More than 18 months after the spread of the novel COVID-19 virus caused nations from all corners of the world to lockdown for the first time, respondents to our recent reinsurance market survey have concerns about the risk transfer industry’s ability to navigate such a challenge in the future.

The results of our H2 2021 Reinsurance Market Survey, held in association with sister site Artemis, are now available to view in full.

The results of our H2 2021 Reinsurance Market Survey, held in association with sister site Artemis, are now available to view in full.

Insurance and reinsurance industry losses related to the pandemic have faded dramatically on the property & casualty (P&C) side of the business, and, while they are starting to dwindle on the life & health (L&H) side, the impact so far in 2021 has been worse than expected for some.

At the same time, the fallout from the business interruption issue, which is ongoing in some areas, highlighted ambiguities in policy wordings and as courts sought to force carriers to cover risks they never intended to cover, the industry’s reputation took another hit.

Of course, the outcomes of the various BI cases around the world have varied, with some courts siding with policyholders on some key decisions, resulting in payments from re/insurers, while other rulings have been more favourable for the industry.

The reality is that BI-related COVID-19 cases are still ongoing and some major insurers are expected to try and call on their reinsurance if claims escalate.

Furthermore, it’s also believed that there’s still some trapped capital in case of COVID-19 BI in the insurance-linked securities (ILS) market.

There have been efforts across the industry to address the BI issue, as the fact of the matter is that insurers and reinsurers alone simply cannot foot the bill of such a systemic risk.

Recently, Rep. Maloney reintroduced the Pandemic Risk Insurance Act of 2021 (PRIA) in the U.S., which would see the creation of the Pandemic Risk Reinsurance Program where the federal government acts as backstop in order to share the burden with the private sector.

And it’s hoped that similar initiatives will be introduced in other parts of the world to ensure that when the next global pandemic strikes, both public and private sector players will be better prepared.

So, while losses have certainly come down from the peaks of 2020 and there’s work underway to mitigate potential issues as seen with the BI class, there’s still room for further deterioration and L&H segment losses.

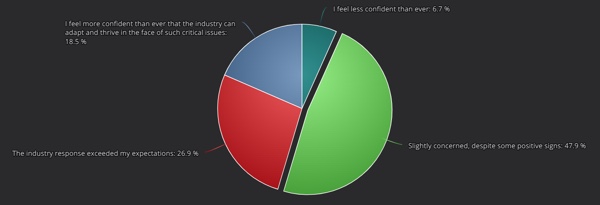

Against this backdrop, we asked industry participants how confident they feel about the re/insurance industry’s ability to weather future challenges of a similar scale.

Of the hundreds of identifiable market participants that responded to our survey, of which over 70% make or provide input into reinsurance buying decisions, 47.9% said that despite some positive signs, they feel slightly concerned about the sector’s ability to manage this type of crisis in the future.

The full results are available online for free and you can analyse the data from responses here.

Just 6.7% of respondents said they feel less confident than ever that the re/insurance market can successfully navigate another global pandemic or similar event.

On the other side of the spectrum, 26.9% of respondents said that the industry’s response to COVID-19 exceeded their expectations, while 18.5% said they’re more confident than ever that the sector can adapt and thrive in the face of such an issue.

So, responses are somewhat mixed. But clearly, there’s some concerns about the industry’s capabilities when it comes to truly systemic risks such as pandemics, climate change, and cyber risk.

We’ve made the full results of this global reinsurance market survey freely available to our readers and we’re happy to discuss the results with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector. Contact us.

Analyse the results of our global reinsurance market survey here.