A new report from broker Willis Re shows that, globally, re/insurers achieved mild premium growth over 2020 due to rate increases for reinsurance and commercial lines of business.

Most lines of business in the US market reversed Q2 declines in premiums and US premiums over the year actually outpaced GDP growth, Willis Re found, despite challenging COVID-19 related offsets.

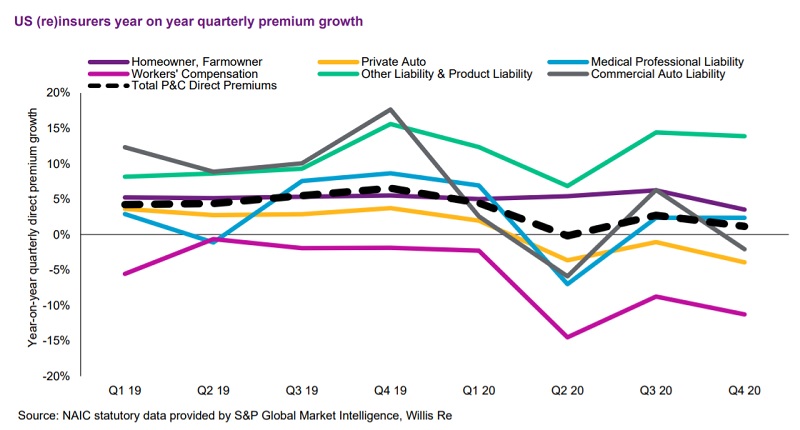

Total all lines direct premium rounded out Q4 with a modest 1% growth over the previous year’s Q4, but most commercial lines, with the exception of workers’ compensation, have achieved rate increases.

Rate increases within other liability and product liability lines have been significant and have accelerated through 2020, which marked a tenth straight year of rate increases for commercial auto.

However, weighing against this was COVID related rebates and discounts, which, combined with rate decreases due to improved performance and pricing competition between carriers, have resulted in a decrease in private auto premiums.

European re/insurers also achieved premium growth in 2020 due to improved pricing for reinsurance and commercial insurance lines of business, Willis Re reported.

The rate of growth decreased in Q2 and Q3, partly due to COVID-19 related impacts on premium levels for certain lines of personal insurance such as travel and assistance. More broadly, economic slowdown resulted in reduced premium levels for credit and surety business.

Premium growth in the US P&C industry historically tracks economic activity as measured by GDP, and analysts at Willis Re noted that in periods of a severe hard market, such as the early 2000’s, growth in direct written premiums (DWP) can significantly outpace underlying GDP growth.

During 2020, industry DWP declined as a result of the underlying economic slowdown due to COVID-19, but the premium decline was slightly less than the drop in GDP indicating some upward lift in pricing due the current hard market.

However, while some segments such as US Casualty and Global Reinsurance are experiencing material price increases, the overall industry is experiencing only modest increases, Willis Re acknowledged.