Fitch Ratings expects Bermuda insurance and reinsurance market favourable reserve development to decline over the next couple of years, warning that any decrease could be accelerated by the speed and extent at which the reinsurance sector’s favourable reserve development reduces.

Recent analysis by global financial services rating agency, Fitch Ratings, explores the performance of a group of 15 Bermuda-based re/insurers, including four that are no longer independent, between 2007 and 2016.

The analysis report provides some interesting insight into the Bermuda marketplace, offering comparisons between insurance and reinsurance segment growth, including the development of favourable and unfavourable reserve development.

“The Bermuda market continues to maintain sizeable, though declining levels of prior AY favorable reserve development, as increased reinsurance segment favorable development was more than offset by reduced insurance reserve releases,” explains Fitch.

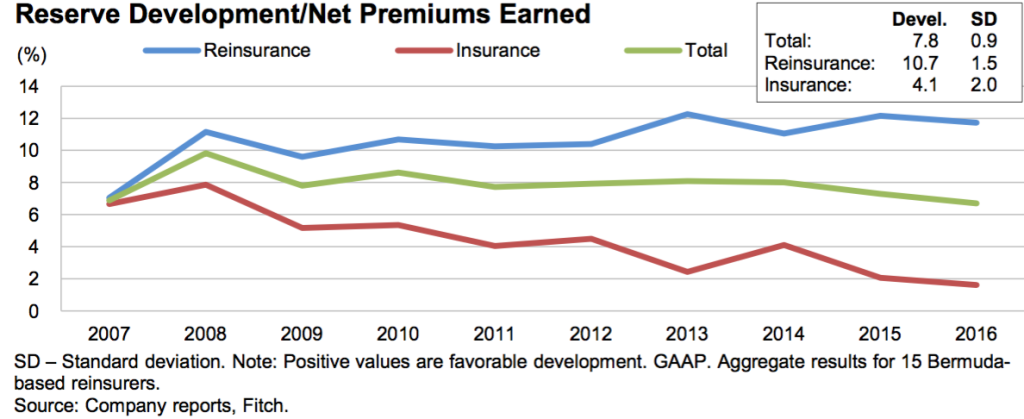

Over the ten-year period, Fitch explains that favourable prior AY (accident year) reserve development benefited the Bermuda-based aggregate combined ratio by 7.8 points. By segment, reinsurance experienced reserve development of 10.7 points during the period, far outpacing the insurance sector benefit of 4.1 points.

Interestingly, Fitch reveals that in 2007 the benefit experienced by each segment was pretty similar, at 7.0 points for reinsurance and 6.7 points for insurance. However, over the ten-year period reinsurance has increased its favourable reserve development to 11.7 points of benefit in 2016, while the insurance segment favourable development has declined substantially, to 1.6 points in 2016.

The chart below, provided by Fitch, highlights the above point.

Looking forward, Fitch says; “Fitch expects Bermuda market favorable reserve development to continue to decrease, but is still likely to add 4 points–5 points of total combined ratio benefit in 2017/2018. However, to the extent that reinsurance segment favorable development drops off more quickly, the deterioration could be more rapid.”

Throughout the softening reinsurance market cycle there has been numerous discussions and also evidence of firms aggressively releasing reserves to bolster weak underwriting income as a result of persistent market headwinds. This, combined with the benign loss experience of recent years has challenged the reserving practices of both insurers and reinsurers in Bermuda and elsewhere around the world.

With reinsurance market pressures expected to persist through 2017 and into 2018, absent a truly market turning event, it will be interesting to see how the reserving practices of companies and the sector as whole fares in the coming months, with deterioration predicted by Fitch.