The latest catastrophe bond and insurance-linked securities (ILS) market report from our sister publication, Artemis, shows that despite the challenges of the ongoing COVID-19 pandemic, issuance levels remained above-average in the third-quarter of 2020.

Available to download now, the report, ‘Q3 2020 – Positive momentum continues in above-average third-quarter’, explores the $1.63 billion of new risk capital issued in the quarter, and analyses the composition of the 21 tranches of notes from 11 transactions.

Available to download now, the report, ‘Q3 2020 – Positive momentum continues in above-average third-quarter’, explores the $1.63 billion of new risk capital issued in the quarter, and analyses the composition of the 21 tranches of notes from 11 transactions.

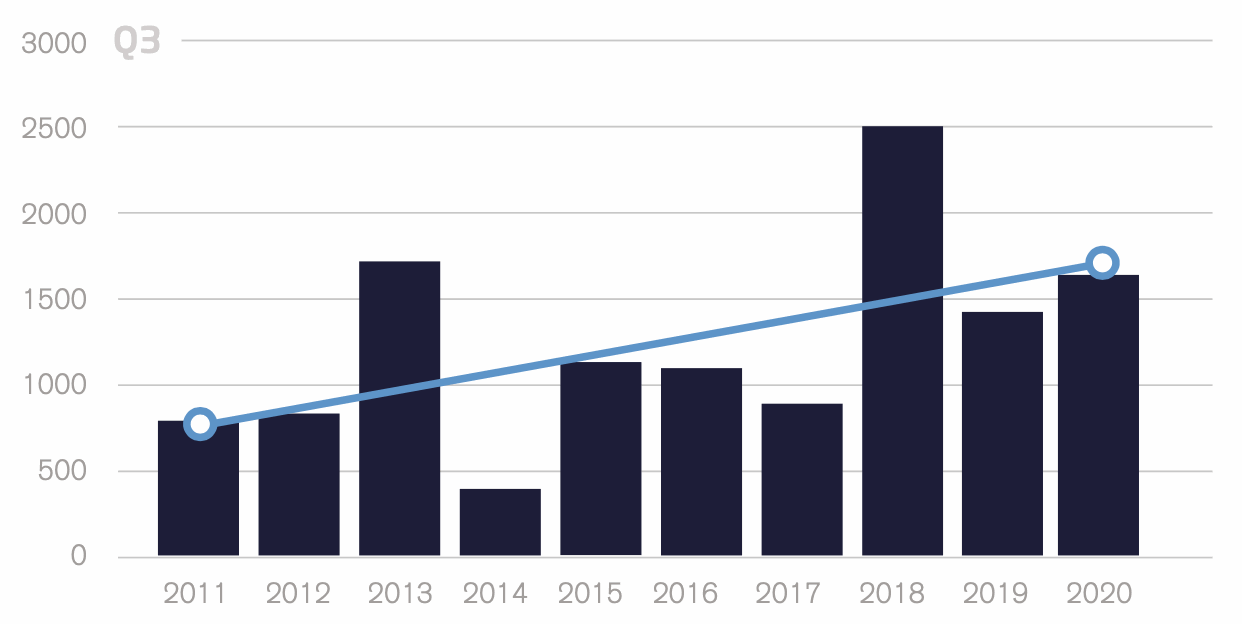

At $1.63 billion, issuance grew by approximately $214 million year-on-year and was actually the third highest of the past decade, helping issuance for the first nine months of the year exceed $10 billion for the third year running.

Taking a look at the deals brought to market in the period, and it’s clear that the transfer of mortgage insurance risk to the capital markets bolstered issuance in Q3, accounting for roughly 47% of issuance.

Privately placed deals also featured heavily in Q3 as did repeat sponsors, as Swiss Re returned with its fourth Matterhorn Re deal of the year, alongside transactions from Sempra Energy and UnipolSai Assicurazioni S.p.A.

The only new sponsor to feature in Q3 2020 was Convex Re, a division of Stephen Catlin and Paul Brand’s Convex Group. This $300 million deal offered protection against U.S. named storm risk and U.S. and Canada earthquake risks.

As shown by the graph below, in the third-quarter of 2020, cat bond and ILS issuance surpassed $1.5 billion for the third time since 2011.

As shown by the Artemis Deal Directory, cat bond and related ILS issuance so far in 2020 has reached an impressive $10.44 billion, which is approximately $2.64 billion higher than the level of issuance witnessed in the same period last year.

Of this total, 73% of deals issued in 2020 featured property catastrophe risks, while $2.2 billion were mortgage ILS deals and $661 million offered reinsurance protection against operational risks and medical benefit claims.

Download your free copy of Artemis’ Q2 3020 Cat Bond & ILS Market Report here.