The Insurance Council of Australia (ICA) has lent its support to a series of proposals designed to improve the uptake of farm income and crop insurance for primary producers in Australia.

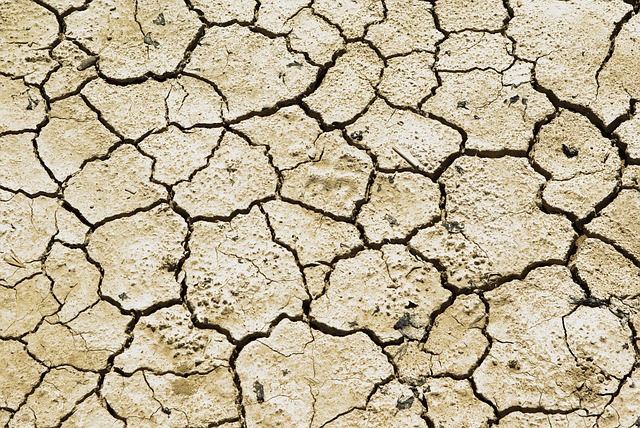

Rob Whelan, Chief Executive Officer of the ICA, said that access to better data, removing unfair taxes, and introducing incentives would be key factors in improving the resilience of Australian farmers during droughts or following extreme weather events such as floods or cyclones.

Rob Whelan, Chief Executive Officer of the ICA, said that access to better data, removing unfair taxes, and introducing incentives would be key factors in improving the resilience of Australian farmers during droughts or following extreme weather events such as floods or cyclones.

One of the key proposals to expand insurance coverage for primary producers is the removal of stamp duties on agricultural insurance products nation-wide, which has already been implemented by several states.

“Government support should be directed at encouraging the take-up of crop and farm income insurance,” said Whelan. “The abolition of stamp duties for agricultural insurance products is one of five measures that insurers believe would help primary producers in times of drought and protect an important sector of the economy.”

The other proposals, which will be raised by the ICA during the Prime Minister’s Drought Summit, include a census on every primary producer to collect and publish critical data, which will support underwriting of existing covered crops and expansion into livestock and non-cereal crops.

Tax reductions for farm income and crop insurance products would also encourage greater insurance take up, the ICA argued, while a government-guarantee facility for insurers would assist companies in maintaining reinsurance cover in the global market.

Additionally, the ICA said that government lending criteria through the Regional Investment Corp (RIC) should be changed to be dependent on a primary producer holding adequate farm income or crop cover.

Whelan claimed that state taxes and levies on insurance are currently unfair and highly inequitable, and have contributed to the low uptake of farm income and crop insurance products.

Any stamp duty concessions on insurance introduced for the agricultural sector should quickly be applied to the whole community, he added.