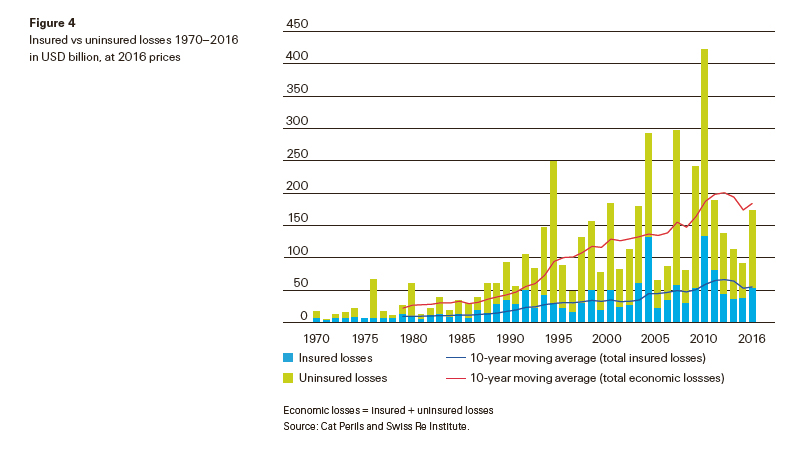

Global insured losses from natural disasters and man-made loss events in 2016 were set at $54 billion in Swiss Re’s latest Sigma study, nearly doubling insured losses from the year before.

2016 economic losses were at $175 billion, up from $94 billion in 2015, according to the Sigma study – making last year the most costly in the last four years for insured and economic losses.

Chief Economist of Swiss Re, Kurt Karl, said; “In 2016, both economic and insured losses were close to their 10-year averages. Insured losses made up about 30% of total losses, with some areas faring much better because of higher insurance penetration.”

High numbers of severe weather events, including earthquakes, storms, floods and wildfires shook the globe last year, causing extensive devastation especially as many natural catastrophe’s hit densely populated regions – factors that pushed insured loss figures up by 42% compared with 2015 losses.

Globally there were a total of 327 disaster events; 191 were natural and 136 man-made.

128 events, or over two-thirds of natural disasters, struck Asia, hitting the region with economic losses of $60 billion, the Japan Kyushu earthquake alone accounted for between $25 – 30 billion economic losses, Swiss Re reported.

Over half of global insured loss figures came from the U.S., Sigma explained this was due to; “a record number of severe convective storm events in the US, and the level of insurance penetration for such storm risks in the US is high. The costliest was a hailstorm that struck Texas in April, resulting in economic losses of USD 3.5 billion, of which USD 3 billion were insured, so about 86% of losses were covered.”

However, in Japan, Kyushu Island, only around 20% of the economic losses from the earthquake in April were covered by insurance.

The protection gap – the difference between insured and economic losses – last year was set at $121 billion.

Last year’s high insured loss figures show increasing numbers of people and governments benefitted from re/insurance solutions, which mitigated the global economic and personal impact of natural catastrophes through quickly settling insurance claims and enabling speedy recovery of lives and livelihoods after disaster events.

Natural catastrophes caused the death of around 11,000 people last year, a figure that fell by more than half from 2015’s 26,000, showing improved global disaster resilience.

“In many parts of the world, insurance can play a much bigger role in helping households and communities recover from the losses and shock that disasters can inflict”, Karl said, commenting on the potential for the re/insurance industry to further close the protection gap.