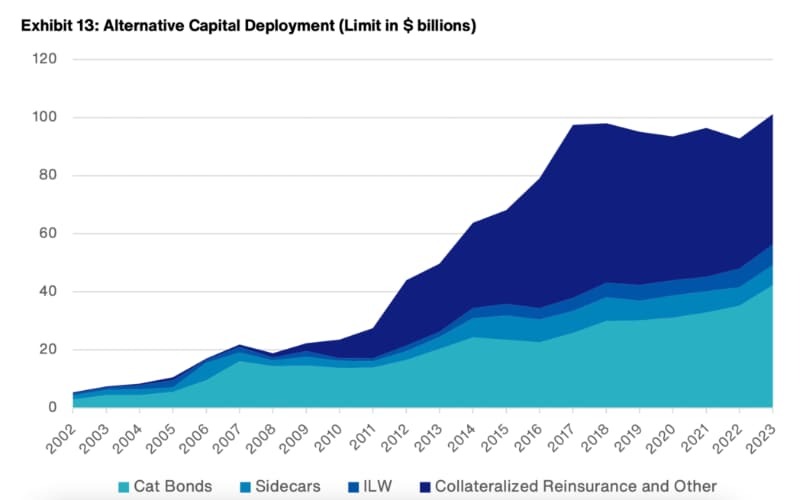

Aon’s Reinsurance Market Dynamics report reveals that 2023 witnessed an unprecedented surge in the utilisation of alternative capital, marking the sector’s best performance in over two decades.

The report underscores the increasing reliance on alternative capital, with a notable milestone of crossing the $100 billion threshold for the first time, signaling a 7% increase from the previous year.

Amidst soaring property reinsurance pricing levels not observed in several years, insurers and reinsurers embraced the opportunity to diversify their portfolios through insurance-linked securities (ILS).

The report indicates that ILS investors experienced the highest risk-adjusted margins in over ten years, offering attractively priced capacity to cedents. The North Atlantic hurricane season, which resulted in muted losses, further contributed to enhanced returns.

A significant portion of this growth was directed towards the catastrophe bond market, which saw a remarkable $7 billion increase in 2023, a 21% surge from the previous year.

The cat bond market reached an all-time high of over $42 billion at the end of 2023, with a record-breaking issuance of $15.4 billion during the year. Notably, the California Earthquake Authority issued a record $1.505 billion of cat bonds.

The fourth quarter played a pivotal role in this expansion, witnessing a total issuance volume of $5.2 billion, surpassing the second-largest fourth quarter (2021) by $2.4 billion.

Cat bond pricing experienced tightening throughout 2023, stabilising in the fourth quarter due to increased supply coinciding with some ILS investors rebalancing their allocations.

One remarkable development in Q4 was the introduction of cyber cat bonds. AXIS initiated the market’s first-ever 144a cyber cat bond, with Beazley and Chubb quickly following suit.

The cyber cat bond market totaled over $400 million in notional value, with ILS investors leading the way in developing this new class of risk.

Aon expresses optimism that this market will continue to evolve, providing insurers with essential capacity to foster the growth of the cyber insurance market while offering investors an opportunity to diversify their portfolios.

Furthermore, the report highlights the robust performance of sidecar investors in 2023, who reaped handsome rewards with returns exceeding 30% in some cases.

With strong underlying reinsurance margins and a lack of major global natural catastrophes, sidecar renewals have proven relatively straightforward as investors commit to another year of well-margined reinsurance business.