The reinsurance industry is experiencing a period of historic unprofitability as the gap between cost of capital and return on equity remains at the highest level its ever been, according to analysts at A.M. Best.

In a new report, the rating agency noted that reinsurers tend to have a low cost of capital due to their focus on catastrophe risk, which is inherently volatile but generally considered to be non-correlated with the capital markets.

This in part is a reason for the growth of insurance-linked securities and the growing influx of third party capital, which promises a higher yield in a low interest environment.

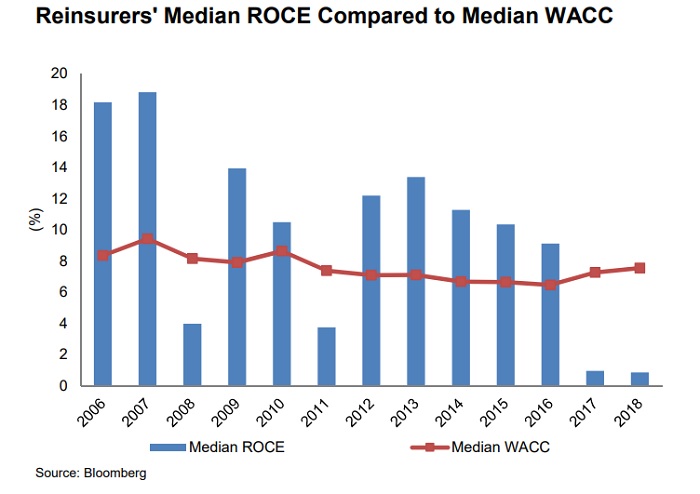

In 2017 and 2018, the weighted average cost of capital (WACC) for reinsurers increased due to the severe catastrophe losses, A.M. Best noted.

However, the median return on common equity (ROCE) for reinsurers has been volatile, and the impact of natural disasters can clearly be observed in companies’ return during catastrophe-prone years.

In 2008, insured losses amounted to $31 billion, largely due to the impact of Hurricane Ike, with the reinsurance industry covering the bulk of the losses and earning a median ROCE of 4.3%, well below its cost of capital.

The reinsurance industry also failed to meet its hurdle rates in 2011, when returns dipped below the cost of equity due to a series of catastrophe including Hurricane Irene in the U.S and the Caribbean, the tsunami that followed the Tohoku earthquake in Japan, Thai floods, and earthquakes in the U.S.

In 2017 and 2018, median ROCE has been reduced to historically low levels for two consecutive years due to the impact of major hurricanes and other natural disasters.

At the same time, median WACC has increased for the reinsurance industry during these years, indicating that profitability has been significantly down during this period.

The lower ROCE of recent years is also due to pricing pressures resulting from the growth of ILS and third-party capital, analysts noted, which promises a higher yield—along with further diversification—in a low interest rate environment.