The Lloyd’s of London specialist insurance and reinsurance market is struggling due to its high expense base and the cost of doing business there, which is driving up its combined ratio above the average of its competitors.

Speaking during an analysts presentation yesterday, John Parry, Chief Financial Officer at Lloyd’s, explained that one of the reasons the markets combined ratio has been higher is down to the higher expense ratio and costs.

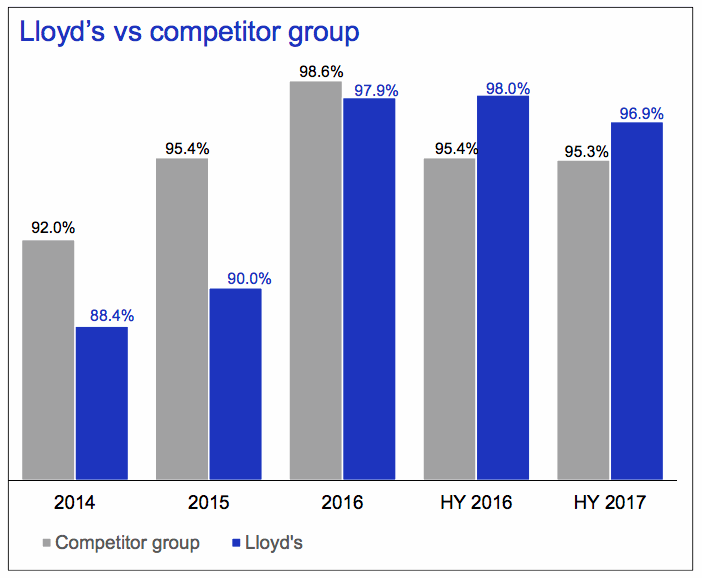

Parry said that despite the fact the Lloyd’s market has a lower loss ratio, compared to the average of a range of competitors, the higher expense base at around 40% is costing it, resulting in its combined ratio coming in at 96.9% for the first-half of the year, above its competitors average.

The Lloyd’s market’s expenses suffer due to it having higher acquisition and administration costs, which are perhaps the highest in the global re/insurance market.

Because of this, it’s often said that Lloyd’s of London is the most expensive place to do business, and while the attraction for companies seeking to operate there is typically the access to specialty insurance or reinsurance underwriting business, it has to be questioned whether that will always be the case if Lloyd’s remains more expensive than competitors.

The capital backing Lloyd’s syndicates is also accessing insurance linked returns in other ways these days, with the growth of the ILS fund market often attracting the same institutional investor base.

If there are more efficient ways to access the risk-linked returns they seek, Lloyd’s has to work hard to get its expense base down over the coming years or risk driving some investor capital away from the market.

CEO Inga Beale highlighted the importance of modernisation programs to the Lloyd’s market, particularly the Target Operating Model (TOM).

Through these program the Lloyd’s market hopes to recover some of its efficiency, at least helping its expenses to come closer into line with the group of competitors it compares itself against.

The Lloyd’s business model, of bringing many sources of third-party and corporate capital together under one hub to be connected to risks with the help of numerous underwriting houses, should be an efficient model anyway.

It’s purely that the legacy of being the oldest re/insurance market in the world and the complexities that come with operating the market oversight required to manage this, add to the costs of doing business.

If modernisation and efficiency aren’t embraced every step of the way, Lloyd’s will continue to find itself struggling due to expenses.

It’s understandable how it got to be (perhaps) the most expensive market to do re/insurance business in, but investors and capital providers are unlikely to stick around if it remains a much more expensive option for accessing insurance linked returns.