Australian insurer QBE opted to shrink the size of its main catastrophe excess of loss (XoL) reinsurance tower by $400 million at the renewals to $2.7 billion with an unchanged retention of $400 million, while the retention on its aggregate protection came down to $500 million.

Announcing its full year 2023 results earlier today, QBE provided an update on its reinsurance coverages for 2024.

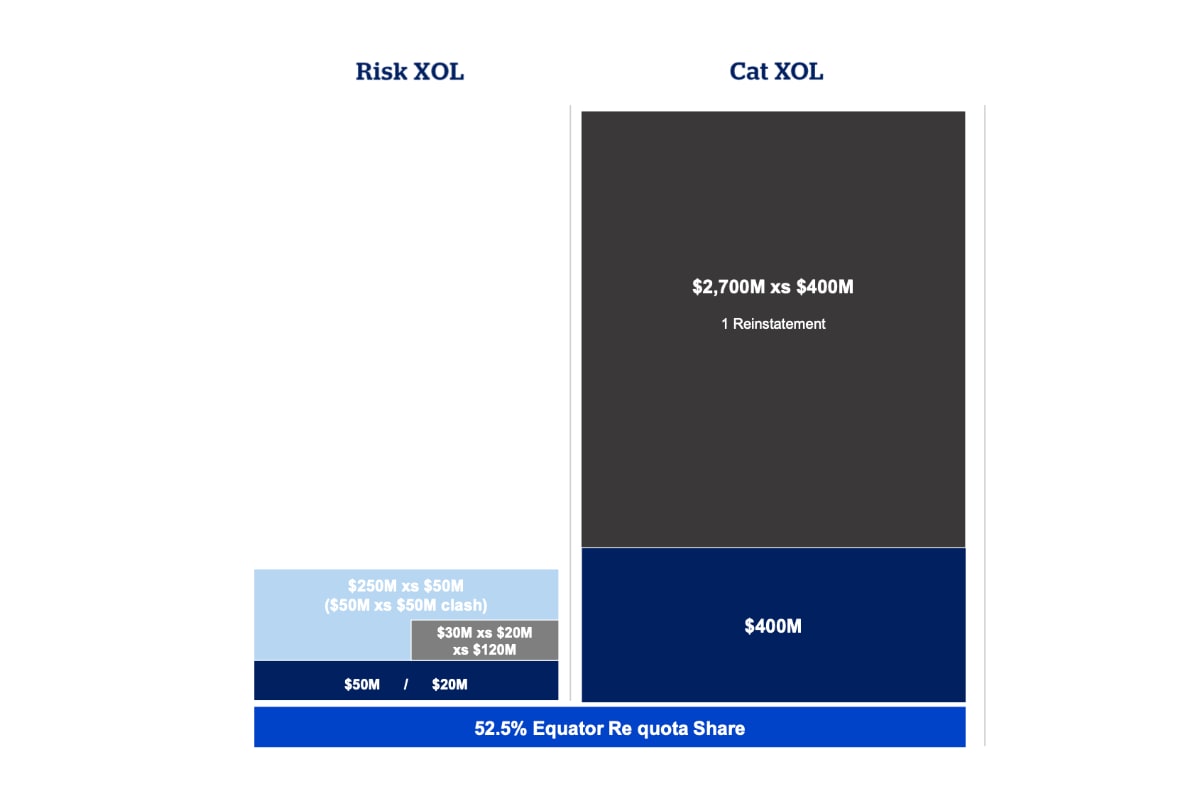

For this year, the firm’s main cat XoL tower extends up to $2.7 billion excess a $400 million retention, compared with $3.1 billion excess $400 million for 2023.

Of the $2.7 billion, QBE has worldwide protection of $1.7 billion, with an additional $1 billion covering US and ANZ catastrophes. Last year, the worldwide cover was $2.1 billion, with US and ANZ cat layers of $600 million.

So, the insurer has decided to shrink the top of its main cat reinsurance tower for 2024, which is a different strategy to some other insurers that have looked to increase their reinsurance coverage for higher layers.

Another year-on-year difference concerns the firm’s Equator Re quota share on XoL business, which has risen from 50% in 2023 to 52.5% for 2024, which will serve to lower volatility, notably to frequency events.

QBE has also renewed its aggregate reinsurance protection for 2024, although with some notable changes when compared with last year. For 2024, the programme has been renewed to provide $300 million of protection excess $500 million, and includes a $75 million per occurrence deductible for US wind and earthquake and all ANZ perils, and a $25 million occurrence deductible for all other covered perils. QBE confirms that for 2024 the aggregate coverage was once again partially placed.

For 2023, QBE’s aggregate cover provided reinsurance protection of $300 million excess $1.1 billion of losses, but only featured a $25 million event deductible across all perils and regions.

Other covers renewed includes a catastrophe wrap layer, which for 2024 provides $150 million of protection excess $500 million for US and Australia windstorm, and US, Australia, and New Zealand earthquake. This is different from 2023 when the swap still attached at $500 million but provided $200 million of protection, and also wasn’t limited to certain perils as it is this year.

You can see a diagram of QBE’s simplified reinsurance programme for 2024 below:

It’s also worth noting that QBE did not renew certain buy-down reinsurance covers for 2024.