As per Christie Lee, senior director – head of analytics, AM Best, a significant amount of losses from the 7.2 magnitude earthquake that recently struck Taiwan could come from business interruption (BI) coverage.

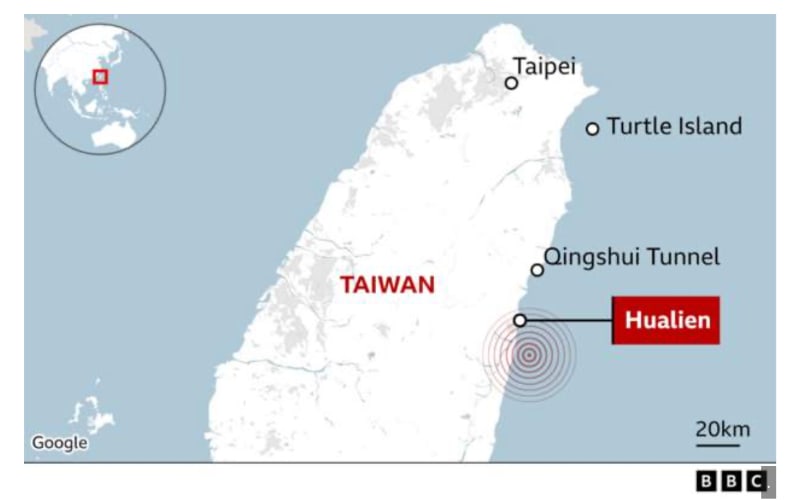

The earthquake, which hit near the eastern county of Hualien on the 3rd of April, was the island’s worst in 25 years, reportedly killing nine and injuring more than 1,000.

The earthquake, which hit near the eastern county of Hualien on the 3rd of April, was the island’s worst in 25 years, reportedly killing nine and injuring more than 1,000.

As well as causing multiple buildings to collapse in Hualien, the shocks were felt as far as Taiwan’s mountainous interior, which was rocked by huge landslides. AM Best noted that in Taiwan’s experience with major earthquakes, the majority of events resulted in claims from industrial losses.

“This is due to the technology and science sectors being material to Taiwan’s overall economy and the large insureds purchasing adequate insurance protection, with these exposures ultimately being ceded to the international reinsurance market. More generally, a significant amount of losses could come from business interruption coverage,” the rating agency explained.

Large semiconductor manufacturing companies in Taiwan are said to have temporarily halted operations and evacuated a number of their plants after the earthquake, which could be a possible source of BI.

Fo those unaware, Taiwan manufactures over 60% of the semiconductors in the world, with most of its capacity coming from one company, Taiwan Semiconductor Manufacturing Company (TSMC).

TSMC, the main contract chipmaker to Apple Inc. and Nvidia Corp., reportedly moved staff out of certain areas after the earthquake. The firm observed in a statement on late Wednesday, “There is no damage to our critical tools including all of our extreme ultraviolet lithography tools.”

It added that a small number of tools were damaged at some facilities, but the company is deploying all available resources to ensure a full recovery.

AM Best has stated that its market segment outlook for Taiwan’s non-life insurance segment stands at negative, owing to rising reinsurance costs and declining investment assets.

The rating agency concluded, “Following the segment’s huge pandemic insurance losses in 2022, the industry’s capitalization has weakened, despite number of players receiving capital injections from parent companies.

“Special reserves, treated as a capital buffer to support large losses, have also been reduced materially by reserve releases that offset pandemic insurance claims.

“The diminished special reserve buffer resulted in an increase in catastrophe reinsurance purchase at the upper layers in past renewals.

“However, some insurers increased the retention level of their catastrophe reinsurance programmes, due to rising reinsurance costs in hard market conditions, which may translate to higher volatility in their net profit.”