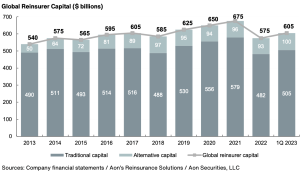

Aon’s recent mid-year Reinsurance Market Dynamics report shows that global reinsurer capital rose by 5%, or $30 billion, to $605 billion over the three months to March 31, 2023.

The insurance and reinsurance broker’s analysis states the key factors for this increase were retained earnings, recovering asset values, and new inflows to the catastrophe bond market.

The insurance and reinsurance broker’s analysis states the key factors for this increase were retained earnings, recovering asset values, and new inflows to the catastrophe bond market.

Traditional capital and alternative capital have been steadily growing during this time period. At $605 billion, global reinsurer capital is at the same level seen in 2017, and above the $575 billion at year-end 2022, but remains lower than the high of $675 billion seen in 2021.

As at the end of Q1 2023, traditional capital amounted to $505 billion, up from $482 billion in 2022, while alternative reinsurance capital has reached a new high of $100 billion, rising from the $93 billion seen at the end of 2022.

Aon estimates that the shareholders’ equity reported by global reinsurers of $505 billion is an increase of 8%, or $38 billion, from the low point of $467 billion seen at the end of September 2022. The factors for this were strong operating results and recovering asset values.

As more capital entered the sector, Aon notes that high-profile natural catastrophe activity seemed to have continued in Q1 2023, with losses from severe convective storms in the United States hitting a new high for this year.

Additionally, there were unprecedented flood events in New Zealand, and a major earthquake occurred in Turkey and Syria in Q1.

Although, most reinsurers posted positive underwriting results, reflecting the benefits of the shift in pricing and coverage seen in recent years. The average combined ratio across the companies studied in the report stands at 91.5%.