After years of falling rates, global property catastrophe reinsurance lines saw upwards pricing movements at the January 1st, 2018 renewals, although the level of rate increases varied significantly across regions, according to reinsurance broker JLT Re.

After the huge level of global catastrophe losses in the third-quarter of 2017 reinsurers were hoping for rate increases at 1/1 2018, which, according to broker JLT Re were varied, with “pronounced firming restricted to classes and geographies experiencing highest losses.”

After the huge level of global catastrophe losses in the third-quarter of 2017 reinsurers were hoping for rate increases at 1/1 2018, which, according to broker JLT Re were varied, with “pronounced firming restricted to classes and geographies experiencing highest losses.”

Ed Hochberg, Chief Executive Officer (CEO) of JLT Re North America, said; “Property-catastrophe rate increases were most pronounced in regions impacted by loss activity, while low single-digit rises or even flat outcomes were more typical for programmes without significant losses.

“Although reinsurers sought to stem margin compression with more substantial rate rises at 1 January 2018, many conceded ground to clients as the date neared, particularly in non-loss affected areas.”

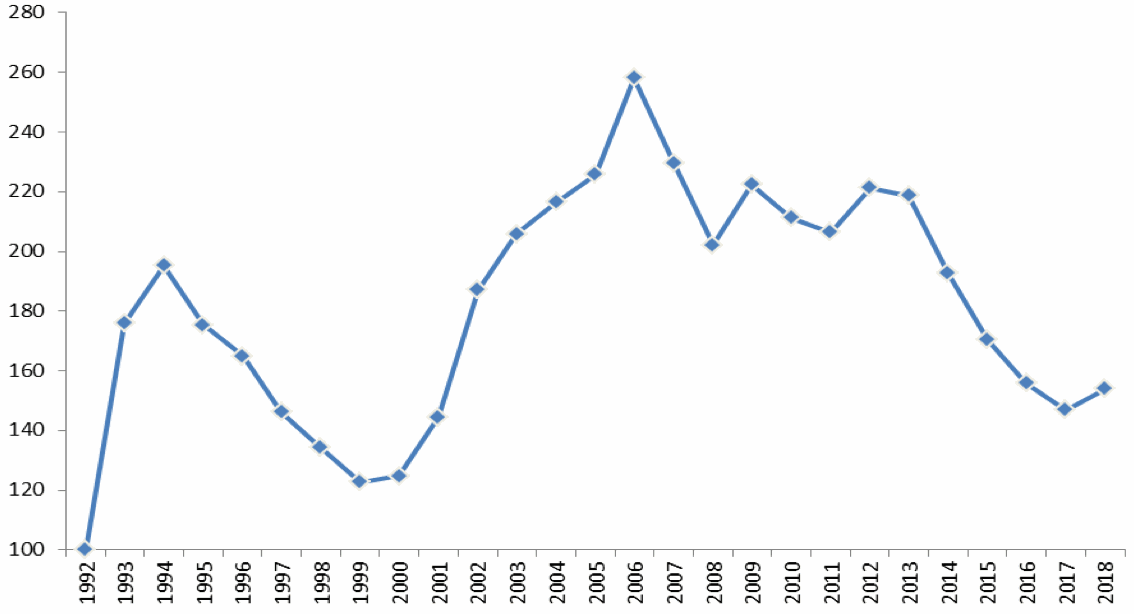

He continued to explain that the JLT Re Risk-Adjusted Global Property-Catastrophe Reinsurance Rate-on-Line index rose by 4.8% at January 1st, 2018, with levels remaining below those seen in 2016.

JLT Re’s Risk-Adjusted Global Property-Catastrophe Reinsurance ROL Index – 1992 to 2018

“The highest increases were recorded in the US, with rates renewing flat to up 5% for loss-free programmes and up 10% to 20% for loss-affected business. Flat to moderately up renewals were typical for international property-catastrophe business, reflecting more benign loss activity in Europe and Asia. Even with these increases, the cost of property protection remains competitive with global property-catastrophe pricing approximately 30% below 2013 levels,” said Hochberg.

Retrocession and direct and facultative (D&F) business saw higher rate increases at the recent renewals, although these increases were still below early market expectations, said the broker.

Bradley Maltese, Deputy CEO of UK & Europe, JLT Re, said; “Despite initial indications that markets would push for more, rates for retrocession catastrophe programmes were generally up by between 10% and 20% on a risk-adjusted basis, with event-based programmes falling towards the lower end of this range. Lloyd’s and global D&F catastrophe business was typically more loss-affected, and this translated into risk-adjusted rate increases of 15% to 25%, sometimes more for badly hit layers.”

Mike Reynolds, Global CEO of JLT Re, added; “Impacts spread beyond property lines as higher catastrophe and attritional losses influenced renewals for certain specialty and casualty lines. This coincided with a growing recognition that rates in some of these areas had fallen to levels that tested technical profitability after successive years of declines. As a result, programmes across some specialty lines were renewed as expiring, or with modest rate increases.

“Negotiations for casualty renewals, meanwhile, were balanced by profitability pressures on original business and reinsurers’ desire for higher rates due to the build-up of claims. Loss-free casualty programmes therefore renewed close to expiring levels whilst accounts that experienced losses saw moderate increases. These outcomes were often accompanied by lower ceding commissions.”