U.S. insurer Allstate has completed the placement of its 2023-2024 catastrophe reinsurance programs, which, excluding reinstatement premiums, were secured at a total cost during Q2 2023 and H1 2023 of $242 million and $461 million, respectively, up significantly from $173 million in Q2 2022 and $317 million in H1 2022.

The higher cost comes as Allstate secured more coverage via additional layers in its nationwide excess catastrophe reinsurance program, adjusted its Florida protection and renewed some of its other programs, against a backdrop of rising reinsurance rates in the hard market.

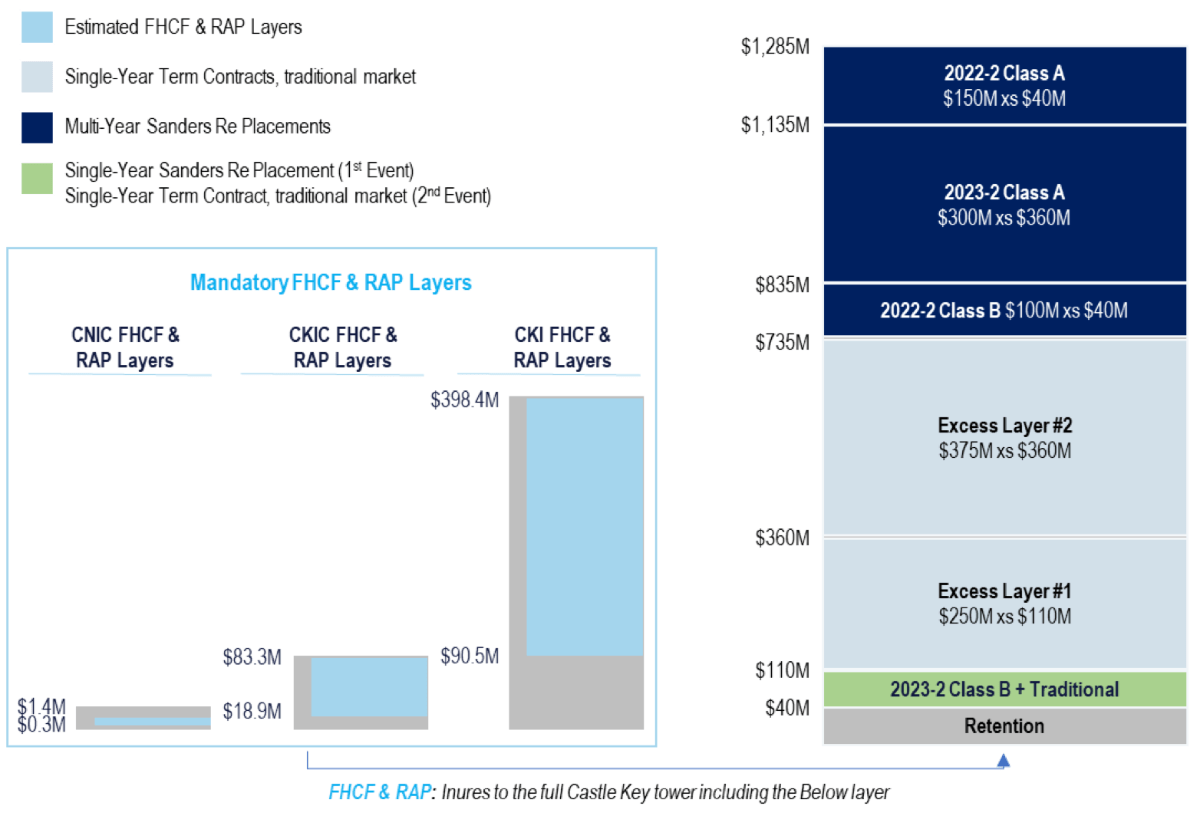

Within Allstate’s Florida excess catastrophe program, which provides coverage for Castle Key Insurance Company, Castle Key Indemnity Company and affiliated companies personal lines property excess catastrophe losses in the state, the firm has made some notable changes, dropping the top of the tower from $1.83 billion to $1.28 billion for 2023-2024.

The program includes three contracts placed in the traditional market and two Sanders Re cat bonds placed in the insurance-linked securities (ILS) market, compared with five contracts placed in the traditional market and two Sanders Re cat bonds a year earlier.

However, the insurer has leveraged the Florida Reinsurance to Assist Policyholders Program (RAP) this year, which provides additional protection alongside the Florida Hurricane Catastrophe Fund contracts.

The RAP contracts provide combined $48.7 million of limits in excess of a $109.8 million retention and are 90% placed. While the mandatory FHCF contracts provide combined $329.5 million of limits in excess of a $153.6 million retention and are also 90% placed.

All in all, Allstate has secured less reinsurance protection in Florida, likely reflecting reduced appetite and also the elevated cost of reinsurance in the state.

Turning to the firm’s nationwide excess catastrophe reinsurance tower, year-on-year, the top of the tower has risen to provide coverage up to $6.92 billion compared with $6.6 billion for 2022-2023. The retention has risen from $500 million to $500 million to $750 million.

This year, multi-year and per-occurrence agreements placed in the traditional market consist of five contracts providing coverage up to $4.25 billion in excess of the retentions and exhausting at $4.75 billion per loss occurrence. A year earlier, multi-year agreements provided the firm with coverage up to $3.75 billion excess the $500 million retention exhausting at $4.25 billion.

The $500 million increase comes from two new annual contracts secured from the traditional reinsurance market which attaches at $4.25 billion of losses, one 95% placed one 4% placed.

Additionally, three new annual contracts provide coverage between $1.75 billion and $4.25 billion, placed 4%.

New contracts secured at the June 1st, 2023, renewals consist of five layers, including a single-year contract providing $250 million of coverage excess a $750 million retention, and four multi-year contracts structured with a retention of $1 billion.

The nationwide program also includes catastrophe bond coverage, which attaches from $4.96 billion of losses, filling various layers and slices of protection up to the $6.924 billion exhaustion point.

Allstate also renewed its national general lender services standalone program at the mid-year 2023 renewals, although the retention has risen with slightly more protection secured.

For Allstate’s national general reciprocal excess catastrophe reinsurance contracts, and its Kentucky earthquake excess catastrophe reinsurance contract, coverage remains unchanged from the previous year.

The announcement of the company’s renewed reinsurance programs comes as the insurer announced its second quarter 2023 results, reporting a net loss of $1.4 billion on the back of increased underwriting losses due to a massive catastrophe hit, which totalled $2.7 billion for the period.