US specialty insurance group Assurant, Inc. has shrunk the size of its overall reinsurance tower limit by $230 million for 2020 as it exited underperforming businesses.

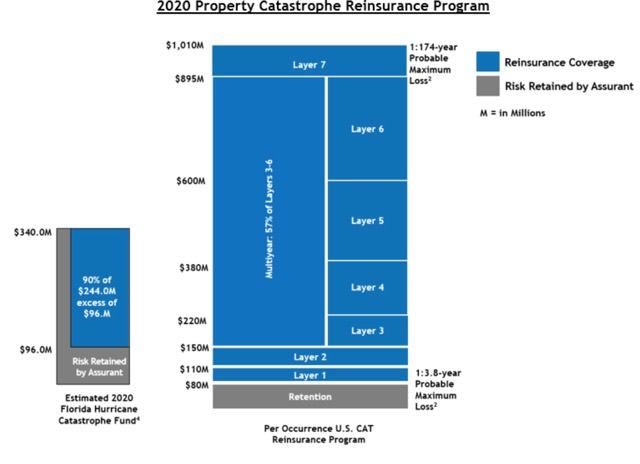

The U.S. Program of Assurant’s 2020 property catastrophe reinsurance program provides $930 million of coverage in excess of a $80 million retention per-event with a projected probable maximum loss (PML) of approximately a 1-in-174-year storm.

In comparison, the 2019 U.S. Program provided $1.16 billion of coverage in excess of a $80 million retention per-event with a projected PML of approximately a 1-in-173-year storm.

When combined with the Florida Hurricane Catastrophe Fund (FHCF) the 2020 program is covered for gross Florida losses of up to $1.15 billion, which is down on the up to $1.4 billion secured last year.

While Assurant’s reinsurance tower limit reduced in the year, the firm did maintain its retention and also secured a greater level of multi-year coverage. Effectively, this mitigates the volatility in future reinsurance contracts amid rising prices and a firming marketplace.

Michael Campbell, President of Global Housing at Assurant, said: “This year, our strong reinsurance partnerships enabled us to increase our multi-year coverage to nearly 50 percent of our total U.S. program, while maintaining our $80 million per-event retention at attractive terms and conditions, compared to the broader market.

“Importantly, we continued to execute on our long-term strategy to reduce less attractive risk exposure, as we exited businesses that do not meet our risk-return expectations, allowing us to lower our overall tower limit by $230 million.”

The increase in multi-year coverage to almost half of Assurant’s U.S. program over the next two to five years, compares with multi-year contracts covering just 35% of reinsurance layers last year.

Additionally, Assurant has maintained the unique cascading feature of its U.S. program that provides multi-event protection in which most higher layers cascade down to $110 million as the lower layers and reinstatement limits are exhausted.

Reinsurance premiums for the 2020 program are estimated to be roughly $138 million pre-tax against $163 million pre-tax for 2019, which, Assurant says is a reflection of its exit from small commercial lines as well as a modest reduction in lender-placed exposure.

The 2020 program was placed with more than 40 reinsurers that are all rated A- or better by A.M. Best.

Assurant’s President and Chief Executive Officer (CEO), Alan Colberg, said: “At Assurant, not only is our commitment to social responsibility critical, but we believe we have an obligation to strengthen and protect the communities where we work and live for all of our stakeholders, including our customers and consumers.

Assurant’s President and Chief Executive Officer (CEO), Alan Colberg, said: “At Assurant, not only is our commitment to social responsibility critical, but we believe we have an obligation to strengthen and protect the communities where we work and live for all of our stakeholders, including our customers and consumers.

“And one way we demonstrate that commitment is by implementing a comprehensive catastrophe reinsurance program.”

Coverage in the Caribbean under the 2020 catastrophe reinsurance program amounts to up to $175 million in excess of $20 million. Assurant’s 2020 Latin America reinsurance protection of up to $170 million in excess of $7 million renews on July, 1st 2020.