Global reinsurer Munich Re and In-Q-Tel, Inc. have signed strategic agreements with epidemic risk modeller, Metabiota, which has announced the launch of the industry’s first commercial risk modelling platform and preparedness index for epidemic risks.

One of the world’s largest reinsurance companies, Munich Re, and In-Q-Tel, an investor that focuses on the development of tech to support the U.S. intelligence community, recently signed “strategic agreements” with Metabiota, according to a statement from the firm.

One of the world’s largest reinsurance companies, Munich Re, and In-Q-Tel, an investor that focuses on the development of tech to support the U.S. intelligence community, recently signed “strategic agreements” with Metabiota, according to a statement from the firm.

The agreements are in light of the commercial launch of Metabiota’s new platform for estimating epidemic preparedness and risk, which the company says includes the frequency and severity of outbreaks, as well as the duration and associated costs.

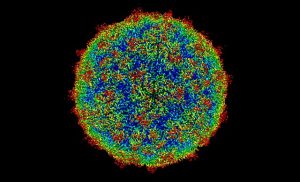

As highlighted by the recent Zika virus outbreak, epidemics have the potential to expand rapidly and impact numerous locations, communities and industries at the same time, and by utilising epidemic risk analytics, historical data, and disease scenarios, Metabiota’s platform aims to assist the insurance industry’s efforts to develop and offer new epidemic insurance solutions.

Epidemic and pandemic risks have been at the forefront of insurance and reinsurance industry discussions in recent times, with the World Bank taking increased measures to address the issue, establishing the Pandemic Emergency Financing Facility (PEF) that utilises re/insurance and insurance-linked securities (ILS) capacity and capabilities to mitigate the impact of an outbreak.

Bill Rossi, Chief Executive Officer (CEO) of Metabiota, said; “We believe that when risk can be properly assessed and mitigated by insurance, the world will be more prepared and able to manage these events.

“At the same time, we’re helping the insurance industry build new revenue streams at a time when their core business is under threat by new business models and technologies. Metabiota’s use of big data and software to model epidemics is truly revolutionizing the insurance industry.”

The intuitive, cloud-based platform launched by Metabiota, gives risk managers and underwriters with new insight into how diseases propogate, says the firm, and ultimately helps re/insurers quantify the risk that epidemics present, which in turn enables them to develop more accurate, effective, and affordable solutions.

The new platform incorporates 100 years of historical data, which utilises a unique catalogue of over 20 million risk scenarios that outline the number of deaths, cases, hospitalisations, and employee absence as a result of an epidemic outbreak, explains Metabiota.

Head of Innovation at reinsurer Munich Re, Tom van den Brulle, said; “Metabiota’s analytics and intelligence help us to push the boundaries of insurability by protecting companies and local economies from the financial loss related to epidemics. This really is the next frontier for the insurance industry – given the high risk of infectious disease outbreaks, it is imperative that we find new ways to manage and finance these risks for our customers.”

Eugene Chiu, Partner, Investments, at IQT, added; “Infectious disease outbreaks present a growing security threat to the United States. Metabiota provides capabilities to better understand infectious disease risk via open source data fusion and sophisticated epidemic simulations.”

Metabiota explains that its new platform includes a proprietary global preparedness index, which measures the national capacity to both detect and respond to an epidemic. The firm says that the index empowers the insurance sector with greater intelligence and understanding of the exposures in each country, providing greater understanding of “public health infrastructure, physical and communications infrastructure, bureaucratic and public management capacities, financial resources to underwrite disease response, and risk communication.”

Furthermore, the World Bank has underlined the new platform as and index as a possible way to better assess future epidemic risks, says Metabiota.