Analysts at AM Best have reported that French insurers and reinsurers are increasingly beginning to reassess their natural catastrophe assumptions following another year of extreme weather in 2022, which included record high temperatures and low rainfall.

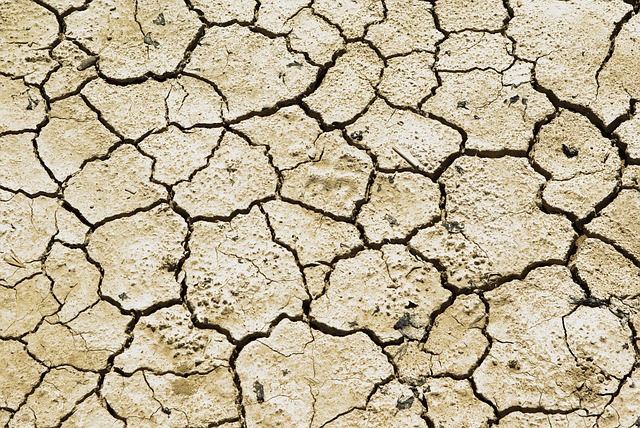

The experience of 2022 aligns with an ongoing trend towards hotter and drier weather in France, and this experience has continued on into 2023 with February marking the driest month on record since 1959, AM Best notes.

The experience of 2022 aligns with an ongoing trend towards hotter and drier weather in France, and this experience has continued on into 2023 with February marking the driest month on record since 1959, AM Best notes.

With hotter, drier weather seen as a contributing factor to an increase in the frequency and severity of weather-related events such as drought, storms and wildfires., French re/insurer are therefore reconsidering their assumptions, pricing and risk appetites for weather-related catastrophe events.

France Assureurs estimates that insurers’ weather-related natural catastrophe losses for 2022 will amount to around €10 billion, driven by hail storm and subsidence caused by drought.

These historically large losses comes as technical results for natural catastrophe cover in France, on a gross basis, have deteriorated markedly since 2017, with nat cat combined ratios trending well over 100%.

AM Best notes that the high insured natural catastrophe losses of recent years have contributed to hard reinsurance market conditions in 2023, which are likely to be exacerbated further by the inflationary environment and last through the medium term.

However, another factor in the picture is the role of the French state, which has a track record of supporting individuals and companies impacted by natural catastrophe events, including the insurance industry.

Most notably, the state has assumed the most extreme risks associated with large events or natural catastrophes, decreasing the insurance industry’s exposure and volatility of earnings, with most cover provided through CCR, which can include unlimited excess of loss cover.

While AM Best views the actions of the state as stable and positive for the re/insurance industry, various reforms of the natural catastrophe program have been undertaken, the most recent of which saw an easing of the rules around declaring a soil subsidence-related catastrophe.

“These changes are likely to impact how risk is shared between the state and insurers,” AM Best noted, adding the evolving definition of natural catastrophes also obscures underlying trends in loss frequency and severity, making analysis and loss modelling more challenging.

“Because the risk sharing is predicated on the declaration of natural catastrophes, the frequency and success rate of local governments’ applications for recognition of events as natural catastrophes is also an important factor that can change over time,” the rating agency wrote.

“There is emerging evidence that the number of applications is increasing, and that applicants are becoming more persistent, particularly with respect to soil subsidence claims.”

“At this point, it is unclear whether the higher application and appeal rate is driven by an increase in events, an increase in awareness at local government level, or a mixture of both. This dynamic does introduce additional uncertainty in modelling and understanding of both the underlying risk and the risk sharing mechanisms in place.”