Mounting uncertainties and increasing pressure on insurers due to inflationary forces, are raising concerns over reserve adequacy in the current economic environment, according to the latest sigma report by Swiss Re Institute.

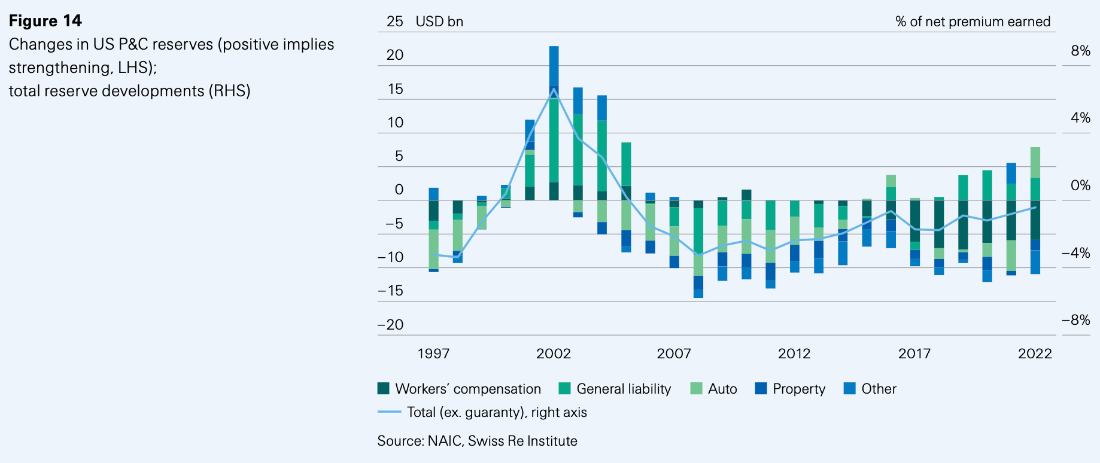

Industry analysts have observed that, excluding workers’ compensation, reserve development in the US insurance industry has been unfavourably impacted in both 2021 and 2022.

Industry analysts have observed that, excluding workers’ compensation, reserve development in the US insurance industry has been unfavourably impacted in both 2021 and 2022.

Although industry reserve buffers are generally considered elevated, there exists a range of uncertainties that are further heightened by the persistent inflation. Several factors, such as court backlogs, the inflation shock, and evolving consumer, transportation, and workplace behaviours, add to the inherent uncertainty associated with reserve analysis.

Notably, during inflationary periods, the problem of delayed settlements becomes more pronounced, intertwining economic and social inflation and leading to higher jury verdicts and claim settlements.

The transition from goods to services inflation is anticipated to have a disproportionate impact on liability exposures, thereby affecting reserves to a considerable extent.

Analysis of the US insurance market reveals that liability lines accounted for 52% of industry premiums in 2022 but a staggering 87% of year-end reserves. Although favourable development in workers’ compensation provided a partial offset in recent years, inadequate reserving in general liability lines has been a persistent concern.

Insurers responded by creating historically large cushions for incurred but not reported claims, particularly in response to the COVID-19 claim risks of the 2020 and 2021 accident years.

Given the heightened uncertainty, insurers are likely to adopt a more cautious risk appetite and reduce new business capacity, thereby sustaining the current hard market conditions.

The impact of uncertainty and inflationary pressures extends beyond the borders of the United States. In key European markets such as the UK, the trend of significant reserve releases continued in 2021‒2022, albeit to a slightly lesser degree than in previous years.

Emerging Asia is set to become the primary driver of global economic growth in the coming years, according to the report by Swiss Re Institute. It estimates that global insurance premiums, encompassing both non-life and life insurance, will experience growth of 1.1% in 2023 and 1.7% in 2024, even amid an economic slowdown.