Florida’s property insurer of last resort, Citizens Property Insurance Corporation, aims to secure reinsurance coverage of approximately $5.5 billion across a sliver and core layer, as part of its 2024 risk transfer program.

As we wrote previously, Citizens projected at its December 2023 Board of Governors meeting that it could require around $5.5 billion of reinsurance and capital markets risk transfer for the 2024 wind season.

This year, the way Citizens purchases its reinsurance is going to change in a meaningful way, as from January 1st, 2024, Citizens is operating under a combined account, known as the Citizens Account, which is the combination of the Personal Lines Account, the Commercial Lines Account, and the Coastal Account.

The change, according to Citizens, enhances its ability to pay claims for future storms and minimises the potential for assessments.

With the single account now in effect, the insurer of last resort has confirmed that it aims to secure reinsurance protection of roughly $5.5 billion for the upcoming wind season. This is comprised of $5 billion of fresh, private risk transfer, and $500 million of existing private risk transfer remaining from its March 2023 issuance of catastrophe bond Lightning Re (Series 2023-1).

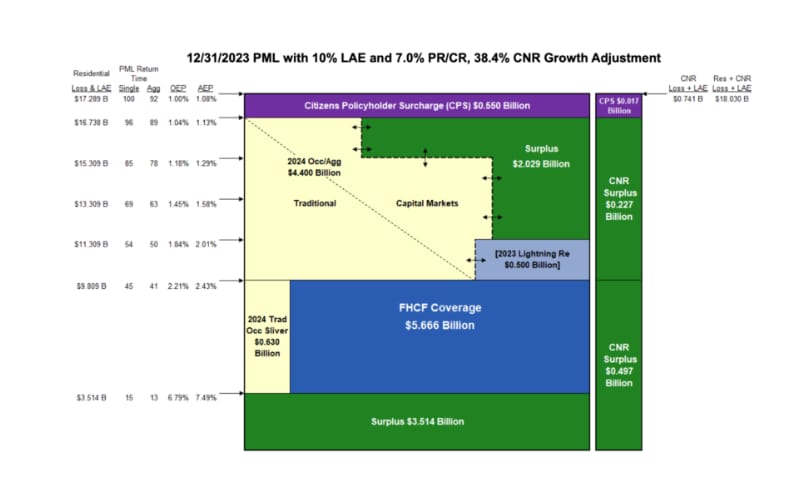

To secure the coverage required, Citizens has budgeted premiums of approximately $700 million, and explains that under this scenario of securing an additional $5 billion of new reinsurance, it would expose all of its surplus for a 1-in-100-year event and would have a potential Citizens policyholder surcharge of $567 million for a 1-in-100 year event.

Broken down by layer, and the bulk of the insurer’s proposed reinsurance for 2024 comes from layer 1, which sits above the sliver layer and the firm’s participation in the Florida Hurricane Catastrophe Fund (FHCF) reimbursement program.

This core layer will provide $4.9 billion of coverage for personal residential and commercial residential losses from the capital and traditional reinsurance markets. Of this, around $4.4 billion of occurrence and annual aggregate coverage will be secured from the traditional and capital markets. Within this layer also sits the Lightning Re (Series 2023-1) cat bond, with 2024 being the second year for these multi-year notes, which provide aggregate protection.

Below the main layer of coverage sits the $5.666 billion of FHCF coverage, and alongside this sits the sliver layer, which for 2024 provides approximately $630 million, in excess of $3.5 billion, of annual, per-occurrence coverage which covers personal residential and commercial residential losses. This sliver layer is placed in the traditional market, and is designed to work in tandem with the mandatory coverage provided by the FHCF.

You can see the 2024 preliminary program layer chart below:

Recall, for 2023, Citizens secured approximately $5.38 billion of risk transfer at a cost of $650 million, which included $2.4 billion of catastrophe bond protection and $2.98 billion of reinsurance from the traditional market.

Citizens says that its staff will work with both “traditional and capital markets teams, as well as its financial advisor, to evaluate available options relating to the structure, terms, pricing, and other relevant matters with regards to the 2024 risk transfer program.”

Recommendations will be presented to the Board in May for final approval of the risk transfer program, so it remains to be seen how much of the $5 billion in fresh limit the insurer is seeking is purchased from the traditional market, and how much is secured in the form of catastrophe bonds with protection provided by the capital markets.