The first-half of 2017 brought catastrophe losses to the global economy of $53 billion, 42% of which, or $22 billion was covered by re/insurance protection, according to Aon Benfield unit, Impact Forecasting’s latest catastrophe report.

76% of total global catastrophe losses were from U.S. events, making the U.S. the only region to see above-average losses in what’s otherwise been a below loss average mid-year mark.

76% of total global catastrophe losses were from U.S. events, making the U.S. the only region to see above-average losses in what’s otherwise been a below loss average mid-year mark.

Due to the states’ high re/insurance density when compared to other parts of the world, the proportion of total global losses insured was up by 10%, on both the near and medium-term averages.

At $53 billion, economic losses are less than half of the 10-year $122 billion average, while total, global insured losses were 35% lower than the 10-year $34 billion average.

Severe convective storms in the U.S. were the costliest peril for this year so far, causing staggering losses of nearly $23 billion, almost half of the global insured catastrophe loss.

Steve Bowen, Impact Forecasting director and meteorologist, commented; “The financial toll from natural catastrophe events during the first six months of 2017 may not have been historic, but it was enough to lead to challenges for governments and the insurance industry around the world.

“This was especially true in the United States after the insurance industry faced its second-costliest first half on record following a relentless six months of hail-driven severe weather damage.”

Globally, nearly eight out of ten monetary insurance payouts for disasters were related to the severe convective storm peril, Bowen said, adding that other events with notable economic damage costs included Australia’s Cyclone Debbie, China and Peru flooding, wildfires in South Africa, and a series of windstorms in Europe.

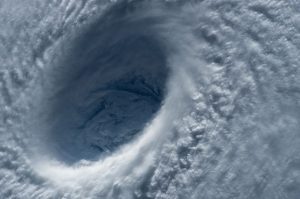

Looking forward to the second half of the year, Bowen believes a major factor in predicting how weather will impact re/insurers is the question of whether an El Niño officially develops.

An El Niño would have massive influence on weather patterns and associated disaster risks, he said.

A recent AIR worldwide report explained the U.S.’ particular vulnerability to severe weather events; “Geography also plays a role in generating preferred environments. One of the reasons the United States has the highest probabilities of severe weather has to do with the country’s geography.

“The Gulf of Mexico is the primary source of warm moist unstable air for the Great Plains. As low pressure systems develop on the lee side of the Rocky Mountains, southeasterly winds ahead of the low draw the warm moist unstable air northwestward.

“At upper levels, strong southwesterly winds bring air from the Mexican Plateau, which is much drier and cooler. This configuration creates both a thermodynamically unstable environment as well as one with both wind speed and directional shear.”

According to Aon Benfield, the EMEA – Europe, Middle East & Africa – and Asia-Pacific each accounted for just 10% of global catastrophe losses, a stark contrast to the U.S.’ recorded 76 % of the global losses sustained by public and private insurance entities during 1H 2017.