In the final quarter of 2022, catastrophe bond and related insurance-linked securities (ILS) issuance fell when compared with the prior year quarter, but remained robust at $1.6 billion, helping the outstanding market hit a year-end high of $37.9 billion, according to Artemis.

Our ILS-focused sister site, Artemis, recently published its Q4 2022 cat bond and ILS market report, which examines issuance in the quarter and the full-year 2022, a period in which capital market investors secured higher pricing as spreads increased amid the hardening reinsurance market landscape.

Our ILS-focused sister site, Artemis, recently published its Q4 2022 cat bond and ILS market report, which examines issuance in the quarter and the full-year 2022, a period in which capital market investors secured higher pricing as spreads increased amid the hardening reinsurance market landscape.

Overall, the quarter saw 15 transactions come to market mostly from repeat sponsors, with GeoVera Insurance Holdings and PICC Property and Casualty Company being the only debut sponsors to feature in the period.

Alongside 10 property catastrophe risk 144a transactions, quarterly issuance included four privately placed deals, and one deal covering other, non-catastrophe risk.

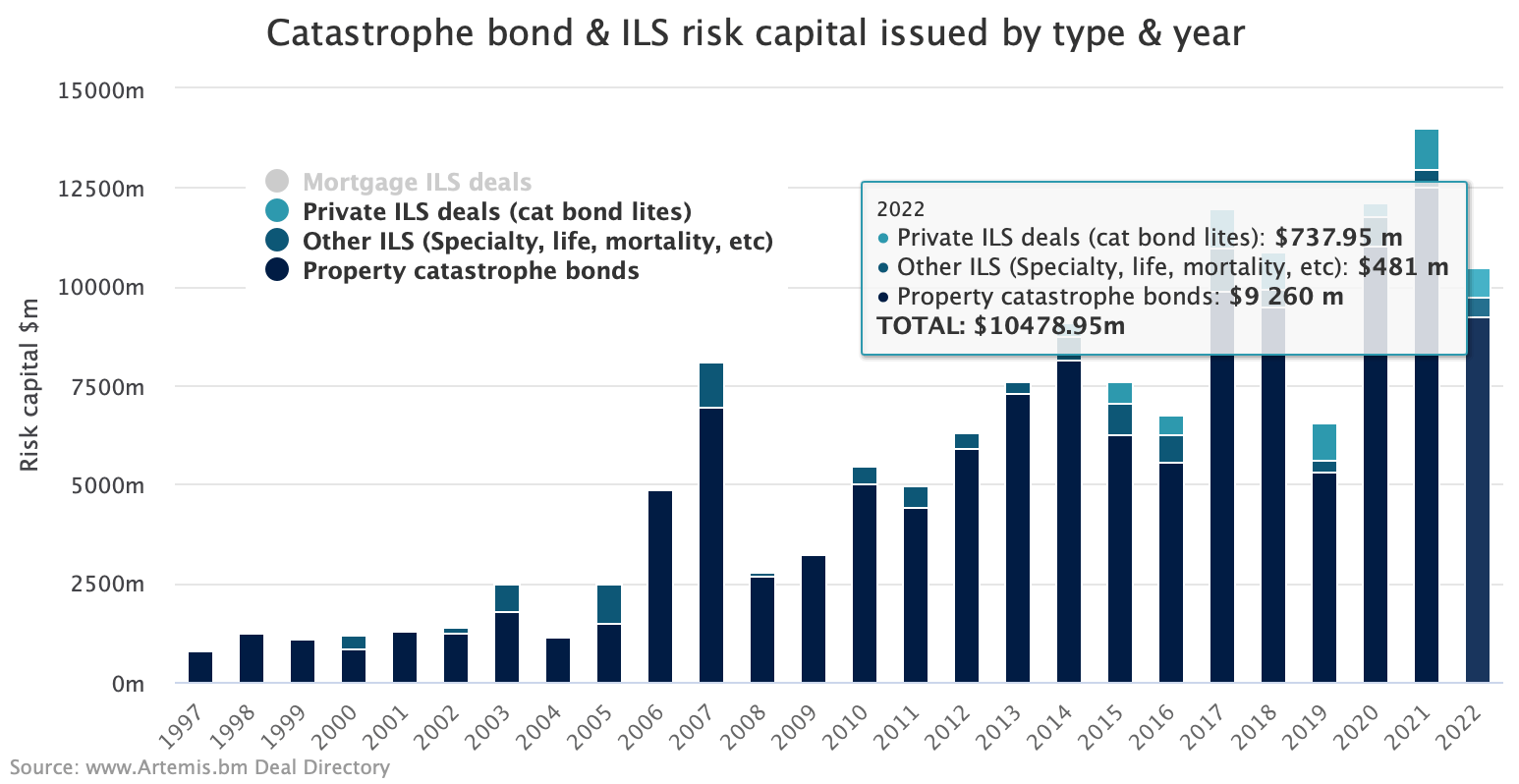

For both Q4 and full-year 2022 issuance fell when compared with the prior year, hitting $1.6 billion for the quarter and $10.5 billion for the year. Despite the dip from 2021, full-year 2022 issuance still came in above the ten-year average for the sector, and has now exceeded the $10 billion mark for the past three years.

In Q4, the large majority, 88% or $1.37 billion, provided cedants with protection against a range of catastrophe risks across numerous geographies. For the full-year, cat risk deals accounted for almost $9.3 billion, or 79% of total risk capital issued.

The chart below, based on data from the Artemis Deal Directory, shows the split of annual cat bond and ILS issuance in 2022.

The roughly $10.5 billion of issuance in 2022 took the outstanding market size, at the end of the year, to $37.9 billion, which represents growth of more than $2 billion from the end of 2021.

As the report explores, which is now available to download for free, the evolution of pricing within the catastrophe bond space has been interesting over the past year.

Throughout the year, investors pushed for higher pricing on the back of consecutive loss years and financial market volatility, resulting in the spread above expected loss reaching its highest point in a decade, while the average multiple (price coupon divided by expected loss) also rose.

Download your free copy of Artemis’ Q4 2022 Cat Bond & ILS Market Report here.