Guy Carpenter, in collaboration with Dr Franziska Arnold-Dwyer from Queen Mary University of London, has announced the proposal of a Climate Resilient Development Bond (CRD Bond), a new re/insurance structure designed to address climate risk at scale.

In a recently published briefing document, the reinsurance broker outlines a CRD Bond structure, which is based on a new operating model which aims to facilitate improved financial resilience and loss prevention for climate change-related weather risks.

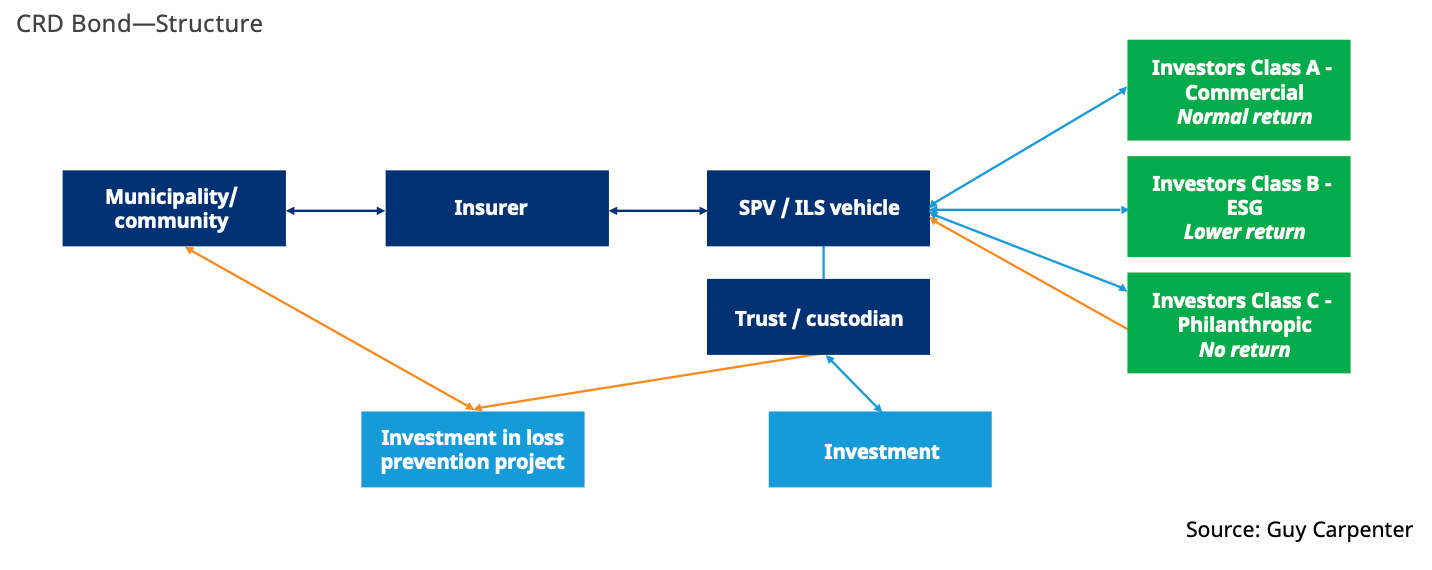

The outline proposes a mix of community-based insurance, stacked investment, and advanced funding for loss prevention measures, leveraging what Guy Carpenter describes as an enhanced insurance-linked security (ILS) structure with cover offered on a parametric trigger basis.

The goal is to provide community-wide coverage, with municipalities able to secure cover from an insurer on a multi-year basis. Additionally, the document states that a CRD Bond would also incorporate a project fund account for a pre-defined and approved project which is specifically designed to reduce exposure to future losses from the insured climate-related event.

The idea is for the capital markets to play a key role. The program is reinsured through a special purpose insurance vehicle (SPI), which transfers the risk to the capital markets through bonds or notes, so a catastrophe bond vehicle or transformer.

The investor types will be commercial, ESG, and philanthropic, and depending on the investor, the principal paid will be purely risk based, or support the project fund component of the structure.

Examples of loss prevention projects include new flood defences or wildlife-resistant housing. During the lifecycle of the bond, the implementation of any loss prevention project will ultimately help to improve the risk profile of the structure and reduce the potential for it to be triggered by an event.

Once the bond reaches maturity, any remaining collateral will be returned to investors with the order of repayment dependent on the type of investor and their risk / return profile.

Julian Enoizi, Global Head of Public Sector at Guy Carpenter, commented: “We need to see a paradigm shift in how the (re)insurance industry addresses climate-related risks. The CRD Bond provides a new type of structure that moves beyond the traditional post-disaster response cover to a truly integrated climate risk approach that combines financial protection against the impact of these perils and proactive support for loss-prevention measures.”

“We believe that the CRD Bond has the potential to make an impactful contribution to the implementation of sustainable and just solutions to the climate crisis. It helps generate financial resilience and loss-prevention capabilities within a mechanism which promotes the principles of equity, sustainable development, and co-operation,” added Dr Arnold-Dwyer.

The proposed structure can be seen below:

This CRD Bond structure is similar to the resilient bond structure announced back in 2015, with both incorporating risk reduction. The latter failed to take off as planned, so it will be interesting to see how the ILS investor base responds to the CRD Bond structure.

The document highlights the importance of the re/insurance sector in addressing climate change, stating that it can rise to the challenge and “create a sea change” in how its role is perceived.

The authors feel that the CRD Bond is a sustainable solution, bringing together financial resilience and loss-prevention measures consistent with the principles of equity, sustainable development, co-operation, and the precautionary principle that underpins the Paris Agreement.