David Paul, Principal at ALIRT Insurance Research, has argued that Alleghany Corporation is a “perfect fit” for the “growing insurance empire” of Warren Buffett’s Berkshire Hathaway.

His comments follow news from earlier today when Berkshire Hathaway announced that it had acquired all outstanding Alleghany shares in an $11.6 billion transaction.

The definitive merger agreement is expected to expand Berkshire’s significant insurance and reinsurance market interests, and will include Alleghany’s reinsurance entity, TransRe.

Paul argues that the move will be very beneficial for Berkshire, given that Alleghany combines strong commercial specialty operations and a reinsurance arm with non-insurance investments.

“Berkshire Hathaway’s pending acquisition of Alleghany Corporation is, in my opinion, a stroke of genius for Warren Buffett,” he said, adding: “it’s almost as if Berkshire Hathaway is acquiring a (much) smaller version of itself.”

Alleghany’s three insurance arms consist of CapSpecialty, RSUI Group, and TransRe, with each of these units having established either intercompany pools or substantial non-pool reinsurance relationships among the operating units.

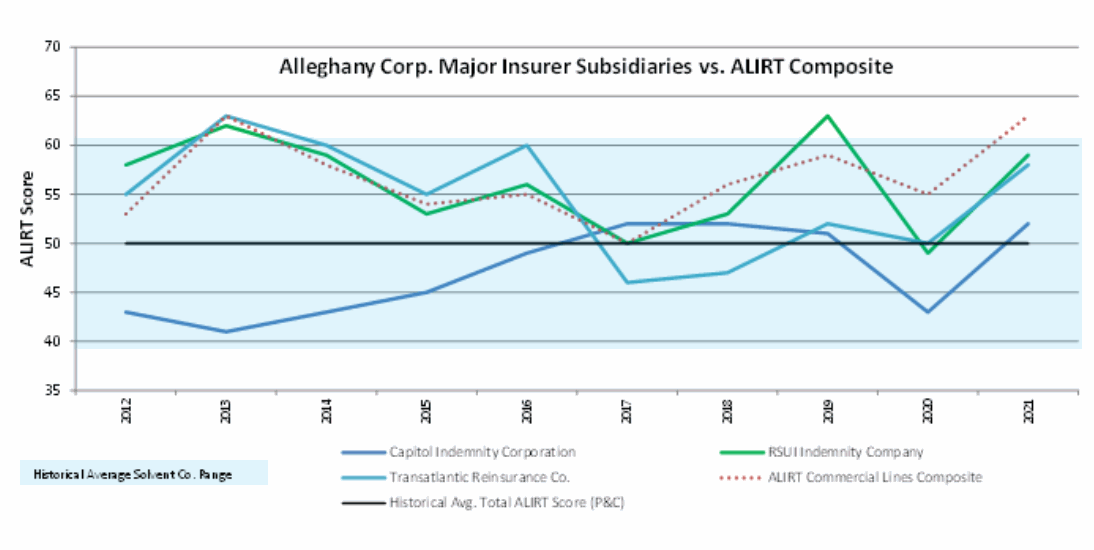

Looking at the 10-year ALIRT Scores for the lead insurers of these three groups, two of Alleghany’s insurance units have tracked fairly close to the ALIRT Commercial Lines composite, Paul notes, while Capitol Indemnity Corporation has shown improvement over time, with most scores lie well within a “normal” range.

Looking at the 10-year ALIRT Scores for the lead insurers of these three groups, two of Alleghany’s insurance units have tracked fairly close to the ALIRT Commercial Lines composite, Paul notes, while Capitol Indemnity Corporation has shown improvement over time, with most scores lie well within a “normal” range.

Paul also believes that Alleghany’s entire insurance operation will retain its brands and operates as a free-standing unit within Berkshire Hathaway, and that the new ownership will lift the ratings of its subsidiary units.

Currently, the RSUI and Transatlantic subgroups are rated A+ by Best, while the CapSpecialty subsidiaries are rated A.

Expected to close in the fourth quarter of 2022, the deal remains subject to customary closing conditions, including approval by Alleghany shareholders and receipt of regulatory approvals.