Property and casualty (P&C) insurance holding company, Heritage Insurance Holdings, Inc., recorded an operating income in the third-quarter of 2017, with the firm’s gross losses from hurricane Irma being passed on to its reinsurers.

Heritage recorded an operating income of $1.4 million in Q3, despite hurricane Irma driving gross losses of an estimated $388 million, of which the company has a retention of $20 million, pre-tax.

Heritage recorded an operating income of $1.4 million in Q3, despite hurricane Irma driving gross losses of an estimated $388 million, of which the company has a retention of $20 million, pre-tax.

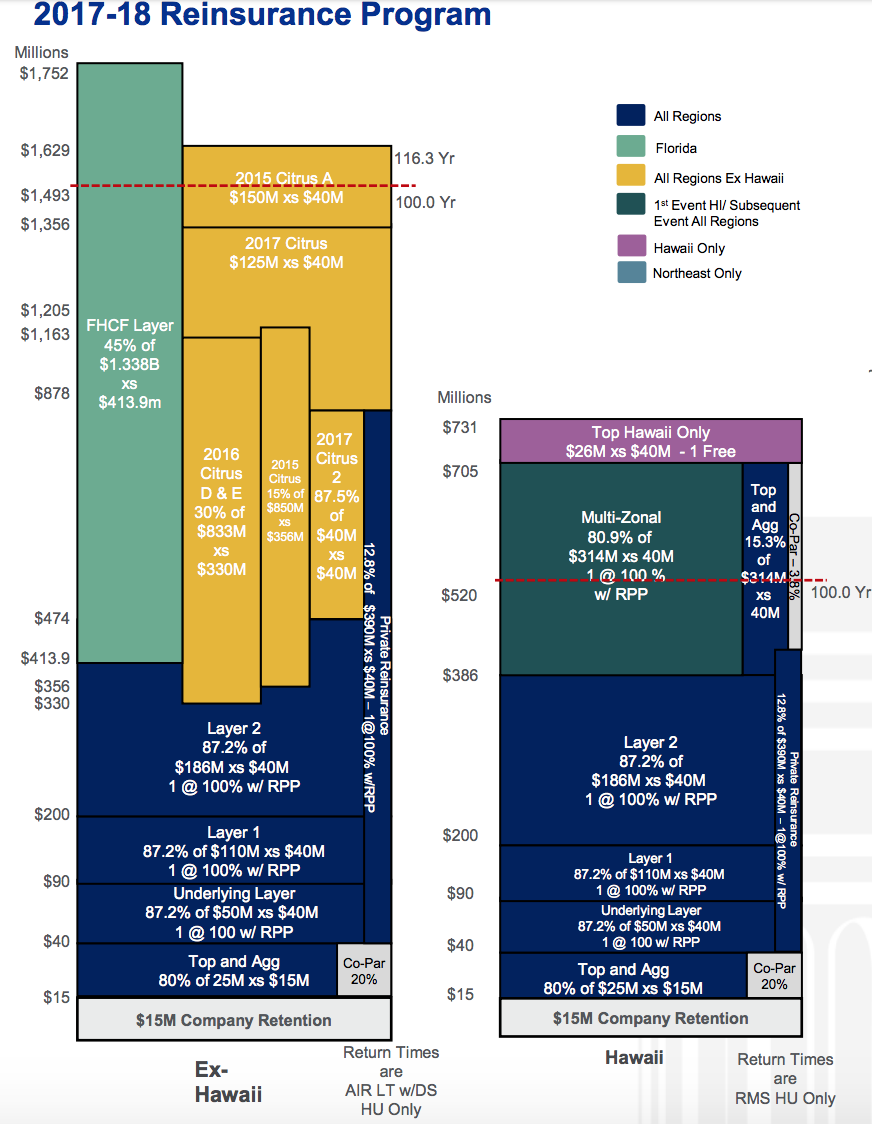

The P&C player reduced its catastrophe retention from $40 million to $20 million, on a pre-tax basis, during its renewal earlier this year, and was one of the main reasons it reported an operating income and didn’t fall to an operating loss for the period.

Heritage’s Chairman and Chief Executive Officer (CEO), Bruce Lucas, highlighted just this during the firm’s Q3 financials release.

“First, on behalf of the entire Heritage family we wish a swift and complete recovery to all of those impacted by the 2017 hurricanes. I am extremely happy to report positive operating income for the quarter. Our results are exceptional considering the magnitude of industry losses amongst our peer group.

“We also made a tactical decision to reduce our catastrophe retention to $20 million on a pre-tax basis, which was a key driver of our strong performance in the quarter,” said Lucas.

Total revenue for the third-quarter of 2017 amounted $101.7 million, while the firm recorded a loss before tax of more than $9.2 million, and a net loss of $8.6 million. Heritage’s $1.4 million of operating income represents a decline of 92% from the same period last year, and absence the reduction of its catastrophe retention, the firm surely would have fallen to an operating loss in the quarter.

A retention of just $20 million from the estimated gross $388 million financial impact of hurricane Irma, suggests the large majority of Heritage’s exposure to the event will be passed to its reinsurance partners.

As shown by the above image, which details Heritage’s reinsurance program, the impact of Irma is going to eat through various layers of the company’s reinsurance protection, and also eat into the very bottom of its catastrophe bond transactions, with one attaching at $330 million and the other at $356 million.

“Beyond the quarter, we believe our future prospects are encouraging,” continued Lucas.

Adding; “If reinsurance prices increase in 2018, Heritage will be less impacted than our peer companies that buy traditional single-year reinsurance programs. We believe that potentially lower reinsurance costs will create a competitive advantage for the Company.”