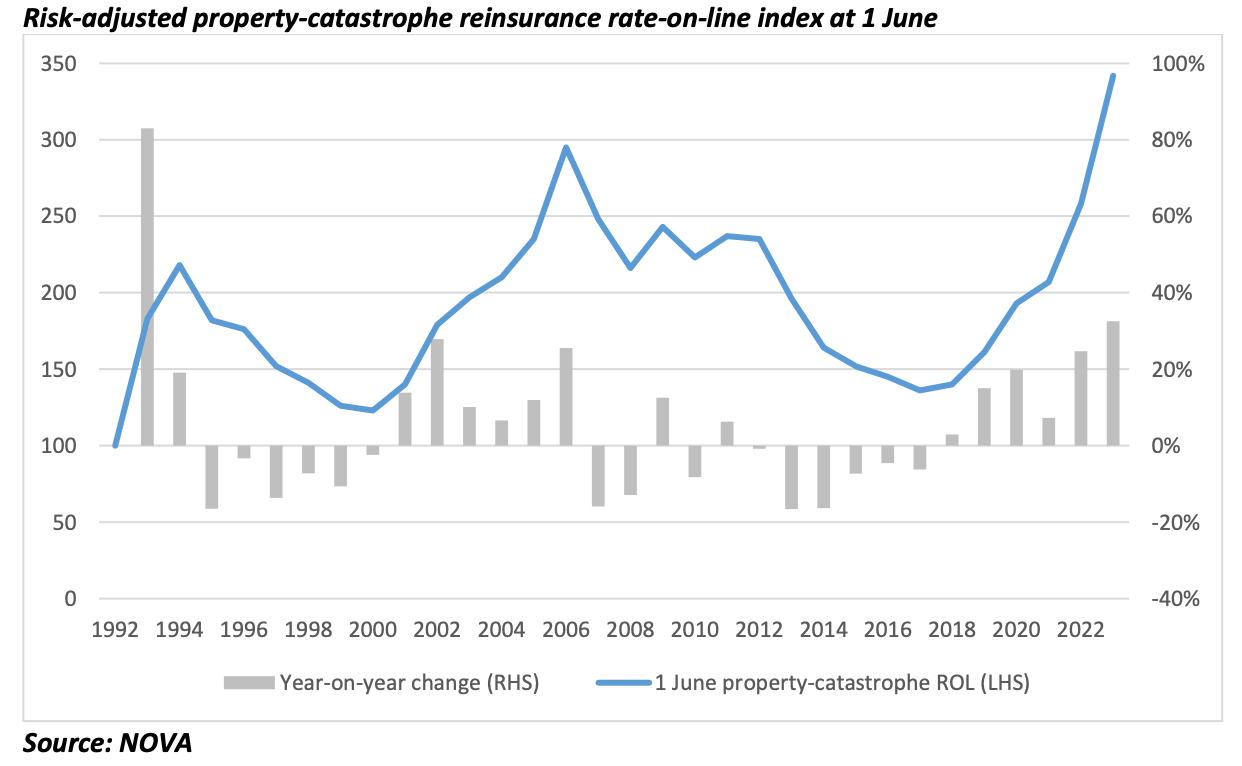

Howden Tiger reports a significant increase in reinsurance rates, with risk-adjusted property-catastrophe pricing up 33% on average at June 1 renewals, reaching its highest level since inception.

The rate increase fell within the range of 25% to 40%, with variations depending on the specific layer. This follows a 25% increase in rates observed in 2022, bringing the index to its highest level since its establishment.

The rate increase fell within the range of 25% to 40%, with variations depending on the specific layer. This follows a 25% increase in rates observed in 2022, bringing the index to its highest level since its establishment.

The rise in pricing was driven by persistent low levels of capital relative to risk, along with a combination of global and local pressures. Hurricane Ian had a significant impact on losses for insurers, leading to varying effects on rates.

Changes in risk-adjusted rates were influenced by portfolio trends and concentrations in Florida, with some programs experiencing increases of over 40% based on the scale and impact of losses. Higher layers of coverage for earthquake and wind also saw year-on-year increases exceeding 40%, particularly due to the implementation of new minimum rate-on-line thresholds.

“In this once-in-a-generation market, it is critical to ensure clients can secure the coverage they need,” stated Wade Gulbransen, Head of North America, Howden Tiger.

“Given strong rate hardening, the need for strategic planning and dynamic placement strategies has become paramount. This isn’t just about finding capacity, it’s about finding the right capacity that fits our clients’ risk profiles and financial objectives while adapting to an industry in transformation.”

Early market engagement and strategic placements paved the way for capacity availability during reinsurance renewals. Private placements were focused on securing early capacity rather than addressing shortfalls.

Marketing efforts began in late January, with a noticeable interest in higher layer risks from both traditional and ILS capacity providers emerging in March.

Lower layers faced challenges as cedents increased retentions and made changes to underwriting guidelines. However, capacity was accessible with the right structures and price points, and higher layer participations were oversubscribed in some regions.

Lower layers experienced higher pricing and additional reinstatement premiums, Howden Tiger noted.