Reinsurance market survey results

Reinsurance market surveys from Reinsurance News and Artemis

View details of our global insurance and reinsurance market surveys, to find out what our growing readership thought about the state of the market at key points in the year. Our most recent surveys are at the top.

With more than 200,000 readers every single month across the two publications, Reinsurance News and our sister site Artemis have the unparalleled reach to derive actionable data and insights from our surveys. Read about sponsoring one of our surveys.

Global reinsurance market survey – mid-year renewals 2022

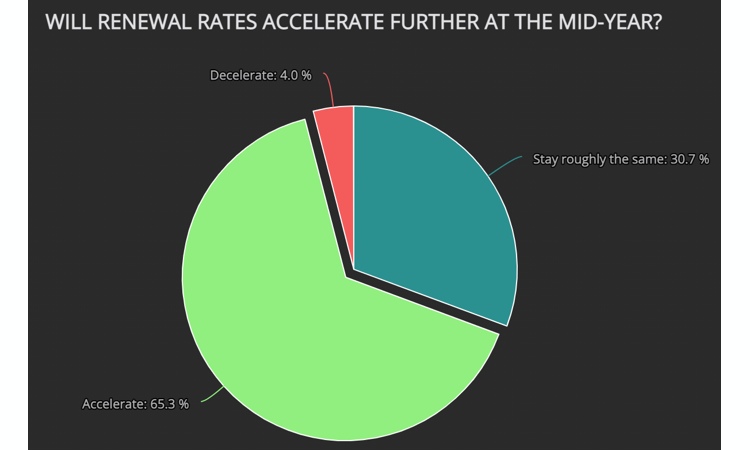

The data reveals that more than 65% of respondents anticipate an acceleration of reinsurance price rises at the mid-year renewals when compared with the January 1st, 2022, renewals. However, just shy of 60% feel it will be very challenging for buyers to fill their reinsurance towers at the mid-year renewals, while 33% expect it to be slightly challenging. View the full Global Reinsurance Market Survey Results from mid-year 2022. |

Global reinsurance market survey – H2 2021

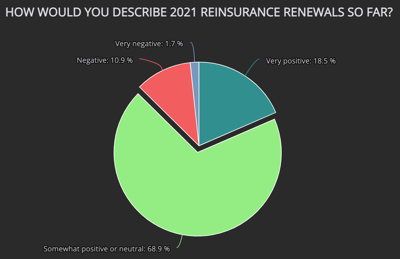

The survey shows that market participants are anticipating the most dramatic rate increases within loss-affected lines of business, notably U.S. and European property cat risks. Outside of the property cat arena, more than 50% of survey respondents are expecting rates in the cyber market to increase by at least 10% at the upcoming renewals. View the full H2 2021 Global Reinsurance Market Survey Results. |

COVID-19 reinsurance market survey update – June 2020

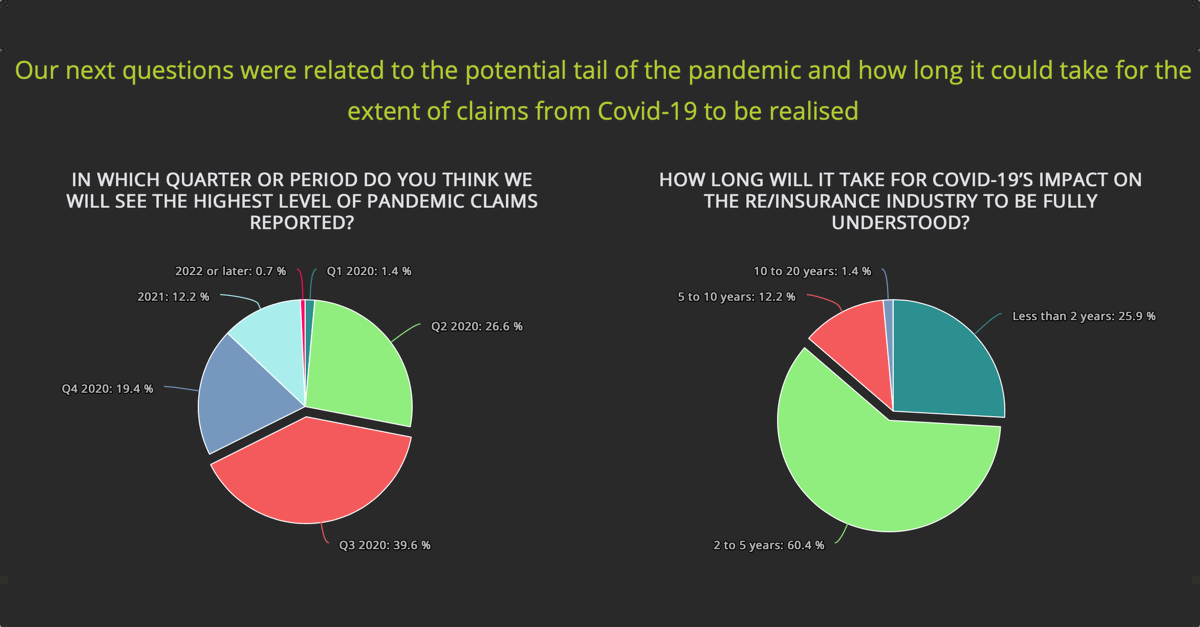

While 25.9% of these respondents were hopeful that the full impact of the pandemic could be understood in less than two years, 60.4% agreed that it could take up to five years. There was broad consensus in other areas too, as the majority of survey answers indicated that re/insurers are more concerned about the affect of COVID-19 on the underwriting side of their business, rather than on the investment side. View the full COVID-19 Global Reinsurance Market Survey Results from June 2020. |

COVID-19 reinsurance market survey – March 2020

And while the ultimate impact of the pandemic remains uncertain, there were some clear points of consensus among respondents. For example, nearly 85% of those who answered the survey said that they expect COVID-19 to drive more reinsurance firming. View the full COVID-19 Global Reinsurance Market Survey Results from March 2020. |

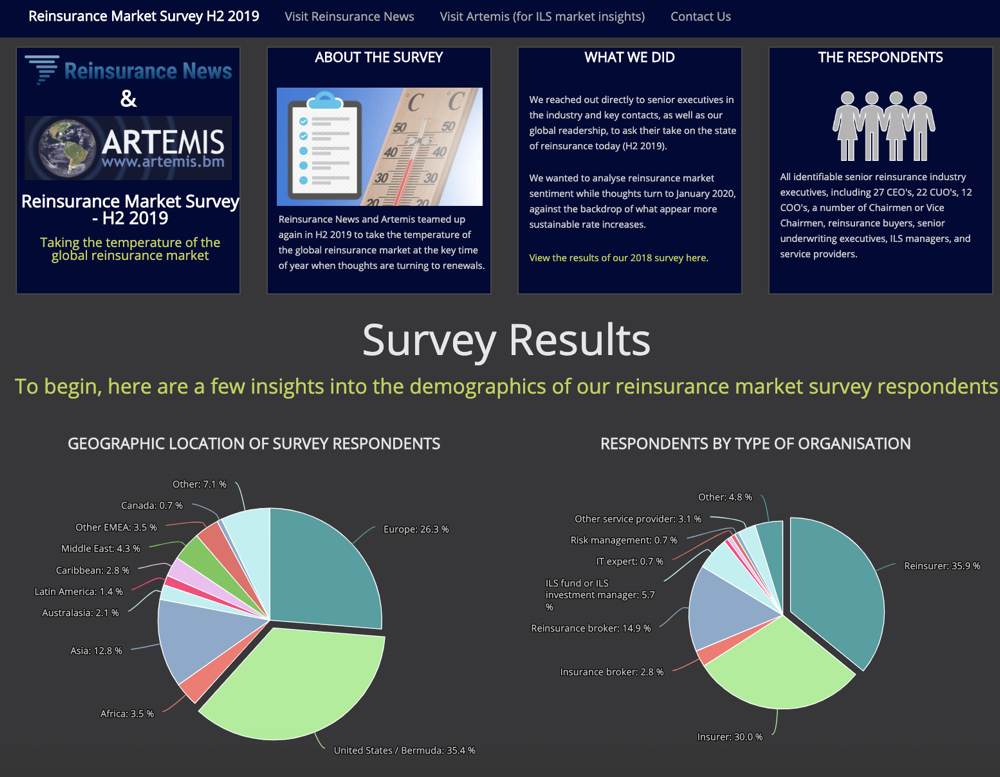

Global reinsurance market survey – H2 2019

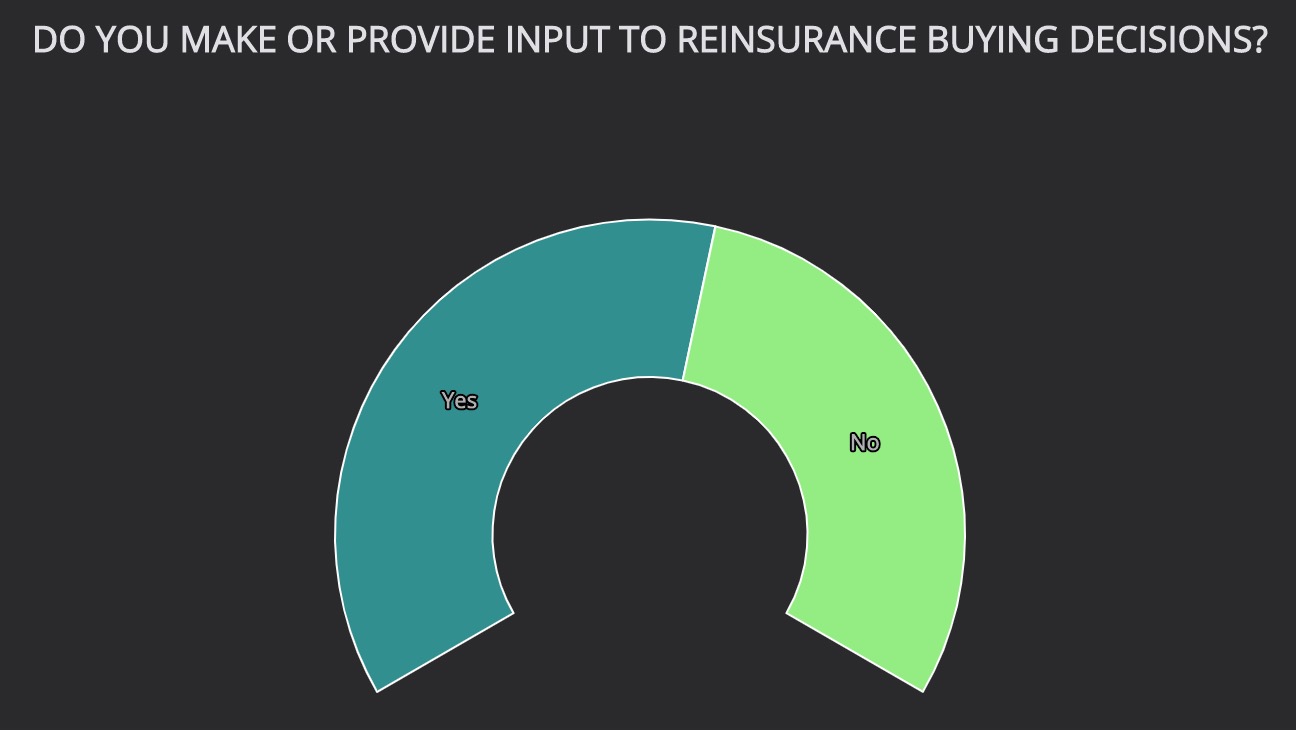

In total over 72% of the respondents provide input to, or are responsible for making, reinsurance buying decisions. The full results of the global reinsurance market survey provide a useful test of the temperature of the industry at this key time of year, offering insight on sentiment and expectations as we moved towards the January 2020 reinsurance renewals. View the full H2 2019 Global Reinsurance Market Survey Results. |

Global reinsurance market survey – H2 2018

Over 62% of the respondents provide input to or are responsible for reinsurance buying decisions and results suggest that market conditions may remain challenging for some. Responses suggested that pricing was expected to be relatively flat across most lines of reinsurance business. But there was an expectation for some significant rate increases in U.S property catastrophe risks following the losses of 2017, retrocessional areas of protection, as well as certain under-performing or emerging lines of business. Regardless of the reasons, a large majority of respondents planned to purchase a similar level of reinsurance protection or a little more at the January 2019 renewals, suggesting a slight uptick in demand. View the full H2 2018 Global Reinsurance Market Survey Results. |

Reinsurance survey sponsorship opportunities

Our surveys provide a useful test of the temperature of the insurance and reinsurance industry at key times of the year and on key topics.

Work with us to brand our surveys, or to drive the topic choice and direction, to access our growing global reinsurance focused readership.

We’d be delighted to discuss the results of our reinsurance market surveys with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector. Contact us here.

Survey sponsors can benefit from significant branding exposure and reach in front of our readership that currently stands at more than 200,000 individuals each month (H1 2020) across Reinsurance News and Artemis.

Sponsors can also benefit from access to the full survey response data, thought-leadership opportunities related to the survey results and other benefits including webinars.