While the ultimate financial impact of Hurricane Laura is expected easily reach into the billions of dollars, its large footprint of damage will require a lengthy period of damage assessment, according to Aon’s latest catastrophe report.

Laura, currently sweeping through Arkansas as a tropical depression, officially became the fourth hurricane of the 2020 Atlantic season shortly after emerging into the southeastern Gulf of Mexico on August 25.

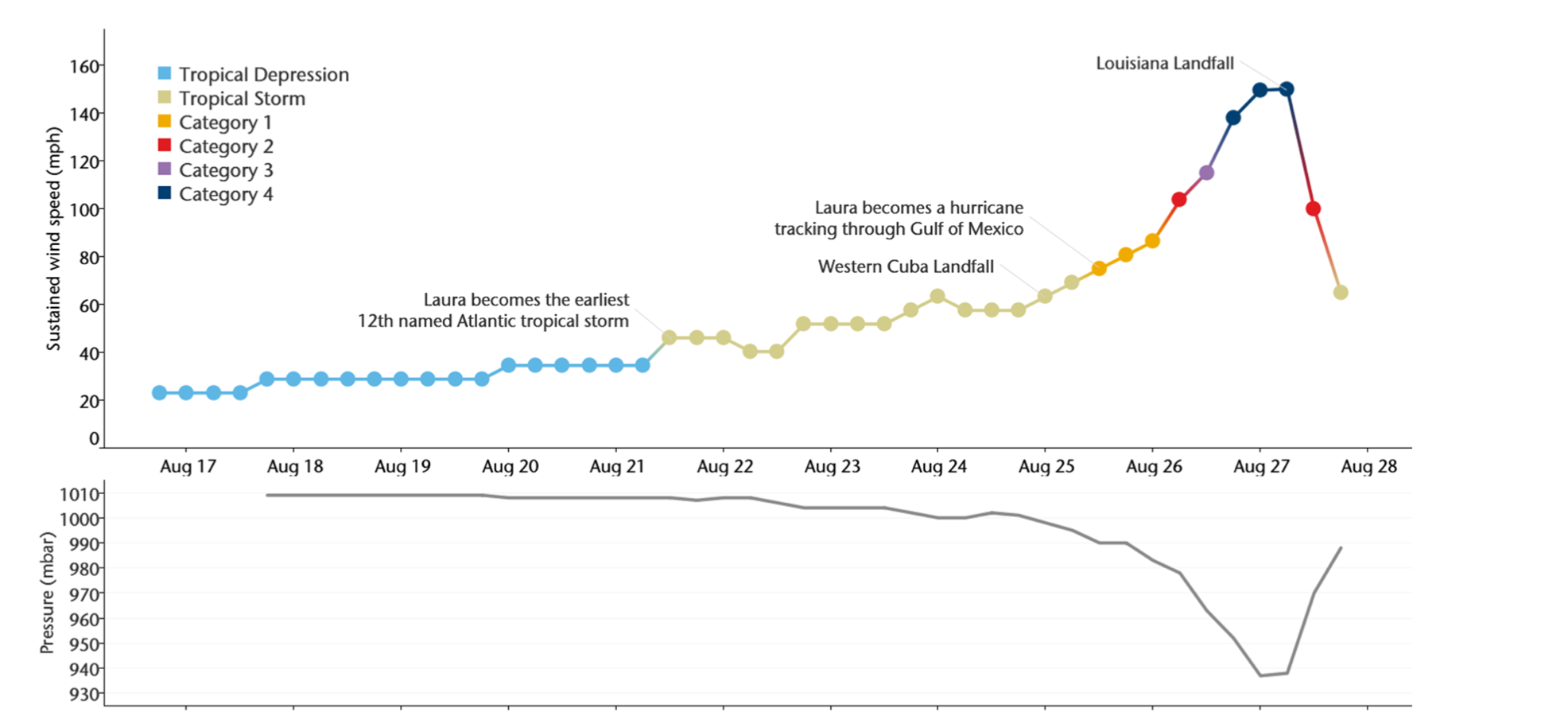

The storm struck the Louisiana coast with a maximum wind speed of 150 mph after tying the record for the fastest intensification rate in the Gulf of Mexico during a 24-hour period. It was the strongest hurricane to make landfall in Louisiana since 1856.

Laura’s development and peak intensity period from August 16 (UTC) until August 27. Source: Aon/NOAA

Laura’s expected industry loss is currently drawing parallels to 2005’s hurricane Rita, which adjusted for inflation cost re/insurers $13.5 billion.

Aon notes that Laura’s financial toll will depend its impact on residential and commercial properties, vehicles, the energy sector, infrastructure (transportation and electrical), agriculture, and direct net-loss business interruption.

While most of the wind-driven damage will be covered by a standard homeowner’s policy, a large portion of the storm surge and inland-flood damage will be uninsured as National Flood Insurance Program (NFIP) take-up rates are low near the hardest-hit landfall areas.

Aon notes how in in Louisiana alone, despite having one the better NFIP state-level take-up rates in the US, roughly 80% of homes were still without a flood insurance policy based on 2019 data.

The feeling among some industry analysts seems to be that losses will be manageable, and that Laura’s impact could easily have been more severe if it had tracked a different path across mainland US.

Others have highlighted the potential compounding effect COVID-19 will have on re/insurers’ balance sheets, and the fact that time remains for additional storms to cause damage during the current Atlantic season.