Reinsurance News

Hyperion X reports peak rate increases of 20% at July renewals

10th July 2020

Hyperion X, the data and analytics specialist unit of the Hyperion Insurance Group, has reported pricing improvements of between 0% and 20% at the July renewal. Following a conversation with Hyperion X executives David Flandro and Nick Griffiths, Morgan Stanley noted that magnitude of rate improvement in July was below the ... Read the full article

Catherine Barton appointed CFO of AIG’s Talbot Underwriting

10th July 2020

Catherine Barton has been unveiled as the new Chief Financial Officer (CFO) of Lloyd's of London syndicate Talbot Underwriting Ltd, an AIG company. Barton's appointment is effective September 28th, 2020 and she will also join the Talbot Board, subject to regulatory approval. She succeeds Nigel Wachman, who retires from Talbot in ... Read the full article

US commercial insurers’ results face COVID-19 claims uncertainty: Fitch

10th July 2020

Benefits for US commercial insurers from recent sharp premium rate improvement are likely to be delayed by effects on underwriting results from COVID-19, according to Fitch Ratings. The ratings agency says the sector was poised for 2020 profit improvement following two consecutive years of statutory industry commercial lines combined ratios slightly ... Read the full article

Everest Insurance adds Louis Manger as Head of Casualty Claims

10th July 2020

Everest Insurance has announced that Louis Manger has joined the company as Head of Casualty Claims. In this role Manger will lead all facets of Casualty claims, including all direct-handled and TPA-administered claims. He will be based in Liberty Corner, NJ. Manger joins from Blackboard Insurance where he served as Chief Claims Officer. Prior ... Read the full article

Japan flood damage to reach hundreds of millions USD: Aon

10th July 2020

Economic damage from the recent monsoonal flooding in Japan is expected to reach well into the hundreds of millions USD or higher, according to re/insurance broker Aon. The latest catastrophe report by Aon’s Impact Forecasting team also anticipates thousands of insurance claims will result from the flooding, although the General Insurance ... Read the full article

Lloyd’s to focus on US reinsurance and E&S, drops admitted licenses

10th July 2020

Insurance and reinsurance marketplace Lloyd’s of London has announced that it plans to strengthen its focus on the US reinsurance and excess and surplus (E&S) markets. As part of this strategy to focus on its core markets, Lloyd’s will relinquish its admitted licences in the US Virgin Islands (US VI), Kentucky ... Read the full article

Kovrr releases open framework to measure catastrophic cyber risk exposure

10th July 2020

Cyber risk modelling company Kovrr has developed an open framework designed to measure and understand catastrophic cyber risk exposure. The CRA-Zones framework defines the minimal elements needed to provide a view of cyber risk aggregations, allows for analysis across multiple portfolios of risks and allows for monitoring of exposure trends. CRA-Zones group ... Read the full article

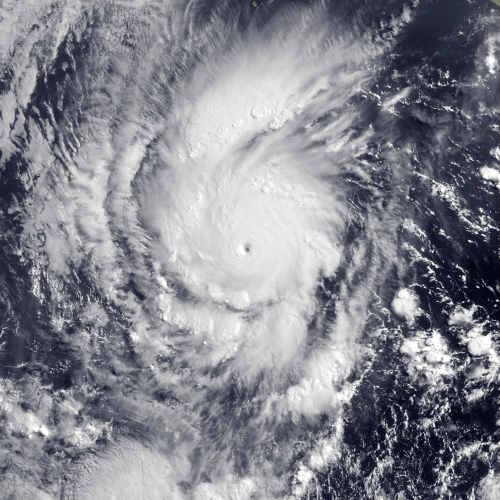

Storm Amanda a “critical test” of parametric cover, says MiCRO

10th July 2020

Tropical Storm Amanda, which recently triggered insurance payouts for El Salvador and Guatemala, was a “critical test” of the index-based insurance cover these countries have in place, according to the Microinsurance Catastrophe Risk Organization (MiCRO). MiCRO designed the excess rainfall coverages that triggered the payouts in collaboration with its local partners ... Read the full article

Symetra Partners with Nassau Re/Imagine insurtech incubator

10th July 2020

Symetra Life Insurance Company has announced a partnership with the Nassau Re/Imagine insurtech incubator designed to tap the creative and developmental opportunities in the region’s insurance industry talent pipeline. The program currently supports 19 startups focused on solving critical problems for the life, annuity, reinsurance, and property & casualty sectors. “At Symetra, ... Read the full article

AXA XL’s Sean McGovern joins the LMG board

10th July 2020

The London Market Group (LMG) has today announced the addition of Sean McGovern to its board, replacing Sinéad Browne, who recently served as the Chief Executive Officer (CEO) of Allianz Global Corporate and Specialty (AGCS) UK. McGovern was recently confirmed as the permanent CEO UK & Lloyd's market at AXA ... Read the full article

Liberty Specialty Markets promotes O’Neill to CUO, Commercial

10th July 2020

Liberty Specialty Markets, a division of insurer and reinsurer Liberty Mutual Insurance Group, has promoted Melanie O'Neill to Chief Underwriting Officer (CUO) of its Commercial arm. O'Neill previously served as Head of Professional Lines at the company and takes up her new role with immediate effect. She takes over as CUO of ... Read the full article

COVID-19 to wipe £3tn from global trade: Russell Group

10th July 2020

Covid-19 will wipe $3 trillion from global trade in 2020 compared with 2019 levels, according to analysis conducted by Russell Group. Based on shipping and aircraft movements, the risk management company predicts trade to be $7.45 trillion in the first half of 2020 and $8.55 trillion in the remaining six months ... Read the full article

RenRe CEO O’Donnell takes control of Ventures as Dutt departs

10th July 2020

Bermuda domiciled reinsurer RenaissanceRe Holdings Ltd. (RenRe) has revealed that Aditya Dutt, Senior Vice President of Ventures, is to leave the company to pursue a new opportunity. As a result of Dutt's departure, RenRe's Chief Executive Officer (CEO), Kevin O'Donnell, will assume responsibility for the firm's third-party reinsurance capital and joint-venture ... Read the full article

HDI Global SE adds two hires to UK Motor Fleet team

10th July 2020

Primary commercial specialist HDI Global SE has announced the appointments of Philip Healy and Dron Kyle to its UK Motor Fleet team. Healy joins HDI as Senior Motor Fleet Underwriter and Team Leader following time at Aon, where he was a placing broker in the UK & Ireland facultative Motor Reinsurance ... Read the full article

India’s insurance regulator (IRDAI) is exploring a pandemic risk pool

10th July 2020

The Insurance Regulatory and Development Authority of India (IRDAI) has established a nine-member working group to explore the possibility of establishing a pandemic risk pool. India is the latest country to reveal that it's exploring the launch of a pandemic risk pool to manage the risks related to reduced economic activity ... Read the full article