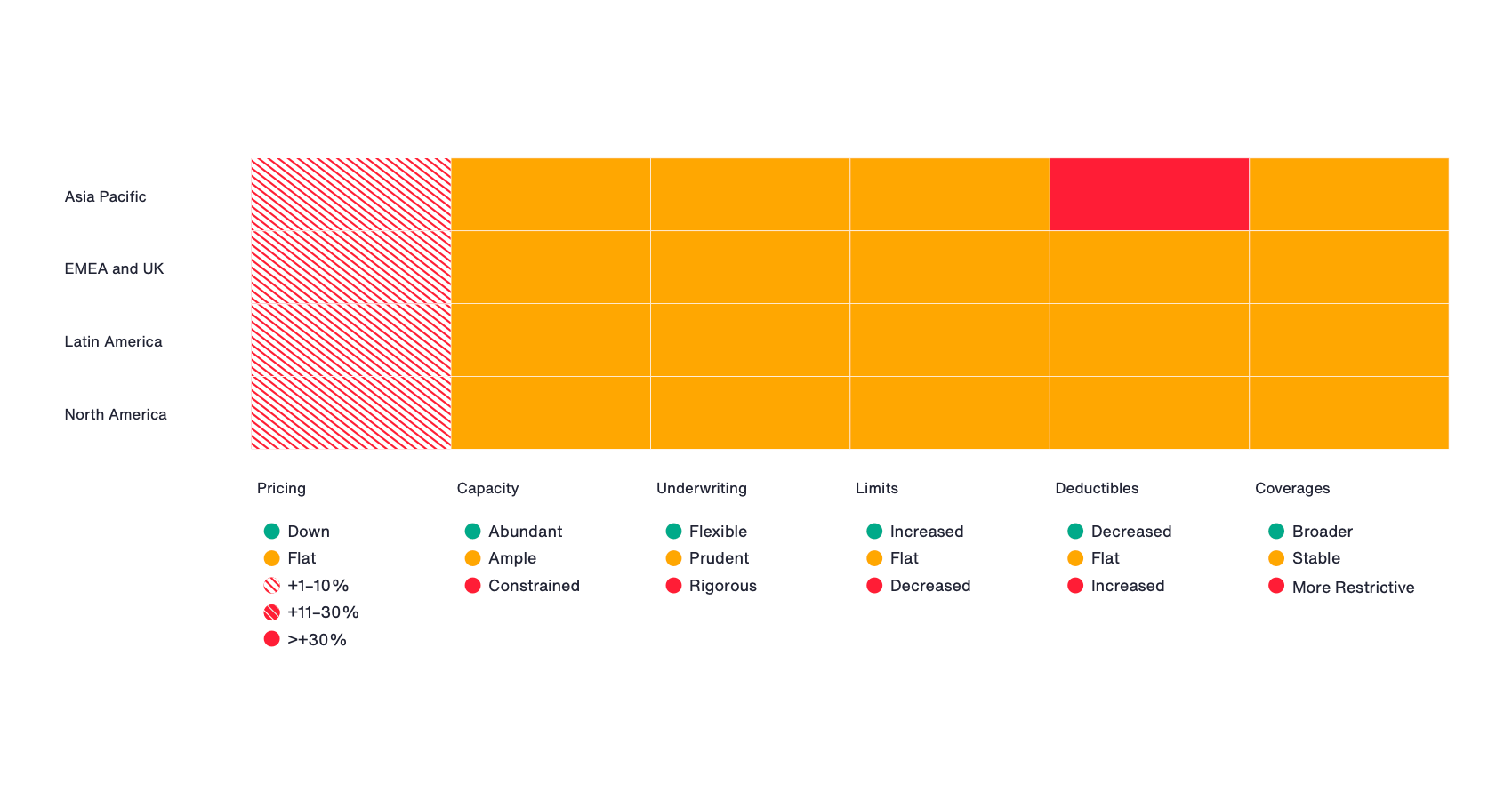

In the second quarter of 2023, the global insurance market experienced a series of dynamic shifts that shaped pricing, capacity, underwriting practices, limits, deductibles, and coverages, according to the Aon Q2 2023 Global Market Insights report.

The report indicates a prevailing upward pressure on pricing across most sectors of the insurance portfolio. However, specific areas targeted for insurer growth, such as Directors and Officers coverage, Cyber insurance, and well-performing, low-hazard risks, managed to achieve flat or decreased pricing.

The report indicates a prevailing upward pressure on pricing across most sectors of the insurance portfolio. However, specific areas targeted for insurer growth, such as Directors and Officers coverage, Cyber insurance, and well-performing, low-hazard risks, managed to achieve flat or decreased pricing.

Property pricing remained volatile due to concerns surrounding inflation, reinsurance costs, climate-related events, and exposures to Natural Catastrophes.

Capacity for most insurance products and risk types remained sufficient, with notable increases observed in Directors and Officers and Cyber insurance.

Nonetheless, the report highlights a constrained capacity for Natural Catastrophe-exposed Property risks, leading to a rise in the utilisation of alternative solutions. Index-based products, self-insurance, and captives gained traction as insurers sought ways to navigate the challenging landscape.

Insurers maintained their focus on disciplined risk selection through robust underwriting practices supported by detailed risk information. Property underwriters paid close attention to valuations and the potential impacts of Natural Catastrophe exposures.

Cyber risks continued to necessitate stringent controls and security measures. While in-person underwriting meetings remained instrumental in building relationships, virtual discussions emerged as a valuable and efficient approach for engaging experts.

The report highlighted an upward pressure on limits driven by inflation and increased verdicts and settlements. However, sub-limits for Natural Catastrophe-exposed properties faced scrutiny and reductions, particularly in lower attachment layers.

In the realm of Cyber insurance, limits saw potential upward adjustments, while Ransomware limits experienced downward pressure. The achievement of full tower limits often required additional layers or involvement of multiple market participants.

While deductible options were explored to mitigate premium costs, stability characterised most deductible amounts. Exceptions arose in Property placements, particularly those exposed to significant Natural Catastrophe risks, as well as challenging risk categories and those lacking adequate controls. These exceptions witnessed upward pressure on deductible amounts.

The report indicated stable coverages, with opportunities for broader terms in cases where insurers pursued growth and differentiation. Notably, insurers could offer more comprehensive coverage in the realm of Cyber insurance when a higher level of cyber security maturity was demonstrated.

However, restrictions persisted for Ransomware, Political Violence, and Strikes Riot and Civil Commotion. Property terms and conditions continued to tighten to address concerns surrounding valuations.