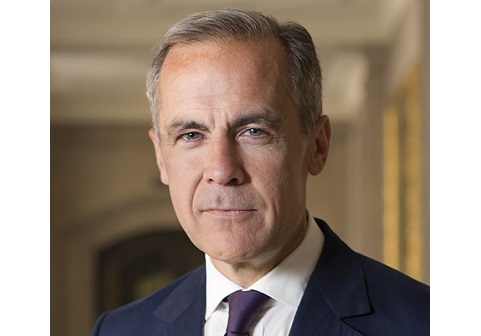

Building global climate resilience will require insurers and reinsurers to take more action on both sides of their balance sheet, according to Mark Carney, Governor of the Bank of England (BoE).

Speaking at the UN General’s Climate Action Summit 2019, Carney said that, on the liability side, re/insurers must focus on reducing the protection gap and supporting the resilience of households and companies to growing climate risks.

Speaking at the UN General’s Climate Action Summit 2019, Carney said that, on the liability side, re/insurers must focus on reducing the protection gap and supporting the resilience of households and companies to growing climate risks.

This approach can be supported by collaborations with the public sector and academia to better understand past losses, as well as new products, such as insurance-linked securities (ILS) based on parametric triggers, Carney said.

The Bank of England believes that innovative insurance products are vital to help reduce macro protection gaps, are generally cheaper to structure and administer, and are more efficient to blend with commercial finance if needed.

Carney also sees potential for more support from development agencies and Multilateral Development Banks as climate-related tail risks increasingly become uneconomic for private sector re/insurers to cover.

On the asset side, Carney argued that infrastructure investments will be essential, and that all countries will need to step up their investments in sustainable energy to support the transition to net zero carbon emissions.

The reality of climate change, he added, also means that all countries will need to invest in new climate-resilient infrastructure, the global cost of which is likely to be monumental, with estimates ranging between $70-90 trillion over the next decade.

“It’s imperative to act now to create practical tools and frameworks to support climate-resilient infrastructure investments – ranging from broader use of catastrophe bonds to greater risk pooling for the most vulnerable countries,” Carney told attendees at the UN summit.

“The world needs much more investment in infrastructure, and greater risk sharing of climate risks,” he explained. “Insurers have a unique ability to meet both needs.”

Carney also cited data from Lloyd’s of London that estimates a 1% rise in insurance penetration can translate to a 13% reduction in uninsured losses and a more than 20% reduction in disaster recovery burden on taxpayers.

Despite the potential benefits, progress has been slow, with the protection gap only narrowing from 78% to 70% globally over the last 30 years.

“The providers of capital – banks, insurers, asset managers and those who supervise them – all need to improve their understanding and management of climate-related financial risks,” Carney said at a separate event during the UN summit.

“Changes in climate policies, new technologies and growing physical risks will prompt reassessments of the values of virtually every financial asset,” he continued. “Firms that align their business models to the transition to a net zero world will be rewarded handsomely. Those that fail to adapt will cease to exist. The longer meaningful adjustment is delayed, the greater the disruption will be.”

“A financial market in the transition to a 1.5 degree world is being built, but we need to move much faster. Now it’s time for a step change to bring the reporting, risk management and return optimisation of sustainable finance into everyday mainstream, financial decision making.”