A sub-100% combined ratio was reported by 80% of reinsurers tracked by Gallagher Re in 2022, with most firms improving versus the prior year due to lower nat cat losses and expense ratios, suggests the reinsurance broker’s latest market report.

Premium growth in 2022 remained solid at 12.3%, though down somewhat from 16.6% in the previous year.

Around 60% of reinsurers reported double-digit premium growth, with the most significant rises due to targeted expansion as the reinsurance market hardened.

Gallagher Re’s analysts explain that portfolio repositioning, including reducing exposure to property catastrophe business, contributed to moderate growth for several companies.

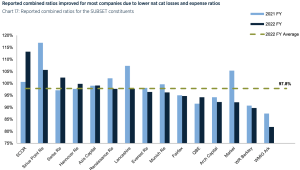

The average reported combined ratio remained strong at 97.8%, marginally up from 97.6% at 2021 FY. (see image below)

Gallagher Re writes, “The combination of an inflation-driven 2 percentage point increase in the ex-nat cat accident year loss ratio to 61.9%, its first deterioration since 2018 FY, and 0.8 percentage points less support from reserve releases, more than offset the combined benefit of a 1.5 percentage point reduction in the impact from natural catastrophe and COVID-19 losses, and a one percentage point reduction in the expense ratio.”

The analysts attribute the reduced support from prior year development to a combination of lower reserve releases in monetary terms and strong premium growth.

The main driver of the former was reserve strengthening by SCOR and Swiss Re. Other companies moderated their reserve releases, due in part to the continued challenging macroeconomic backdrop.

Gallagher Re continues, “Following consecutive increases since 2018 FY, the normalized natural catastrophe load reduced to 8.2 percentage points from 10.1 percentage points at 2021 FY as 2017 FY (heavily impacted by the Harvey-Irma-Maria hurricanes) is no longer part of that calculation (which is based on a five-year moving average of actual natural catastrophe and COVID-19 losses).

“The actual natural catastrophe loss impact of 8.8 percentage points exceeded the normalized load of 8.2 percentage points.”

Despite deterioration in the ex-nat cat accident year combined ratio to 90.6%, the underlying combined ratio in 2022 reduced to 98.8%, compared with 99.7% in 2021, due to the reduction in the normalized natural catastrophe load.

The analysts state that this is the third consecutive year of improvement for the underlying combined ratio.

WMIG Ark continued its strong profitability with an improved combined ratio of 81.8% compared with 2021’s 87.4%, supported by a reduced impact from natural catastrophe losses and increased support from reserves releases.

Meanwhile, reserve strengthening and a higher ex-nat cat accident year loss ratio were the main drivers of the deterioration in SCOR’s combined ratio.

The analysts write, “Having increased to 2.3 percentage points at 2021 FY, PYD support to the combined ratio reduced to 1.5 percentage points at 2022 FY due to a combination of lower reserve releases in monetary terms and strong premium growth.

“Between 2015 FY and 2022 FY, support from reserve releases to the combined ratio was largely on a downward trend. Given continued inflationary pressures we do not expect any material uplift in the near term.”

“Although lower in absolute terms, reserve releases contributed 16% to group pre-tax profit, up from 10% in the prior year.”

Gallagher Re concludes, “This increase reflects an investment-driven reduction in average group pre-tax profit at 2022 FY. Most companies had reduced support to their combined ratios from reserve releases, due in part to the continued challenging macroeconomic backdrop.

“Albeit down from the prior year, Lancashire reported another significant reserve release. SCOR’s reserve strengthening, due to revised assumptions for inflation and latent exposures, added 6.2 percentage points to its 2022 FY combined ratio.”