A wave of restructuring and consolidation efforts in the re/insurance industry is expected to provide attractive opportunities for equity market investors, according to Twelve Capital.

Twelve Capital – an independent investment manager specialising in insurance investments – noted that the global re/insurance industry appears to be increasingly exploring M&A options as a means of growth.

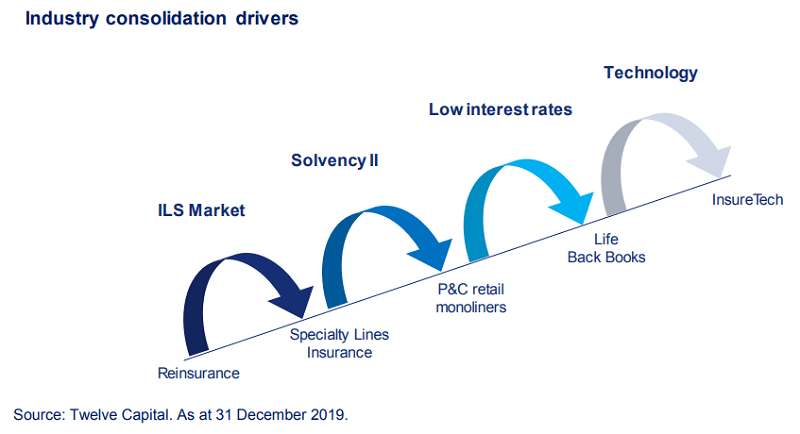

The trend began approximately five years ago within reinsurance markets, it said, but has subsequently spread to specialty lines insurance, retail property & casualty insurance, and most recently to life assurance markets.

One major factor in this wave has been the rising influence of insurtech, which Twelve Capital believes will provide further momentum for M&A activity this year and beyond.

Other pull factors include cost synergies and reinsurance spend savings, shareholder pressure, capital diversification benefits, low financing costs, regulatory clarity, and excess capital in the industry.

And on the push side, Twelve Capital noted operating backdrop pressures, new supply in reinsurance and specialty markets, low yields in home markets, clients demanding a greater breadth of service, currency concerns, and regulatory changes that have challenged the profitability of some products.

In terms of opportunities for equity market investors, analysts noted that there is potential for increased gains linked to harvesting M&A takeover premia, which typically range between 25% and 40%.

Additionally, Twelve Capital does not believe that the market has fully priced in the potential of the re/insurance sector to generate sizeable business growth and operating margin expansion due to the benefits of restructuring and consolidation.

And for new investors, the firm said that the insurance sector is not showing signs of overheated valuation and that the entry point for investment is attractive.

Relative P/E and P/BV multiples versus the global equity market remain in line with their historic averages, and dividend yields from European insurers in excess of 4.5% are compelling in Twelve Capital’s view.