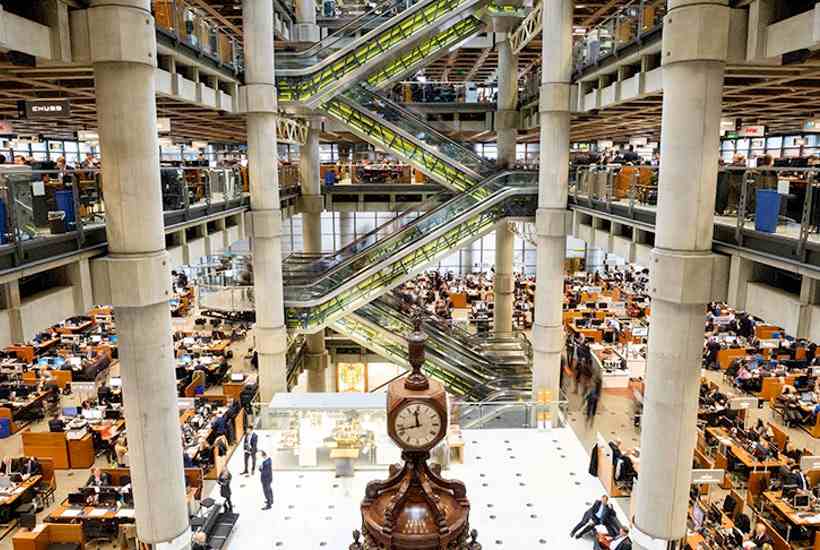

Digital Lloyd’s syndicate Ki has onboarded its initial broker trading partners, providing access to its algorithmic underwriting ahead of the upcoming January 1 renewals.

Broking partners include Aon, Aon Re, BGCI, including Ed and Besso, Bishopsgate, BMS, Gallagher, Guy Carpenter, Howden, Lockton, Lockton Re, Marsh, Miller, Price Forbes, AmWins / THB, Tysers, Willis and Willis Re.

Broking partners include Aon, Aon Re, BGCI, including Ed and Besso, Bishopsgate, BMS, Gallagher, Guy Carpenter, Howden, Lockton, Lockton Re, Marsh, Miller, Price Forbes, AmWins / THB, Tysers, Willis and Willis Re.

Ki has agreed to provide capacity to each trading partner in 2021, thereby giving clients security about placing business in Lloyd’s next year.

“We are very proud to launch our digital platform with our initial trading partners and through collaboration with them we have already allocated the majority of our 2021 capacity, bringing valuable capacity and certainty to those brokers’ clients and business partners across 31 lines of business,” said Dan Hearsum, Managing Director of Ki.

“The response from our trading partners has been phenomenal, with real commitment shown to embrace this new chapter for Lloyd’s.”

Mark Allan, CEO of Ki, also commented: “We are delighted to have delivered the first digital follow syndicate in Lloyd’s, with the onboarding of these partners enabling their brokers to dramatically accelerate access to follow capacity for their clients. The simplicity of the platform aligned with the commitment of capacity brings much needed security to the market.”

The creation of Ki was first announced in May 2020, with the aim of reducing the amount of time taken for brokers to place their follow capacity.

Ki’s algorithm, developed with support from University College London, will evaluate Lloyd’s policies and automatically quote for business through an always available digital platform, built by Google Cloud and accessed directly by brokers.

The syndicate will write a broad range of specialty business in the Lloyd’s market, and has already raised $500 million of committed capital from funds managed by Blackstone Tactical Opportunities and Fairfax Financial Holdings Limited.