Florida’s Citizens Property Insurance Corporation is out in the market seeking roughly $1.581 billion of fresh reinsurance coverage from its 2020 reinsurance renewal of both traditional and catastrophe bond coverage.

Our sister publication Artemis was first to report today that Florida Citizens is back in the catastrophe bond market targeting support for a $300 million Everglades Re II Ltd. cat bond deal, as part of its reinsurance renewal.

That’s just a small part of the overall reinsurance renewal for the Florida state-supported insurer of last resort, with the total reinsurance purchase across all account reinsurance towers and layers looking set to be around $1.581 billion.

As ever, Florida Citizens is looking to secure this reinsurance in the most effective and cost-efficient manner.

So, the new Everglades catastrophe bond issuance will share in certain layers of its program with traditional sources of reinsurance, with the size of each as yet not fixed.

This allows Citizens to maximise its opportunities for savings in whichever side of the market proves to offer the best value.

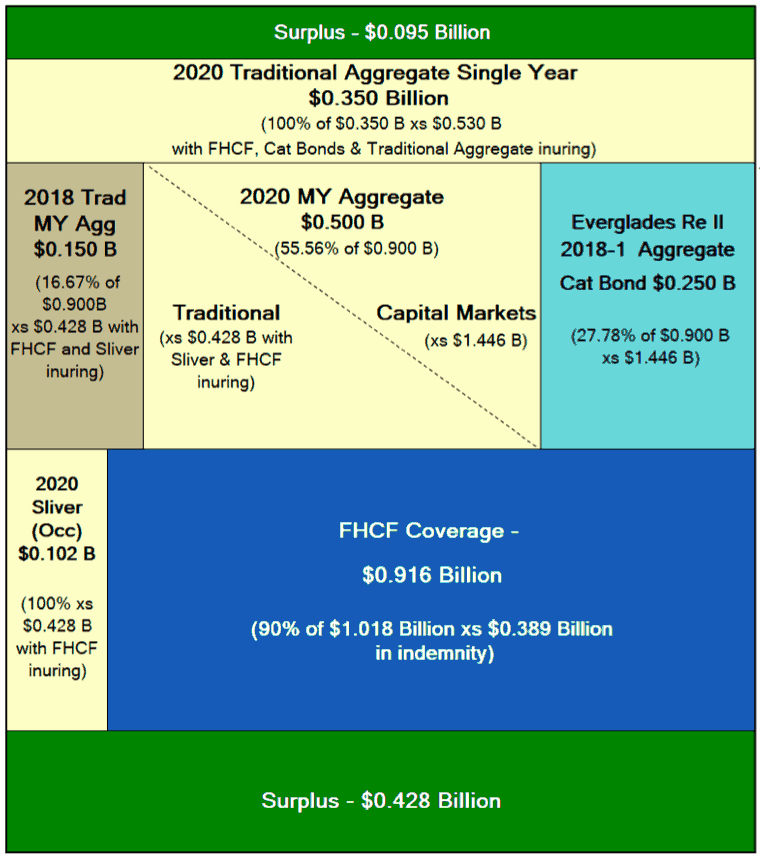

Florida Citizens is looking for around $952 million of reinsurance for its Coastal Account for the 2020 wind season and beyond.

This is split as a $350 million layer of single-year traditional aggregate reinsurance that will sit in the upper-end of the coastal account tower, attaching at $2.346 billion of losses to Citizens.

Beneath that sit $150 million of multi-year reinsurance secured in 2018 attaching at $428 million of losses with layers beneath inuring, as well as $250 million from an Everglades Re II 2018 cat bond issuance attaching at $1.446 billion of losses.

Alongside these will be a new purchase of $500 million of multi-year aggregate reinsurance, split between one series of the new Everglades Re II catastrophe bond attaching at $1.446 billion of losses that attaches at and traditional reinsurance that will also be inured to the layers below and so attaching at $428 million of losses.

Lower down, Florida Citizens will also be purchasing a $102 million sliver of per occurrence reinsurance that will sit alongside its Coastal Account coverage from the Florida Hurricane Catastrophe Fund (FHCF).

The proposed Coastal Account reinsurance tower can be seen below:

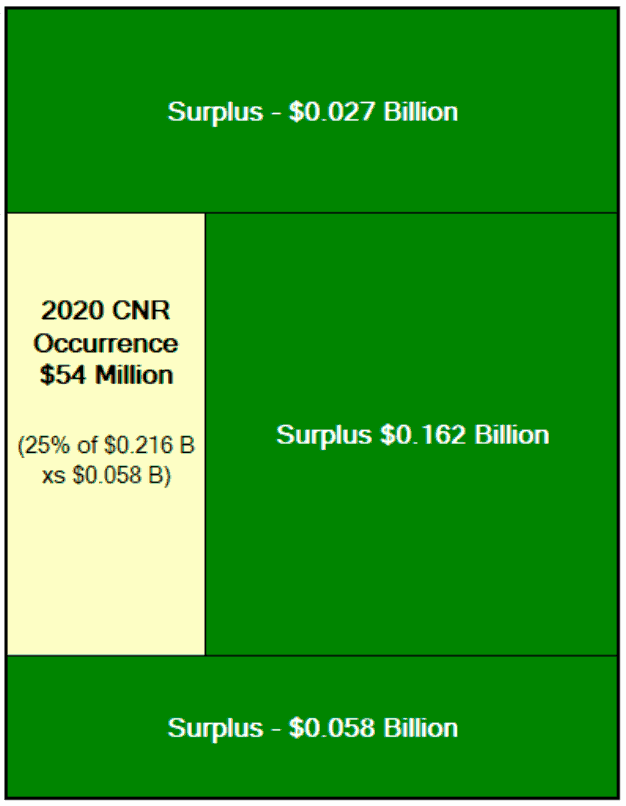

Moving on to Florida Citizens Commercial Non-Residential Account reinsurance tower, the insurer is out in the market hoping to procure a $54 million slice of per-occurrence reinsurance protection that will fill out 25% of a $216 million layer attaching at $58 million of losses to that account.

The proposed Commercial Non-Residential Account reinsurance tower can be seen below:

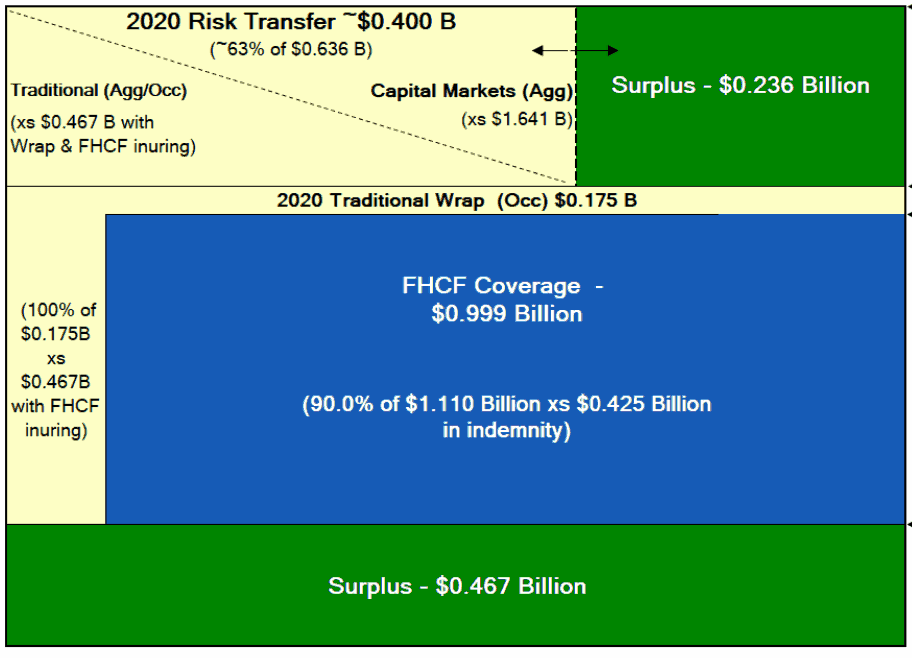

Finally, the Florida Citizens Personal Lines Account reinsurance tower, which for the first time will feature catastrophe bond coverage in 2020, if the issuance of the insurers new Everglades Re cat bond is successful.

For the personal lines account reinsurance tower of Citizens the insurer is seeking to procure a $175 million slice of traditional per-occurrence reinsurance that will wrap alongside and above its FHCF coverage, attaching at $467 million of losses.

Above this will sit a newly procured $400 million slice of reinsurance that will sit alongside its surplus.

This $400 million chunk of the Personal Lines Account reinsurance tower will be split between one series of the Everglades Re II cat bond issuance and traditional multi-year aggregate or occurrence reinsurance protection, with the pricing set to define the split and types of coverage involved.

The cat bond tranche in this tower will attach at $1.641 billion of losses to Florida Citizens personal lines account, while the traditional reinsurance will inur to the FHCF and reinsurance coverage below and so attach at $467 million.

The proposed Personal Lines Account reinsurance tower can be seen below:

There are a lot of factors that will play into how Florida Citizens elects to mix reinsurance capital sources within the towers, but the target is to secure $1.581 billion of reinsurance in as similar a manner to the above diagrams as possible, we understand.

How much of the role the capital markets play through the new Everglades Re cat bonds remains to be seen, with pricing a key factor. But it seems likely the cat bonds will make up at least $300 million of these towers, perhaps more.