Reinsurance News

Risk Modelling

Ed to utilise URS’ Risk Explorer modelling software

24th October 2018

Ed, the global reinsurance, wholesale and specialty brokerage, has licensed Ultimate Risk Solutions’ (URS) financial risk modelling software to help design bespoke risk mitigation solutions for its clients. The broker said that using URS’ Risk Explorer software will allow it model its clients’ portfolios and evaluate potential re/insurance structures more quickly ... Read the full article

Verisk launches new flood underwriting tool WaterLine

23rd October 2018

Leading data analytics provider Verisk has announced the launch of WaterLine, a new underwriting tool that scores flood risk for all properties in the contiguous United States, helping insurers keep up with the growing number of homes and businesses vulnerable to flood. WaterLine was developed by Verisk businesses ISO and AIR ... Read the full article

JBA launches high-resolution Florida flood maps

23rd October 2018

JBA Risk Management, the global flood risk modeller, has announced the launch of its new high-resolution state-wide flood map for Florida, part of a wider rollout for the continental U.S. Managing Director of JBA Matt Reid stated that the flood map provides “a comprehensive understanding of all three principal types of ... Read the full article

Named peril casualty cover is $90bn per year opportunity, says Praedicat CEO

17th October 2018

Robert Reville, Chief Executive Officer (CEO) of Praedicat, an InsurTech risk modelling and analytics firm, has claimed that developing named peril casualty cover is currently the biggest opportunity in re/insurance, representing a potential $90 billion annual growth opportunity. Praedicat analyses scientific literature to model more than 60,000 potential disease litigation scenarios, ... Read the full article

Risk modeller Kovrr develops new silent cyber product

4th October 2018

Kovrr, an Israel-headquartered cyber risk modeller, has developed a new silent cyber risk offering that enables insurance and reinsurance carriers to identify uncalculated capital at risk and quantify policy clauses that may leave them liable in the event of a cyber-attack. The product, which Kovrr claims is the first fully integrated ... Read the full article

Willis Towers Watson develops new multi-peril property loss modelling tool

19th September 2018

Insurance and reinsurance broker Willis Towers Watson has developed a new technology platform to help organisations analyse potential property losses, called Property Quantified. Set to be launched during the RIMS Canada 2018 Conference on September 23, the Property Quantified platform will enable clients analyse losses across a global portfolio and optimise ... Read the full article

Verisk to offer aerial catastrophe imagery via Geomni

17th September 2018

Data analytics provider Verisk has announced that it plans to offer its customers free access to high-resolution aerial imagery following major loss events via Geomni, a Verisk business with a database of address- and location-based property analytics. Geomni will provide online access to before-and-after imagery of structures and properties inside a ... Read the full article

PERILS to assume management of CRESTA Secretariat

10th September 2018

Zurich-based catastrophe loss data aggregator PERILS has announced that it has taken over responsibility for the ongoing management of the CRESTA Secretariat, the global standard for managing natural perils insurance data. Established by the insurance and reinsurance industry in 1977 as an independent body, the Secretariat has previously been managed on ... Read the full article

PCS develops county level U.S property catastrophe loss estimates

5th September 2018

Property Claims Services (PCS), a Verisk Analytics business, has developed a new level of granularity for U.S property catastrophe insured loss data, offering county level industry loss estimates and claim counts for events with insured losses of at least US $1 billion. PCS said it has worked closely with insurers in ... Read the full article

Simplitium adds CatRisk’s Middle East and Africa earthquake model to ModEx platform

29th August 2018

Simplitium, a global financial services technology provider, has announced that catastrophe risk modeller CatRisk Solutions is to offer its Middle East and Africa Earthquake Model on Simplitium’s multi-vendor ModEx platform. Additionally, Simplitium said that global reinsurance broker Chedid Re had been signed as the first joint client for the service, and ... Read the full article

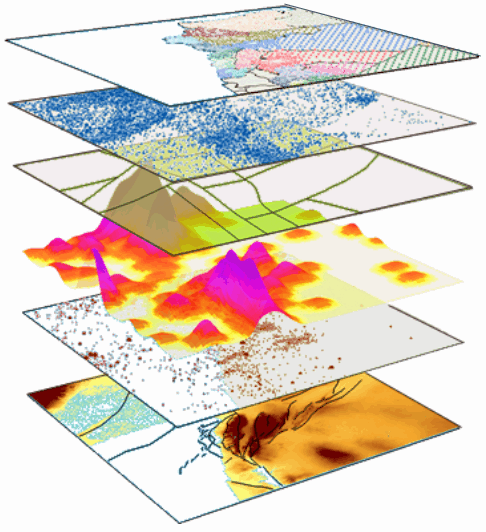

Technology unlocking ‘un-modellable’ catastrophe risks, says CoreLogic’s Larsen

21st August 2018

Recent advances in technology and data analysis have opened new opportunities in catastrophe risk modelling, allowing companies to tackle perils that were previously considered ‘un-modellable’, according to Tom Larsen, Senior Director, Content Strategy at CoreLogic. Larsen explained that risk models support re/insurers in many aspects of loss mitigation for large catastrophes, ... Read the full article

AIR Worldwide releases updated U.S Wildfire Model

15th August 2018

AIR Worldwide, the catastrophe risk modelling arm of Verisk Analytics, has released an updated Wildfire Model that provides a comprehensive view of the risk of wildfire to properties within the 13 westernmost conterminous U.S states. The updated model uses an event-based approach to account for the variability in weather in the ... Read the full article

CoreLogic launches Hazard HQ catastrophe info hub

10th August 2018

CoreLogic, a global property information, analytics and data-enabled service provider, has launched a new publicly-accessible risk and information resource centre, called Hazard HQ, which offers clients insight on the risks natural catastrophes pose to properties across the U.S. Hazard HQ will respond to the growing demand for comprehensive risk assessment resources ... Read the full article

Property remodelling surge creates insurance blindspot: BuildFax

8th August 2018

An almost 60% rise in property remodelling since 2009 has resulted in a misalignment between insurance premiums and risk exposure, according to a new report by BuildFax, a provider of property condition and history insights. Leveraging 23 billion data points, BuildFax observed a 58.9% increase in residential remodelling activity from 2009 ... Read the full article

Drone InsurTech firm Betterview develops new AI driven roof analysis product

1st August 2018

Betterview, an insurance technology and drone start-up firm that is backed by Munich Re and Maiden Re, has launched a new product that uses artificial intelligence (AI) to analyse the characteristics and risks of a property and its roof, called Property Profile. Property Profile uses satellite imagery and historical weather data ... Read the full article