As cyber insurance remains the fastest growing sub-sector of the global insurance market, S&P has underlined the importance of reinsurance in the development of a sustainable and effective market.

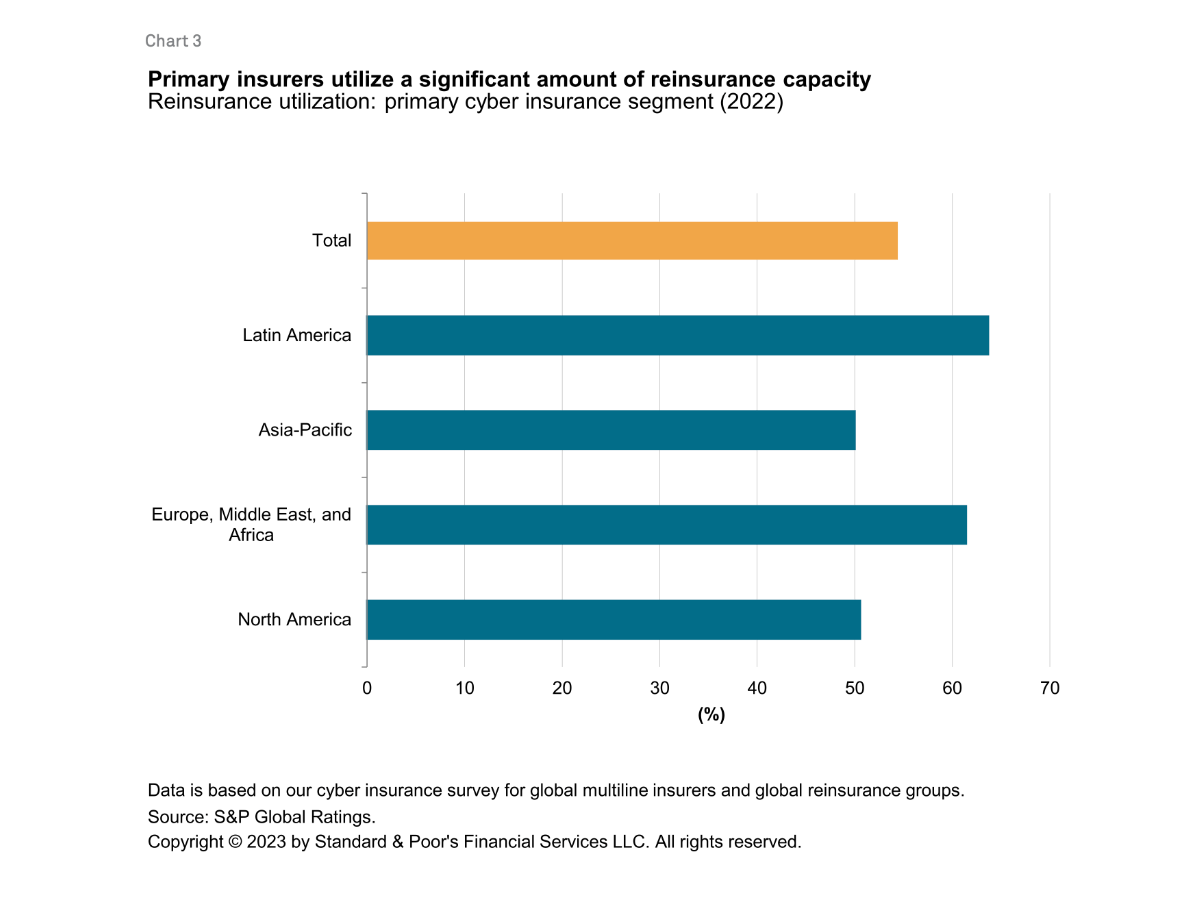

According to S&P, primary carriers ceded around 50% to 65% of their cyber insurance premiums to reinsurers in 2022, depending on the region. This is significant, and highlights the heavy reliance on reinsurance in the cyber insurance sector.

According to S&P, primary carriers ceded around 50% to 65% of their cyber insurance premiums to reinsurers in 2022, depending on the region. This is significant, and highlights the heavy reliance on reinsurance in the cyber insurance sector.

“In our view, reinsurers will remain an important pillar in the development of a sustainable and effective cyber insurance market,” says S&P.

“The reinsurance market and, eventually, the retrocession market will therefore be extremely important in providing capital and capacity to support further GPW growth,” adds the ratings agency.

In 2022, S&P says that global insurance premiums amounted to roughly $12 billion, and are likely to rise by as much as 30% annually to around $23 billion by 2025.

To achieve this growth, S&P feels that the role of reinsurers is critical and not just because of their capacity, but also expertise in modelling and underwriting which is also assisting with market developments.

“In our view, if cyber insurance is to meet the needs of customers in the future, it is more important than ever that the industry focuses on risk differentiation, strong underwriting, and the provision of assistance services along the lines of prevention measures, crisis management, and data recovery,” says S&P.

As claims patterns change and cyber threats continue to increase, coupled with vast accumulation risk, S&P has stressed the opportunities these factors create to increase reinsurance capacity.

In fact, the ratings agency notes that the number of reinsurance companies offering cyber coverage is on the rise in response to market dynamics.

“Many reinsurers are nearing the limits of the amount of cyber exposure they can and want to handle. However, we don’t expect the market to soften as it has for primary cyber insurance. This is evident from the reinsurance segment’s higher rate adjustments so far in 2023. Reinsurers also need to regain underwriting profitability in their cyber portfolios,” says S&P.

After a challenging 2022 on the back of low profitability and even underwriting losses in cyber portfolios, S&P expects to see more rate increases for cyber reinsurance business in 2023.

“However, we believe primary cyber insurance underwriters can absorb the increases without passing them on to policyholders. This may be vital in the development of a sustainable cyber insurance market,” says the ratings agency.