Reinsurance News

Beazley promotes Rachel Turk to Group Head of Strategy

22nd September 2021

Specialist insurer Beazley has appointed Rachel Turk to the newly created position of Group Head of Strategy, a role which sees her join the firm's executive committee with immediate effect. Turk joined the company back in 2009 as a D&O underwriter in Specialty Lines, later becoming Focus Group Leader in 2015, ... Read the full article

Legal & General enters £250m buy-in transaction with Selecta UK Pension Plan

22nd September 2021

Legal & General has agreed a £250m buy-in transaction with the Selecta UK Pension Plan securing the benefit payments of approximately 1,000 pensioners and 1,000 deferred members. Selecta UK is Europe’s leading coffee and vending machine operator. The Plan has an existing relationship with Legal & General, having worked with Legal ... Read the full article

Effective reinsurance utilisation to reduce Provinzial’s Bernd losses: Fitch

22nd September 2021

Primary German insurer Provinzial is expecting gross claims of at least €1 billion from the flooding in the country in July, although the company's net hit should come down considerably thanks to its effective use of reinsurance, reports Fitch. In early August, Provinzial estimated that losses from Storm Bernd would ... Read the full article

Sompo Intl to acquire Italian agriculture insurer ARA

22nd September 2021

Bermuda-based property and casualty re/insurer Sompo International has reached an agreement to purchase ARA 1857 S.p.A.- Assicurazioni Rischi Agricoli VMG 1857 (ARA), one of the leading players in the Italian agriculture insurance market. The deal, expected to close by the first quarter of 2022, will see ARA ... Read the full article

AXA UK names WTW’s Ovenden as CUO of Commercial business

22nd September 2021

AXA UK has appointed former Willis Towers Watson executive David Ovenden to serve as Chief Underwriting Officer of its Commercial business. He succeeds David Williams who after 41 years in the role is set to depart in search of non-executive roles at the year's end. At WTW, Ovenden spent 3 years leading ... Read the full article

London insurance market vital to UK recovery, says IUA Chairman

22nd September 2021

Rob Kuchinski, Chairman of the International Underwriting Association (IUA), has asserted that London’s specialty insurance market will be “vital” in helping the UK recover economically from the effects of the COVID-19 pandemic. Speaking at the IUA’s annual general meeting, Kuchinski outlined how the body has assisted official in underwriting underwriters’ risk ... Read the full article

Aviva names Andrea Montague as Chief Risk Officer

22nd September 2021

Aviva has announced the appointment of Andrea Montague as Chief Risk Officer, reporting to Group CEO Amanda Blanc. She will join Aviva’s Executive Committee along with Chief Information Officer John Cummings. Montague joined Aviva in April 2020 as Group Chief Financial Controller and has previously worked at Royal London and Standard Life ... Read the full article

JBA & RSIS partner on flood modelling for African insurers

22nd September 2021

JBA Flood Risk Management Limited has collaborated with Reinsurance Solutions Intermediary Services (RSIS), an African-based reinsurance broker that will use the JBA global flood modelling capability to provide flood risk analytics and catastrophe modelling services for its insurance clients across the continent. RSIS has offices in Mauritius, Ivory Coast, Kenya, South ... Read the full article

AM Best stable on “resilient” Canadian P&C sector

21st September 2021

AM Best is maintaining its stable outlook on what it sees as a "resilient" Canadian property and casualty (P&C) re/insurance sector, based on its strong underwriting performance and capitalisation, as well as the country's relatively successful handling of the COVID-19 pandemic. Canada's GDP contracted by 5.4% last year but is expected ... Read the full article

HDI Global USA names David Sapia Director of Liability Underwriting

21st September 2021

HDI Global USA has named David Sapia Director of Liability Underwriting, a role that will see him responsible for the profitability, growth, and overall strategic direction of HDI’s US Casualty business. He reports to HDI Global USA's Chief Executive Officer Jim Clark and arrives with over 30 years' underwriting and field ... Read the full article

VIG’s Aegon acquisition blocked in Hungary

21st September 2021

Vienna Insurance Group (VIG) has hit a roadblock in its pending acquisition of Aegon’s businesses in Central and Eastern Europe, after a decision by Hungarian authorities to block the deal was upheld. Last year, Aegon reached an agreement to sell its insurance, pension, and asset management operations in Hungary, Poland, ... Read the full article

KCC releases new US wildfire model

21st September 2021

Catastrophe risk modeller Karen Clark & Company (KCC) has announced the release of Version 1.0 of its US Wildfire Model. This fully probabilistic model provides Exceedance Probability (EP) curves, PMLs, and AALs down to the location level and can be used to develop underwriting and pricing strategies that account for the ... Read the full article

US life industry improves risk-adjusted capitalisation in 2017-2019: AM Best

21st September 2021

According to a new report by rating agency AM Best, the U.S. life/health industry improved its risk-adjusted capitalisation in 2017-2019 due to strong growth in available capital, particularly in 2019. The rating agency's Best’s Capital Adequacy Ratio (BCAR) model was retooled to measure required capital at multiple value-at-risk (VaR) levels ... Read the full article

Munich Re and EDF Renewables take stakes in Cali energy projects

21st September 2021

EDF Renewables North America (EDFR) and MEAG, acting in its capacity as Munich Re’s global asset manager, have announced a strategic investment that will see a subsidiary of Munich Re acquire a 50% stake in two renewable energy projects in California. The projects are located adjacent to one another in Riverside ... Read the full article

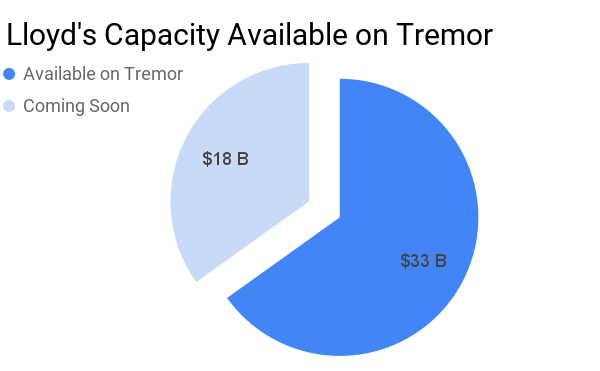

Over two-thirds of Lloyd’s capacity now accessible via Tremor

21st September 2021

Over two thirds of Lloyd’s capacity is now available via the online re/insurance pricing and placing platform Tremor Technologies, a figure equating to $33 billion. Tremor says 33 Lloyd’s Syndicates representing over 70% of its Managing Agents have entered into agreements to offer coverage directly on its marketplace. The Syndicates are described ... Read the full article