Reinsurance News

QIC results hit by typhoon losses and Ogden change

3rd February 2020

Qatar Insurance Company (QIC) has maintained a stable net profit of $184 million over 2019, but its underwriting performance suffered due to major catastrophe losses and changes to the Ogden discount rate, which caused the company’s combined ratio to slip to 103.3%. Net profit compared with $182 million in the previous ... Read the full article

BMS hires senior financial lines broker Kennell-Webb in Australia

3rd February 2020

BMS has continued to expand its footprint in the Australian insurance and reinsurance market, announcing the addition of senior financial lines broker Kirsty Kennell-Webb. Specialist insurance and reinsurance broker BMS said that Kennell-Webb will be based in its Sydney office once here current contractual obligations are fulfilled. Kennell-Webb has more than 12 ... Read the full article

Reinsurance a powerful enabler in mitigating climate change: Swiss Re’s Berger

3rd February 2020

The re/insurance industry is proving to be a powerful enabler in mitigating the effects of climate change, and has been spurred on by the shortcomings of government action, according to Andreas Berger, CEO of Swiss Re Corporate Solutions. Berger noted that the industry has been accelerating its investment in low-carbon initiatives ... Read the full article

AM Best’s post-Brexit arrangements will apply irrespective of EU trade deal

3rd February 2020

A.M. Best has said that measures it has implemented to prepare for a post-Brexit environment will apply irrespective of the UK's ability to reach a trade with the European Union (EU) by December 2020. Like many other global organisations within the UK financial services sector, ratings agency A.M. Best has taken ... Read the full article

Crypto exchange Bittrex secures $300m cold storage cover

3rd February 2020

US blockchain technology and cryptocurrency exchange Bittrex has obtained digital asset insurance of up to $300 million for its cold storage system. Bittrex worked closely with Marsh in placing cover with Arch Syndicate 2012, which provides protection from external theft and internal collusion. The company was approved for the coverage after successfully ... Read the full article

Reinsurers face highest risks from coronavirus, says A.M. Best

31st January 2020

Analysts at AM Best believe that reinsurers could face higher levels of risk related to the ongoing Coronavirus outbreak than their primary life & health counterparts. The rating agency noted that reinsurers typically have higher exposures to mortality and morbidity risks, and may have as much as 40% or more of ... Read the full article

Essent secures $496mn of mortgage reinsurance from capital markets

31st January 2020

Bermuda domiciled mortgage insurer Essent Group Ltd. has announced that its subsidiary, Essent Guaranty, Inc., has secured a further $495.9 million of fully collateralised excess of loss reinsurance coverage from the capital markets. The coverage was obtained through Radnor Re 2020-1 Ltd, a newly formed Bermuda special purpose insurer, and relates ... Read the full article

Philippines to consider mandatory disaster insurance for properties

31st January 2020

The Insurance Commission (IC) of the Philippines is reportedly in talks with private sector re/insurers regarding the introduction of mandatory catastrophe insurance protection for private assets, according to Business Mirror. The regulator has signed a memorandum of understanding (MoU) with the Philippine Insurers and Reinsurance Association (PIRA) and National Reinsurance Corp. ... Read the full article

Liberty Mutual promotes Tracy Ryan to President of GRS, North America

31st January 2020

Liberty Mutual Insurance has announced the appointment of Tracy Ryan to President of Global Risk Solutions (GRS) North America. Ryan has been with the company for 25 years and has held numerous leadership roles during this time. Most recently, she served as Executive Vice President and Chief Claims Officer for GRS. In ... Read the full article

AJ Gallagher reports 5.6% organic revenue growth for 2019

31st January 2020

International insurance brokerage, risk management and consulting services firm, Arthur J. Gallagher & Co. (AJ Gallagher), has announced total revenue growth of 17% for the fourth-quarter of 2019, of which 5.8% was organic. For the full-year, the firm's total revenue growth hit 14%, of which 5.6% was organic, leading Chairman, President, ... Read the full article

FEMA targets additional catastrophe bond coverage for NFIP

31st January 2020

The US Federal Emergency Management Agency (FEMA) is seeking a further $300 million of flood protection from the capital markets with its third catastrophe bond issuance, FloodSmart Re Ltd. (Series 2020-1). This is the third time FEMA has looked to secure flood reinsurance protection from the capital markets for its National ... Read the full article

Seven biggest bulk annuity deals in 2019 dwarfed whole of 2018, Hymans

31st January 2020

Seven of the biggest bulk annuity transactions in 2019 amounted to over £24 billion, exceeding the total amount managed in 2018 across 162 transactions, says actuarial and advisory consultancy firm Hymans Robertson. Furthermore, a record £10 billion of deferred member liabilities were insured during 2019. Hymans says this is a result of ... Read the full article

IGI gets regulatory nod for go-public Tiberius deal

31st January 2020

International General Insurance Holdings (IGI), the specialist commercial re/insurer, has received regulatory approval from the Bermuda Monetary Authority (BMA) for its planned business combination with Tiberius Acquisition Corp., which will result in the public listing of IGI. First announced back in October 2019, this deal prices IGI at approximately 1.26x ... Read the full article

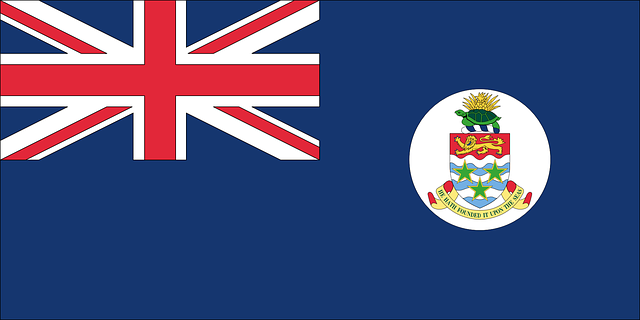

Cayman Islands continues international insurance growth in 2019

31st January 2020

According to figures from the Cayman Islands Monetary Authority (CIMA), the region’s international insurance industry saw continued growth in 2019, with 33 new licences issued. This was the same number of new licences as in the previous year, with the total number of insurance licensees now standing at 764, of ... Read the full article

Everest Insurance to offer workers’ comp through Dovetail’s online platform

31st January 2020

Everest Insurance, a division of Bermuda-based reinsurer Everest Re Group, has announced that it will offer its workers' compensation solution through Dovetail's online platform. Dovetail is a Victor company and its online platform enables both agents and brokers to quickly purchase insurance policies for their small commercial clients. Currently, the program is ... Read the full article