Australian insurer IAG has confirmed the completion of its whole-of-account quota share arrangement, aggregate reinsurance and third/fourth event covers for the financial year ending June 30th, 2024.

The primary insurer has adjusted its aggregate reinsurance coverage for FY24 in light of current reinsurance market conditions.

The primary insurer has adjusted its aggregate reinsurance coverage for FY24 in light of current reinsurance market conditions.

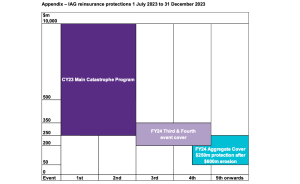

This year, IAG has secured aggregate reinsurance protection of $250 million in excess of $600 million, with individual qualifying events capped at $200 million in excess of $50 million per event.

In comparison, the firm’s FY23 aggregate program provided $350 million of cover in excess of $500 million.

So, the attachment point has risen by $100 million year-on-year, while the aggregate program provides $100 million less protection. This is likely a result of reinsurers continuing to move away from frequency risks as a result of rising losses from secondary perils in recent times.

In addition, third and fourth event financial year occurrence covers have been purchased to provide $150 million of protection for events greater than $200 million. Last year it was $100m for events above $150m. For FY24, the covers have been placed to 67.5% to reflect IAG’s whole-of-account quota share arrangements.

IAG has renewed its 2.5% whole-of-account quota share arrangement with Hannover Re, effective July 1st, with a term of five years.

IAG Chief Financial Officer (CFO), Michelle McPherson, commented, “IAG has now renewed all four whole-of-account quota share reinsurance arrangements with leading global reinsurers. The 32.5% quota share arrangements are an important part of IAG’s capital structure, providing certainty for the next five to seven years.

“The quota share arrangements have been renewed providing materially consistent financial outcomes and are particularly valuable in a challenging reinsurance market. These arrangements cover 32.5% of all gross claims costs, meaning we are only required to purchase 67.5% of the main catastrophe program in global reinsurance markets.”

After allowing for the quota share arrangements, IAG has a maximum event retention of $169 million for a first and second event, which stays the same year over year.