Despite having become an increasingly common feature of the insurance and reinsurance landscape in recent years, the industry’s perception of mega-M&A moving forward appears to be one categorised by uncertainty; influenced by an awareness of heightened competition and anti-trust concerns.

The results of our H2 2021 Reinsurance Market Survey, held in association with sister site Artemis, are now available to view in full.

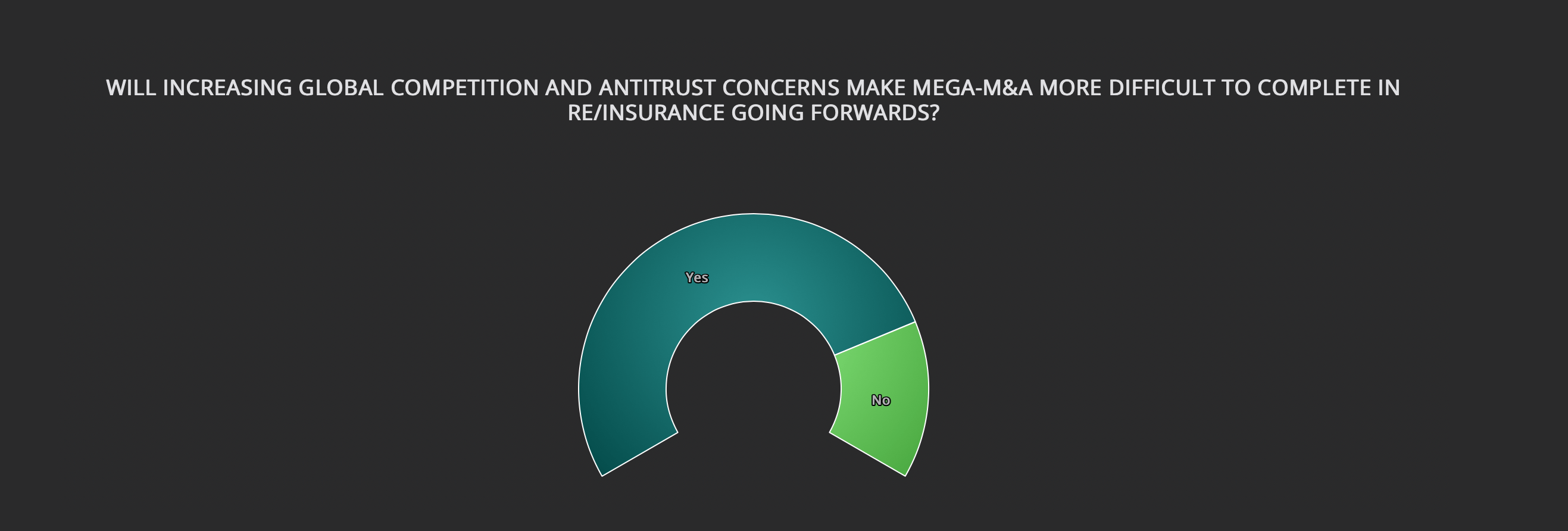

78.1% of respondents were in agreement to the difficulties facing so-called mega-M&A deals, a term generally used to describe deals both significant in value and notable for their involvement of already segment-leading organisations.

The most recent, the notable, example of mega-M&A (one which was undoubtedly freshest in our survey respondents’ minds) was the failed combination of Aon and Willis Towers Watson, two firms at the top of the re/insurance broking food chain.

The deal would ultimately disintegrate under the weight of regulatory discord and the U.S. Department of Justice’s (DOJ) filing of a civil antitrust lawsuit.

The DOJ’s decision to block the proposed $30 billion combination was driven by a perceived threat to competition, as well as the likelihood for it to result in increased prices and, ultimately, creation of a “broking behemoth.”

The attempted Aon/WTW combination is one that, in retrospect, could be viewed as a culmination, or rather extension, of the increasingly bold and expensive takeover attempts which proceeded it.

It could be argued that a recent example can be seen in AXA’s (ultimately successful) purchase of Bermudian property and casualty re/insurance firm XL Group in 2018.

AXA originally announced that it planned to acquire XL Group for $15.3 billion, before revealing branding and structuring plans for a future combined operation now known as AXA XL.

Still, despite the high cost and relatively recent completion of AXA XL’s formation, it’s worth noting that the Aon/WTW attempt was unique; in both its $30 billion valuation and the involvement of what were, and still are, the top two players in re/insurance broking.

Ultimately, its safe to say the fate of re/insurance mega-M&A is secured; sustained in equal parts by the unavoidable pursuit for profit and strategic advantage built into this industry (and free market capitalism more generally), and the sheer nebulousness of the term itself.

At the time of this article’s publication, for example, the sale of significant reinsurance player PartnerRe to French mutual insurer Covéa is well under way.

The pair had previously entered into a Memorandum of Understanding (MoU) in March 2020, under which Covéa would acquire PartnerRe from EXOR for a total cash consideration of $9 billion, as well as a cash dividend of $50 million.

Now, it’s important to note that the survey data (a joint effort between Reinsurance News and our sister site Artemis) on which this article has been based is as part of a wider attempt to gauge industry sentiment across a broad range of key market topics.

However, a reasonable conclusion one could draw from this datapoint (as well as the content of articles linked above detailing Aon’s pursuit of WTW) is that, while the presence of increasing anti-trust concerns and broader global competition will indeed add complications any M&A deal involving a multi-billion dollar transaction, a new environment does seemed to have formed.

As a result of factors referenced above, alongside broader public awareness, any re/insurance M&A attempt involving the consolidation of two rival, already-dominant organisations, will now face a kind of scepticism and scrutiny which, when accounted for at a boardroom level, could very easily render its pursuit illogical.