US primary insurer Allstate has expanded its per-occurrence Nationwide Excess Catastrophe Reinsurance programme for 2022-2023 to provide coverage up to $6.614 billion of losses, less a $500 million retention.

In Q1 2022, Allstate completed the renewal of some of its catastrophe reinsurance placements for 2022-2023, specifically its Nationwide Excess Catastrophe Reinsurance tower.

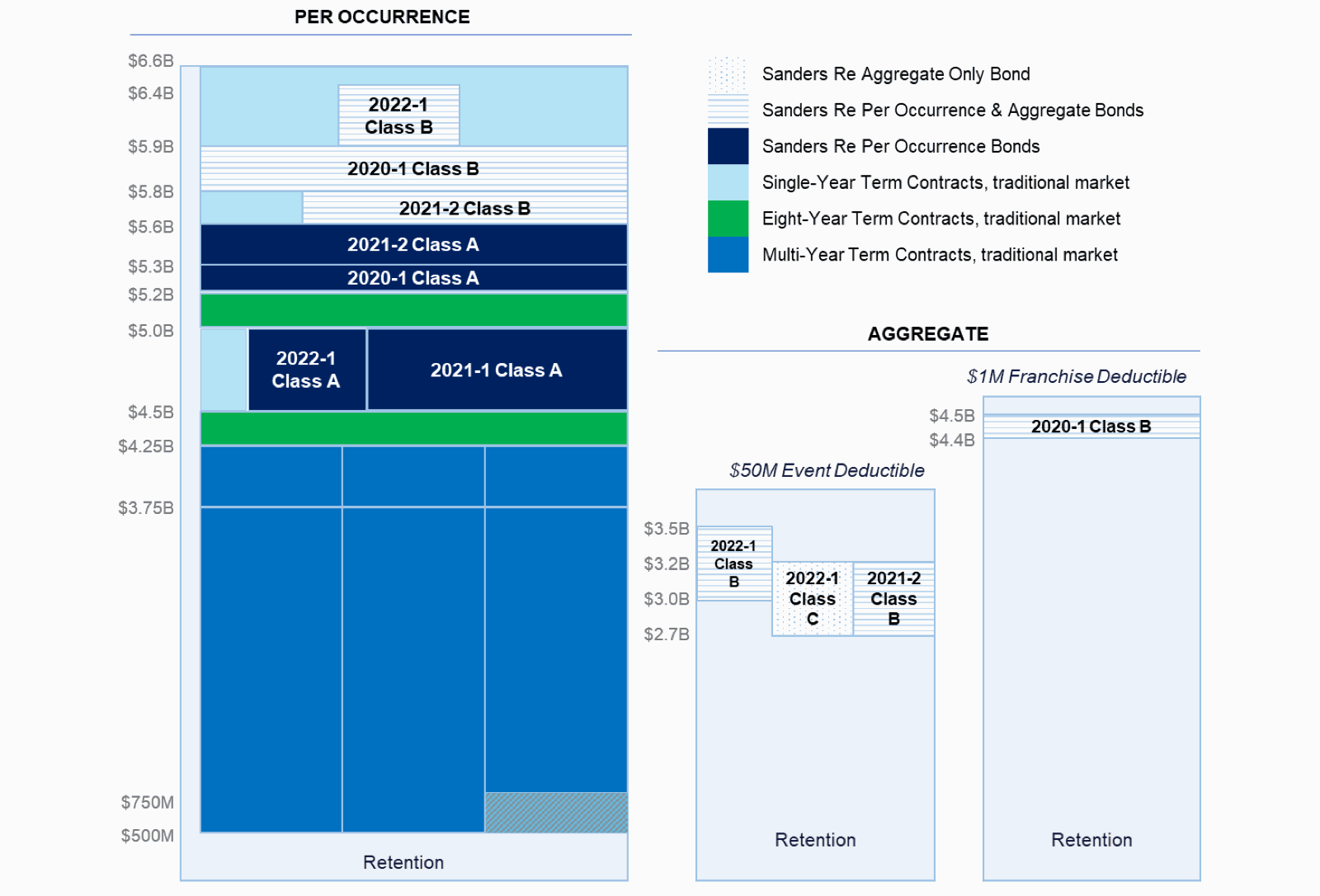

For the year ahead, the programme provides coverage up to $6.614 billion of loss less a $500 million retention, whereas the 2021-2022 placement provided coverage up to $5.763 billion of loss, with the same retention for Allstate. This means that Allstate has secured an extra $851 million of reinsurance capacity for this programme for 2022-2023 when compared with the previous year.

Unsurprisingly, given hardening market conditions and the larger placement, Allstate’s Q1 catastrophe reinsurance spend amounted to $144 million, compared with $113 million in the first-quarter of 2021.

The Nationwide tower includes occurrence contracts from both the traditional reinsurance market and the insurance-linked securities (ILS) market. Additionally, annual aggregate coverage is included in four contracts supported by the ILS space.

Allstate explains that the agreements in place provide multi-line catastrophe protection in all states except Florida, where cover is only provided for personal lines automobile.

From the traditional reinsurance market, Allstate has secured multi-year per-occurrence coverage of $3.75 billion from four contracts, in excess of a $500 million retention and exhausting at $4.25 billion per loss occurrence. Above $4.25 billion of losses, reinsurance is provided through a combination of contracts placed with traditional market reinsurers and catastrophe bonds from Sanders Re.

In comparison, the 2021-2022 programme included multi-year agreements providing coverage up to $3.25 billion in excess of a $500 million retention. Last year’s programme also provided reinsurance capacity above $3.75 billion through a combination of traditional reinsurance and catastrophe bonds from Sanders Re.

So, it’s clear that $500 million of the additional $851 million of reinsurance Allstate procured for this placement in Q1 2022 came from the traditional market.

Looking at the aggregate catastrophe excess-of-loss side of Allstate’s latest reinsurance arrangements, and the top of the tower has declined to $4.5 billion from $4.8 billion last year. Drivers of this decline will be recoveries made under the aggregate Sanders Re catastrophe bonds, but also the change in cat bond terms and conditions to utilise event deductibles.

The most recent cat bond from Allstate is the $500 million Sanders Re III Ltd. (Series 2022-1) deal that provides it with both occurrence and annual aggregate protection. But the insurer has numerous other in-force transactions, including the $400 million Sanders Re II Ltd. (Series 2021-2) deal, the $250 million Sanders Re II Ltd. (Series 2021-1) issuance, and a $250 million Sanders Re II Ltd. (Series 2020-1) transaction.

For the entirety of 2021, Allstate’s catastrophe reinsurance spend was $556 million, so it will be interesting to see where the full-year 2022 costs come out after the firm has placed its Florida and other area programs at the mid-year reinsurance renewals.