Reinsurance News

Losses

News on catastrophe and man-made losses that impact or could impact the reinsurance industry and reinsurers around the globe.

Q1’24 insured nat cat losses above average at $17bn at least: Aon

29th April 2024

Global losses from disaster events reached $45 billion in the first quarter of 2024, of which at least $17 billion was covered by insurance, with an estimated quarterly protection gap of 64%, according to insurance and reinsurance broker Aon. Insurance and reinsurance industry losses of at least $17 billion from disasters ... Read the full article

MOVEit & Change Healthcare attacks designated as cyber catastrophe loss events by PCS

29th April 2024

Verisk's Property Claim Services (PCS), a provider of industry loss estimates and loss data globally, has designated the MOVEit cyber attack and the Change Healthcare cyber attack as PCS Cyber Catastrophe Loss Events, as reported first by our sister publication, Artemis. For PCS to designate these cyber attacks as PCS Cyber ... Read the full article

Forecasts indicate that US severe weather losses could run on par with 2023, BMS’s Siffert

25th April 2024

Insurance industry losses from US severe weather events have already surpassed $10 billion for this year, with the toll for many events still being calculated. However, forecasts for the coming days and weeks could wind up taking the toll on par with last year, warns Andrew Siffert, Senior Meteorologist at ... Read the full article

Claims paid for New Year’s Day Japan earthquake rise to $492m: GIAJ

23rd April 2024

The General Insurance Association of Japan (GIAJ) has released new insurance claims data for the January 1st M7.5 earthquake that hit near the Noto Peninsula in Ishikawa prefecture, revealing that the claims paid total has risen by around 22% in a few weeks to approximately $492 million (JPY 74.44 billion). Read the full article

PERILS raises industry loss estimate for Babet-Aline floods and storms to €691m

22nd April 2024

PERILS, the Zurich-based catastrophe insurance data provider, has disclosed its third industry loss estimate for the floods and storms caused by low-pressure systems Babet (Viktor) and Aline (Wolfgang) over the British Isles and northwestern Europe in October 2023, increasing it to €691 million. PERILS’ previous loss estimates was €683 million, ... Read the full article

Southwest Asia, UAE storms & floods to drive hundreds of millions in losses: Aon

19th April 2024

Heavy rainfall, storms, and widespread flooding hit Southwestern Asia, notably the United Arab Emirates (UAE), between April 8-17, causing significant economic and insured losses estimated to potentially reach into the hundreds of millions of USD, according to Aon’s weekly cat report. The UAE’s National Center for Meteorology recorded a record-breaking 24-hour ... Read the full article

Loss underestimation a pressing issue, warns Gallagher Re

19th April 2024

Gallagher Re's Q1'24 Natural Catastrophe and Climate Report underscores the critical need for the insurance industry to evaluate unexpected factors that extend event loss behaviour, while also addressing the growing challenge of social inflation. The report identifies event loss underestimation as the most pressing issue, with complexities in loss development varying ... Read the full article

Allstate pegs total catastrophe losses for Q1 2024 at $731m

18th April 2024

U.S. primary insurer Allstate has estimated that total catastrophe losses for Q1 of 2024 were $731 million, pre-tax, much below the $1.69 billion recorded in Q1 of 2023. The firm also disclosed catastrophe losses for March 2024 of $328 million or $259 million, after-tax. As per Allstate, March catastrophe losses included ... Read the full article

Low penetration, extensive reinsurance suggests UAE flooding will be manageable for insurers: AM Best

18th April 2024

Analysis by AM Best discloses that low insurance penetration, coupled with extensive reinsurance cover, should keep the cost borne by United Arab Emirates (UAE) primary insurers at a manageable level after the recent extreme weather that caused severe flash flooding. Rating agency AM Best suggests the flash flooding has caused a ... Read the full article

US convective storm activity drives global Q1 insured losses of $20bn: Gallagher Re

17th April 2024

Gallagher Re has estimated that global insured losses from natural catastrophes in Q1 of 2024 were $20 billion, heavily driven by severe convective storm (SCS) activity in the US. According to the global reinsurance broker's Natural Catastrophe & Climate Report, from which all this information was derived, insured losses in Q1 ... Read the full article

SCS April events to drive economic & insured losses into the hundreds of millions or higher: Aon

12th April 2024

The recent strong winds and severe convective storms that struck the central and southern United States between April 6-11, are estimated to drive economic and insured losses into the hundreds of millions or higher, USD, according to Aon's weekly cat report. Between April 6-7, a deep surface low-pressure system initiated severe ... Read the full article

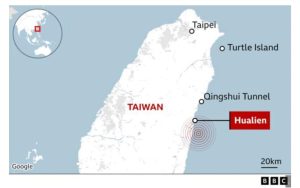

Insurable losses from Taiwan earthquake to be between $0.5-$1bn CoreLogic estimates

9th April 2024

CoreLogic estimates insurable losses from the 7.2 magnitude earthquake that hit Taiwan on April 3, 2024 will be between $0.5 and $1.0 billion (note, CoreLogic has reduced its figures from a range of $5bn-$8bn). This is considered the largest quake to hit the country in the last 25 years. Having ... Read the full article

Taiwan quake to impact local insurance industry due to high take-up rates

5th April 2024

According to Aon, the deadly magnitude-7.4 earthquake that struck eastern Taiwan on April 3 is likely to result in a notable event for the local insurance industry due to relatively high take-up rates. The quake is reportedly the island's largest in 25 years, with officials having reported at least 10 fatalities ... Read the full article

PERILS raises industry loss for Australia Christmas storms to AU$1.55bn

3rd April 2024

Zurich-based catastrophe insurance data provider PERILS AG has provided a second update on the insured loss estimate for the Australia Christmas Storms, which affected the states of Victoria, New South Wales, and Queensland, lifting the figure by 11% to AU$1.547 billion (USD 1bn). In February, PERILS disclosed its initial industry ... Read the full article

Taiwan’s strongest earthquake in 25 years could drive meaningful loss for local insurance industry

3rd April 2024

A 7.2 magnitude earthquake struck 18km south of Taiwan's Hualien city at 8am local time today, driving the strongest tremors to have hit the country in the last 25 years, and given the region's relatively high levels of insurance penetration it could be a meaningful loss for the local insurance ... Read the full article