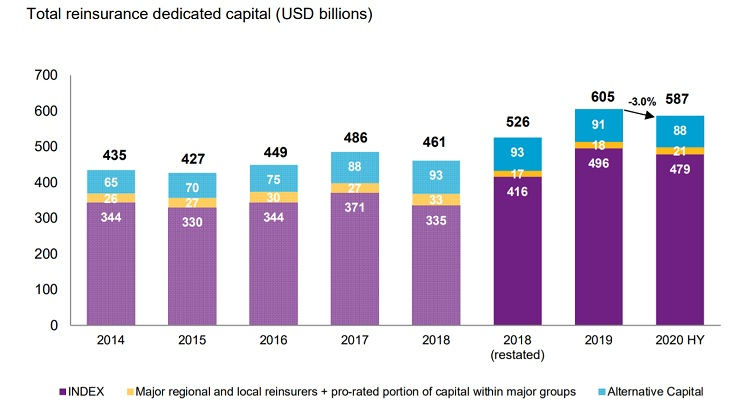

Willis Re, the reinsurance broking arm of Willis Towers Watson (WTW), has reported that total capital dedicated to the global reinsurance industry was $587 billion at June 30th, 2020, reflecting a decline of just 3% when compared with year-end 2019.

The latest Reinsurance Market Report from Willis Re found that industry capital had shrunk to a much lesser degree than some had feared, following the impact of the coronavirus pandemic.

However, the broker did acknowledge that the half-year figure masks an approximate fall of 30% up to late March, when virus-induced volatility in the investment markets was at its height.

That deficit was largely restored over the following months, and total capital now remains 12% higher than at the end of 2018.

Based on this data, and on current investment market levels, Willis Re has argued that COVID-19 has not been a capital event for the reinsurance industry.

This view contrasts somewhat with a recent report from rating agency S&P Global Ratings, which said that the pandemic has eroded capital buffers enough that even an average catastrophe year could now drive an earnings event for more than 40% of the top 20 reinsurers.

Based on analysis of 18 reinsurers, Willis Re found that this subset’s combined ratio worsened from 94.9% in the first half of 2019 to 104.1%, due to COVID-19 losses which added 11.1 percentage points to combined ratios on average.

However, on an underlying basis (normalising COVID-19 and catastrophe losses and excluding prior year reserve development) the combined ratio improved from 100.5% to 98.6%.

And while underlying underwriting performance improved, it did not improve enough to boost return on equity (RoE).

The reported RoE for Willis Re’s group fell to negative 0.7% and the underlying RoE also fell, moving from an already low 4.2% in the first half of 2019 to 2.7%. This was driven by a drop in investment yield, which more than offset the improved underlying combined ratios.

“Whichever way one measures RoE, it remains well below the industry’s cost of capital of roughly 7-8%,” Willis Re noted.

James Kent, Global CEO of Willis Re, commented: “This half-year analysis shows a reinsurance market understandably in a state of change. While reinsurers have so far resiliently shouldered the combined effects of COVID-19 losses and investment market volatility, underlying profitability remains challenging. “

“Uncertainty therefore remains, particularly over the potential impact of COVID-19 on long-tail lines, which is driving reinsurers to deliver additional improvement in underwriting returns,” Kent continued.

“We expect to see further reinsurance market discipline as well as continued differentiation between regions and clients based on past performance and underlying risk.”