Analysts at Aon have said they expect demand for all forms of alternative capital to remain elevated throughout 2023 as insurers and reinsurers look to mitigate both macro-economic and reinsurance market challenges.

In a new report on January reinsurance market dynamics, the broker noted that ILS capital has become an “essential source of capacity” for insurers, and an important component of reinsurance purchasing strategy.

In a new report on January reinsurance market dynamics, the broker noted that ILS capital has become an “essential source of capacity” for insurers, and an important component of reinsurance purchasing strategy.

Last year, the property cat bond market was supported by new and repeat insurance and reinsurance sponsors and Aon says it maintained “an orderly manner” despite the macroeconomic headwinds facing the market, Hurricane Ian, the war in Ukraine, inflationary concerns and rising interest rates.

In particular, analysts observed a supply-demand imbalance for cat bond capacity, as more insurers and reinsurers sought to tap the cat bond market to mitigate challenging traditional reinsurance and retrocession renewal seasons.

This, along with increased catastrophe activity over the past five years, has pushed the bond market into a higher total return environment, with material increases in overall pricing, accompanied by higher collateral returns.

Aon therefore anticipates that ILS investors will take advantage of attractive returns and diversification opportunities presented by the market in 2023, driving further growth and delivering valuable capacity for re/insurers.

“Margins in ILS have increased significantly during 2022,” Aon wrote. “From an ILS sponsors’ perspective, the increasing prices seen in traditional reinsurance and retrocession markets is increasing the demand for ILS capacity.”

“We are now in a market where demand for ILS capacity exceeds supply, and while this has resulted in higher overall pricing and tighter terms and conditions, regular sponsors of cat bonds and other ILS products have been appreciative for this alternative source of capital, having developed stronger relationships with ILS investors.”

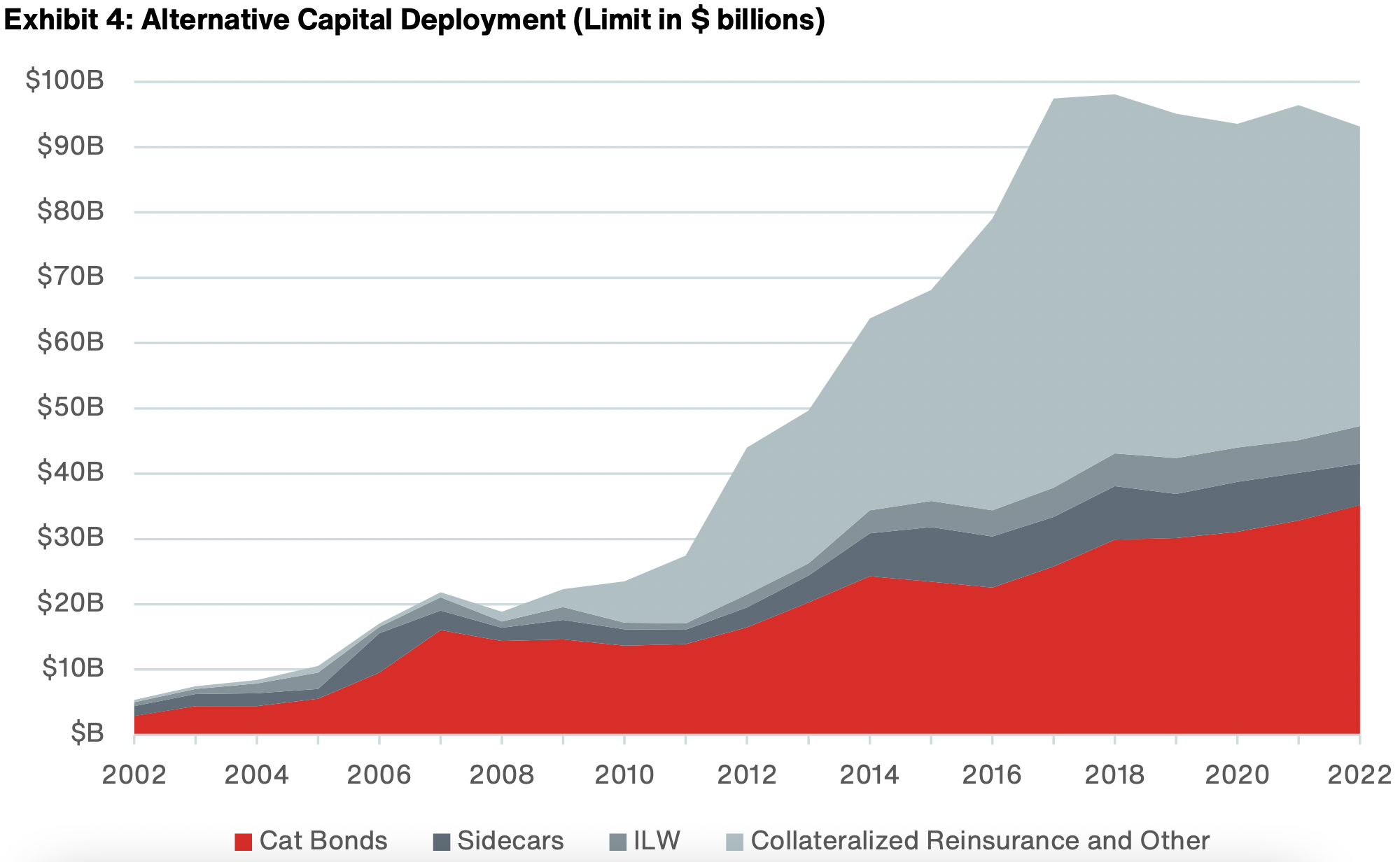

Historically, Aon notes that higher margins and the diversification of the asset class, relative to the broader financial markets, has resulted in meaningful market growth and could be a net positive for new and existing sponsors.

So looking ahead, the broker believes this is likely to occur once the markets better understand Ian loss development, inflationary trends, interest rates and the overall geopolitical uncertainties that have pervaded the broader financial markets in 2022.

“The overall theme remains that diversification is playing out well compared to prior ‘bull run’ of the broader financial markets,” it concluded. “The investment case for ILS remains strong, and will be further bolstered by reinsurance and retrocessional rate increases sustained at year-end 2022.”