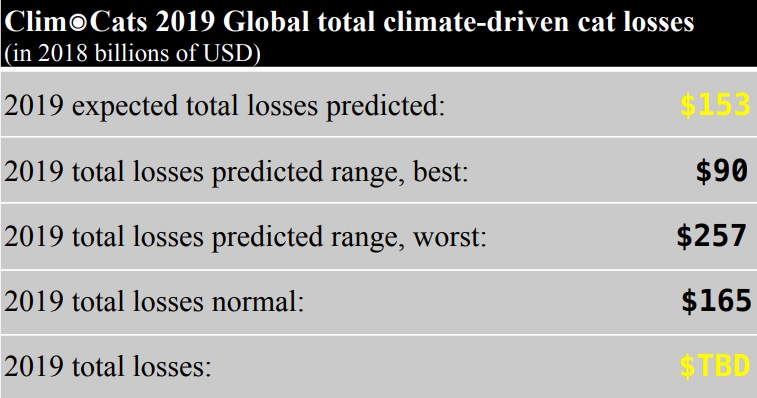

AbsoluteClimo announces new cat model, predicts $153bn losses in 2019

20th February 2019

AbsoluteClimo, a Hawaii-based climate modelling, forecasting and risk management company, has announced a new catastrophe risk model that is predicting global climate-driven cat losses of $153 billion in 2019. The new model, called Clim๏Cats, utilises AbsoluteClimo’s machine learning predictive engine to link climate physics – such as temperature, rainfall and wind ... Read the full article

JBA to deliver Sri Lanka Flood Model on Simplitium’s ModEx platform

20th February 2019

Simplitium, a provider of risk analysis services, has announced that the Sri Lanka Flood Model from global flood risk modeller JBA Risk Management is to be delivered on its multi-vendor ModEx platform. It’s hoped the move will broaden accessibility of the Sri Lanka model for both insurers and the wider Disaster ... Read the full article

RMS launches HD wildfire model for contiguous U.S

18th February 2019

Catastrophe risk modelling and analytics firm RMS has announced the release of its U.S. Wildfire High Definition (HD) Model for the contiguous United States. RMS says this new model offers an improvement on the zoning and mapping products currently employed by the re/insurance industry to evaluate wildfire risk. The company says these methods ... Read the full article

Global Parametrics partners with supercomputing experts on climate risk modelling

4th February 2019

Global Parametrics, a parametric and index-based risk transfer start-up that’s backed by the UK and German governments, has partnered with the Barcelona Supercomputing Centre (BSC) to improve the speed and scale of its climate-related risk modelling. The BSC is a member of the Partnership for Advanced Computing in Europe (PRACE) and ... Read the full article

Cat modellers can learn from tech industry: Simplitium’s Lay & Jones

10th January 2019

With recent developments driving the need for ever more efficiency in the re/insurance industry, catastrophe modellers could benefit from emulating the approach of the technology sector, according to Simplitium’s James Lay and Matthew Jones. Lay and Jones noted that cost reduction was a central theme for many re/insurers during 2018, as ... Read the full article

European reinsurers identify benefits of internal models

9th January 2019

The Insurance Europe Reinsurance Advisory Board (RAB), a special representative body consisting of some of the largest European reinsurers, has published a new report outlining the benefits of the use of internal models. The group claimed that internal models make the risk profile of re/insurance companies more transparent and enrich their ... Read the full article

Analysts forecast average Atlantic hurricane activity for 2019

17th December 2018

Preliminary forecasts from meteorological experts suggest that the Atlantic will experience average levels of hurricane activity in 2019, although El Niño may add some uncertainty to the outlook. Analysis from Tropical Storm Risk (TSR), a re/insurance industry-backed tropical weather research group, predicts that the 2019 Atlantic hurricane season will be about ... Read the full article

Simplitium introduces reinsurance capabilities to ModEx platform

26th November 2018

Simplitium, a provider of risk analysis services, has introduced reinsurance capabilities to its multi-vendor ModEx platform. ModEx is the multi-peril catastrophe risk modelling platform operated on the Oasis Loss Modelling Framework (LMF), offering a hosted and fully managed service that removes the need for any client-side installation. This new introduction expands the ... Read the full article

Asia Pacific region to experience even more destructive cat events, says RMS

29th October 2018

Catastrophe risk modelling and analytics firm RMS has said that the Asia Pacific region can expect to experience even more destructive events at the 1% level of annual probability, which could have a major impact on both governments and re/insurers. The Asia Pacific region has already experienced several disasters over 2018, ... Read the full article